Antwort Why is swap charged? Weitere Antworten – How are swap fees charged

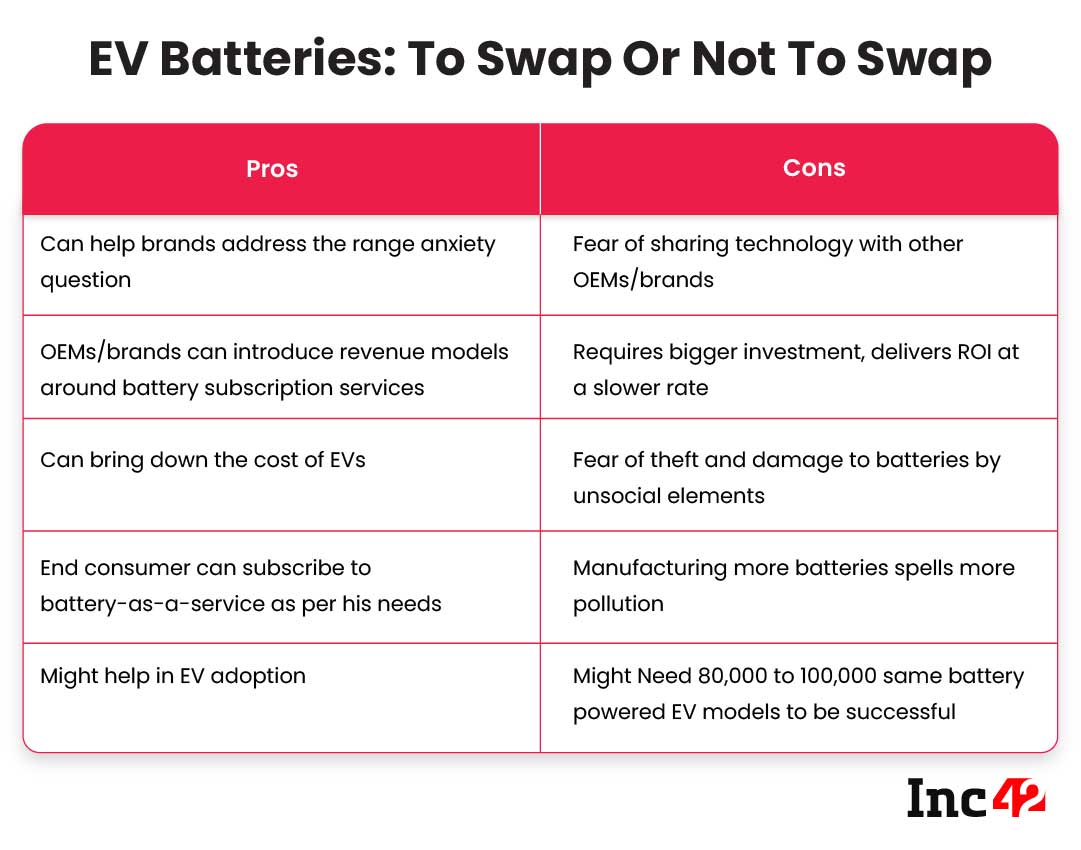

A swap, also known as “rollover fee”, is charged when you keep a position open overnight. A swap is the interest rate differential between the two currencies of the pair you are trading.How to Avoid Swap Fees. Retail traders can avoid swap charges if they open and close their trades during the same trading session. This is done in high frequency trading and intraday trading. Opening and closing trades during the same trading session also reduces trading risks for the trader.Swap = (Pip Value * Swap Rate * Number of Nights) / 10

Note: FxPro calculates swap once for each day of the week that a position is rolled over, however, to account for weekends, a triple charge will take place on Wednesday for FX & metals, and on Friday for other instruments.

Why is my swap so high in forex : A Forex swap rate depends largely on the underlying interest rates for the currencies in the pair you are trading. There is also a custody fee incorporated into swap rates. If the costs of holding an asset are high (such as with commodities) negative swaps will usually be observed for both long and short positions.

Why do forex brokers charge swap fees

Swap fees, also known as rollover or overnight fees, are charges applied to positions held open overnight. These fees compensate for the interest rate differential between the two currencies being traded. Swap fees are calculated based on the size of the position and the prevailing interest rates.

Who pays the swap rate : The fixed-rate payer pays the fixed interest rate amount to the floating-rate payer while the floating- rate payer pays the floating interest amount based on the reference rate. Duration and Termination: In the swap agreement, the tenor or duration of the swap is defined.

If the interest rate is lower for the bought currency, a swap will be charged from the account. Swaps don't occur when a trade happens within one day. So if a trader opens a position and closes it that same day, there will be no interest rates charged.

Selecting the optimal cryptocurrency pair

The type of cryptocurrency involved in the swap can also influence the fee. Some cryptocurrency pairs offer higher liquidity and lower transaction costs. Researching this and opting for low-fee cryptocurrency pairs for efficient swaps can be an effective way to cut costs.

Do swaps have fees

The counterparties in a typical swap transaction are a corporation, a bank or an investor on one side (the bank client) and an investment or commercial bank on the other side. After a bank executes a swap, it usually offsets the swap through an inter-dealer broker and retains a fee for setting up the original swap.A swap is an interest fee that is either paid or charged to you at the end of each trading day if you keep your trade open overnight. The procedure of moving open positions from one trading day to another is called rollover.Improper risk management is a major reason why Forex traders tend to lose money quickly. It's not by chance that trading platforms are equipped with automatic take-profit and stop-loss mechanisms. Mastering them will significantly improve a trader's chances for success.

Most brokers charge a swap rate between 23:00 to 00:00. Sometimes a swap is charged for holding a position over the weekend, even if the position is not held over the entire weekend. This is done to compensate for the markets closing during this period.

Are swap fees expensive : The swap fees are simply the associated transaction costs. Understanding these costs is pivotal in shaping your trading strategies and potential gains. For example, say each swap comes with a fee of 20 basis points (bps), which is equivalent to 0.20%. If you perform ten such swaps, your returns diminish by 2%.

How are swaps paid : A swap is an agreement for a financial exchange in which one of the two parties promises to make, with an established frequency, a series of payments, in exchange for receiving another set of payments from the other party. These flows normally respond to interest payments based on the nominal amount of the swap.

Why is swap fees haram

Islamic finance prohibits the payment and receipt of interest. In conventional forex trading, interest is typically charged on positions held overnight (swap or rollover fees). Therefore, engaging in conventional forex trading with interest charges would not be permissible in Islamic finance.

Timing your swaps

For Ethereum and other networks that use gas, network congestion can trigger a spike in gas prices, leading to higher swap fees. Keeping an eye on gas prices and scheduling transactions during periods of lower network activity can lower swap costs.Another reason why day traders tend to lose money is that it's very different from long-term investing. While traders take advantage of price swings (which means they have to make specific predictions), investors tend to buy a diversified basket of assets for the long haul.

Why do 90% of traders fail : Without a trading plan, retail traders are more likely to trade randomly, inconsistently, and irrationally. Another reason why retail traders lose money is that they do not have an asymmetrical risk-reward ratio.