Antwort Why Mastercard is better than Visa? Weitere Antworten – Is Mastercard better than Visa

Mastercard credit cards are more widely accepted internationally, while Visa cards tend to offer more benefits. But for most consumers, there is no practical difference between Visa and Mastercard. You should only worry about whether to get a Visa or Mastercard if you're torn between two offers.Visa charges the card issuer on a per-transaction basis or based on the card volume. Contrarily, MasterCard charges card-issuing institutions based on the percentage of global dollar volume. Global dollar volume refers to the total volume of all transactions made using MasterCard-enabled cards within a specific period.Mastercard is a payment network processor. Mastercard partners with financial institutions that issue Mastercard payment cards processed exclusively on the Mastercard network. Mastercard's primary source of revenue comes from the fees that it charges issuers based on each card's gross dollar volume.

Is Amex Visa or Mastercard : American Express is neither Visa, nor Mastercard. Basically, there are 4 big networks in the U.S.: American Express, Visa, Mastercard and Discover.

Is Mastercard as safe as Visa

Which is more secure Both Visa and Mastercard offer zero fraud liability for all cards, which means that any user who is victim to fraud, theft, or breach of data will not be liable for the lost money. Both networks are generally considered to be secure, but use different methods for securing your data.

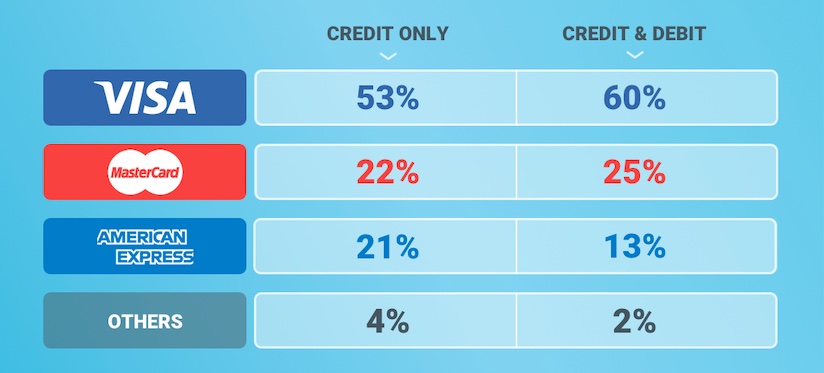

Do more people use Visa or Mastercard : Most Common Types of Credit Cards

Of the four main types of credit cards—Visa, Mastercard, American Express and Discover—Visa is by far the most common, making up 58.3% of cards in circulation.

If your bank switched a card from Visa to Mastercard, it was likely because they felt the features and benefits of Mastercard were better than those of Visa. For example, the issuer might take into consideration processing fees or network-level benefits like travel insurance or purchase protection.

Despite some differences between European and US cards, there's little to worry about. US-issued Visa and Mastercard credit cards, along with familiar payment apps, typically work fine in Europe.

What is the disadvantage of Mastercard

The disadvantage of Mastercard is that their credit cards tend to offer fewer benefits than Visa cards, and Mastercard debit cards don't always provide full protection from ATM fraud. Still, owning a Mastercard has far more advantages than disadvantages.Best Credit Cards of 2024

- Chase Sapphire Preferred® Card: Best Entry-Level Travel Card.

- Capital One Venture X Rewards Credit Card: Best Flexible Rewards Card.

- Chase Sapphire Reserve®: Best Credit Card for Travel Insurance.

- The Platinum Card® from American Express: Best Credit Card for Luxury Travel and Lifestyle Benefits.

For instance, credit cards and prepaid cards issued across the European continent were used for nearly 97 billion transactions in 2019. Nearly 60 percent of all these transactions were done with Visa general purpose cards, while MasterCard made up for 39 percent of the market.

Despite some differences between European and US cards, there's little to worry about. US-issued Visa and Mastercard credit cards, along with familiar payment apps, typically work fine in Europe.

Why are citizens switching to Mastercard : What does moving the debit business to Mastercard mean Coughlin: Our debit business is one of our crown jewels and the expanded partnership helps us better leverage all the capabilities Mastercard already has in place in terms of fraud detection and open banking.

What is the best credit card in Europe : There are a few travel credit cards that check all these boxes — here are our top four picks.

- Best for travelers who want flexibility: Chase Sapphire Reserve®

- Best for wining and dining: Capital One® Savor® Cash Rewards Credit Card.

- Best for college students: Bank of America® Travel Rewards credit card for Students.

Why don’t Europeans use credit cards

Thanks to technological advances, tax evasion, and merchants' disgust with fees, you may find that credit cards in Europe are not nearly as welcome as other payment methods.

Rewards credit cards are best for everyday purchases, earning you cash back or points on your spending. Travel credit cards are a solid fit for frequent travelers and include co-branded airline and hotel cards. For those new to credit, a secured or student credit card can be a useful tool to build your credit score.What is the most prestigious credit card One of the world's most prestigious credit cards is the Centurion® Card from American Express*. Though there may be other cards with more elaborate benefits, those cards are kept well under wraps.

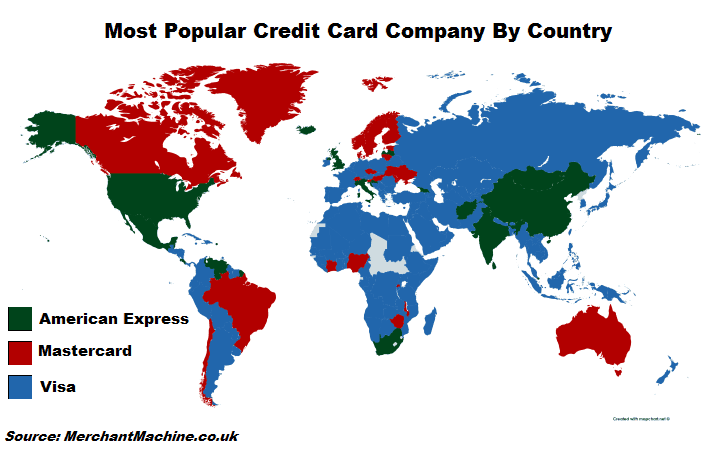

Should I use Visa or Mastercard in Europe : American credit cards work throughout Europe (at hotels, larger shops and restaurants, travel agencies, car-rental agencies, and so on); Visa and MasterCard are the most widely accepted. American Express is less common, and the Discover card is unknown in Europe.