Antwort Why use SWIFT GPI? Weitere Antworten – What are the advantages of SWIFT GPI

Swift GPI lets you make high-speed cross-border payments in minutes or seconds. Nearly 50% of gpi payments are credited to end beneficiaries within 30 minutes, 40% in under 5 minutes, and almost 100% of gpi payments are credited within 24 hours.SWIFT gpi is an optional service on SWIFT network and operates on the basis of business rules and technical specifications captured in rulebooks between gpi customers (i.e. financial institutions who are SWIFT users and signed up for the gpi service).ABN AMRO, Bank of China, BBVA, Citi, Danske Bank, DBS Bank, Industrial and Commercial Bank of China, ING Bank, Intesa Sanpaolo, Nordea Bank, Standard Chartered Bank and UniCredit are live with SWIFT gpi, exchanging gpi payments across 60 country corridors.

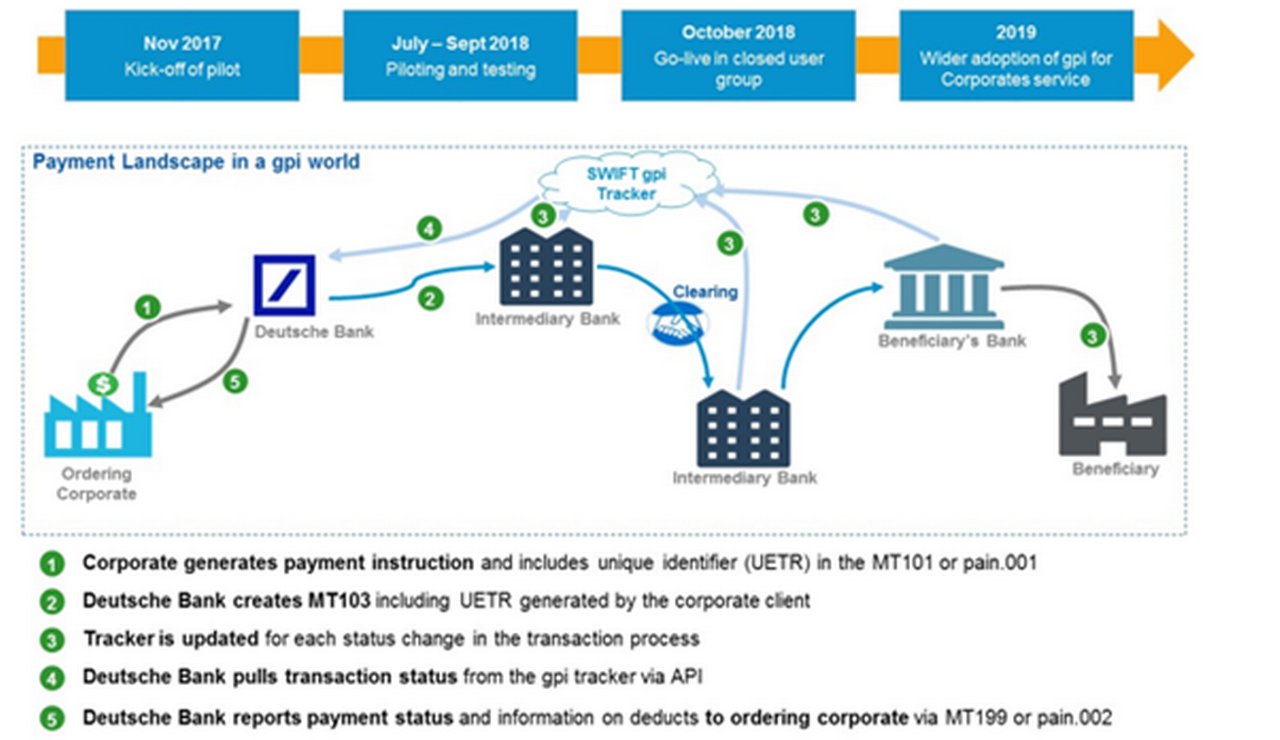

How does the SWIFT GPI work : SWIFT gpi combines domestic real-time payment networks to deliver cross border payments almost instantly and without the restrictions of bank operating hours. Each transaction is assigned a Unique End-to-End Transaction Reference (UETR) that payment providers can use to trace the transfer from start to finish.

How is SWIFT GPI faster

SWIFT gpi revolves around four core principles:

Settling a payment within the same business day. Monitoring payment status in real time. Providing transparency of fees all along the payment chain. Passing on unaltered remittance information to identify the underlying reason for the payment.

How many banks use SWIFT gpi : Swift GPI isn't a proof of concept. It's tried and tested by a community of over 4,450+ financial institutions.

As of now, 100 banks in the APAC region, delivering 90 percent of traffic are gpi-enabled or in the process of enabling while globally 3500 banks have committed to adoption of gpi, SWIFT said. In 2018, the payments platform handled over $40 trillion worth of transactions globally.

Unlike traditional SWIFT payments, which could be slow and lacked transparency, SWIFT gpi provides faster payments, real-time tracking, transparent fee structures, and consistent data records, making international payments more efficient and user-friendly.

Do European banks use SWIFT

SWIFT code and BIC are often used interchangeably. However, there are key differences between them. The BIC is only used for European banks, but SWIFT codes are used around the world.SWIFT data issued in December 2020 revealed that in total 4,100 financial institutions had signed up to become gpi members, although the figure is elevated by individual branches of major international banking groups such as Deutsche Bank becoming members.At a high level, Swift GPI is intended to increase the speed and transparency of high-value payments, with or without foreign exchange. Swift Go is intended to support low-value and cross-border payments by guaranteeing that the principal amount is not adjusted throughout its lifecycle.

Gpi guarantees that all remittance data that is sent with payments will be unaltered throughout the whole payments journey. This allows recipients to easily reconcile payments against invoices or orders.

How many banks use SWIFT GPI : Swift GPI isn't a proof of concept. It's tried and tested by a community of over 4,450+ financial institutions.

Is SWIFT better than IBAN : IBANs are more secure than SWIFT codes because they are unique identifiers for bank accounts in specific countries. SWIFT codes only identify the bank that will receive a payment, but they do not identify the specific bank account. This means that there is a greater risk of errors and fraud when using SWIFT codes.

Which countries don’t use SWIFT

| Afghanistan | Barbados | Chad |

|---|---|---|

| Coral Sea Islands, territory of | Dhekelia | Heard Island and McDonald Islands |

| Democratic Republic of Congo | Falkland Islands | Jamaica |

| East Timor | Haiti | Johnston Atoll |

| Gibraltar | Iran | Kingman Reef |

With SWIFT global payments innovation (gpi), you can account for your money every step of the way. Plus, your payments arrive in minutes, not days. FNB is among the select banks and financial institutions offering SWIFT gpi capabilities.SWIFT gpi (gpi stands for Global Payments Innovation) is a new initiative from SWIFT and was developed to improve the experience of making a payment via the SWIFT network for both customers and banks.

Why Swift is the best : The Swift is a compact car known for its agile handling and peppy performance. With a stylish design and comfortable interior, it offers good fuel efficiency and a range of tech features, including touchscreen infotainment. However, rear-seat space is limited, and some competitors offer more advanced safety features.