Antwort Why do IBAN transfers take so long? Weitere Antworten – How long do IBAN transfers take

one to five working days

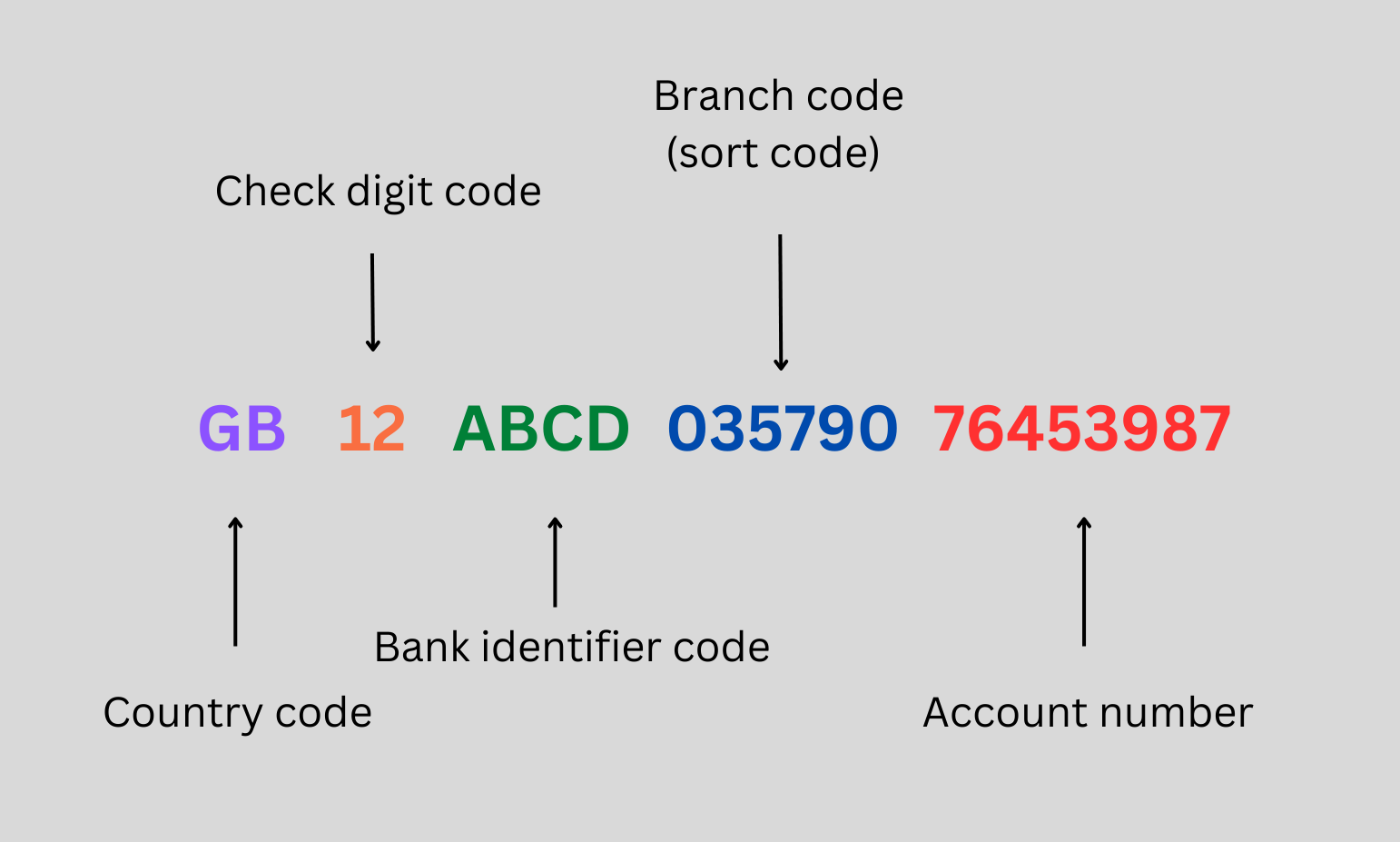

Generally speaking, international bank transfers will arrive within one to five working days. Let's explore what this looks like. To send an international payment, you simply need to gather all the necessary information (IBAN number, BIC/SWIFT number, recipient's banking details, etc.)Time zones: Transferring between banks in different time zones can add delays. Dates and timing: Weekends and public holidays in either the sending or receiving country can cause delays in processing international transfers, as can carrying out the transaction at the end of the business day.There can be many reasons why international money transfers take time to be processed such as bank holidays, weekend delays, currency conversion delays, fraud detection & prevention measures, slow international bank networks, global events, and natural disasters among many other reasons.

Why does it take 3 days to transfer money : The online banking industry has a “three-day good funds model” policy; where transfers will typically take between two and four days. The banks want to be sure the money is really there and available before it lets the receiver use the money – this is why they don't make the funds available immediately.

How do I track an IBAN transfer

Contact your bank or payment service provider: Reach out to your bank's customer service or visit the nearest branch (if they have any). Provide them with the transaction details and ask for assistance in tracking the wire transfer. They will have access to the necessary systems and information to help you.

What happens if money is transferred but not received : If the bank initiated the transfer, notify the bank immediately so that it can investigate your claim. If you first contact the bank by phone, it is a good practice to follow up in writing. If you wired the funds through a third party (e.g., Western Union), contact that party to find out what their procedures are.

The time it takes for a bank transfer to be successful depends on a number of factors, and some of these factors could cause a delay. These factors include the timing of the transfer, where the transfer is being made, the currencies involved, security checks, bank holidays, and the reasons for the transaction.

Firstly, most bank transfers are processed immediately. However, some bank transfers can take up to two hours, overnight or even the next business day. The time it takes for a bank transfer to be successful depends on a number of factors, and some of these factors could cause a delay.

What is the longest a bank transfer should take

Your specific bank transfer time will vary depending on a range of factors, including fraud prevention, different currencies, different time zones, and bank holidays/weekends. In general, the bank transfer time will be around one to five working days.Your specific bank transfer time will vary depending on a range of factors, including fraud prevention, different currencies, different time zones, and bank holidays/weekends. In general, the bank transfer time will be around one to five working days.If you need the funds to arrive in the recipient's bank account as soon as possible, you may be able to expedite the process. Some banks offer this service if the recipient account is within the same financial institution, and the sender has previously sent a transfer.

If the payment or transfer you have made left your account immediately you will see the transaction in your list of most recent transactions. If you have scheduled a payment or transfer for a date in the future you will be able to check online that it has been created successfully.

Can we track international money transfer : To find out if an international wire you sent was received, you have a few options: You can contact the recipient and ask directly. You can request a trace on the transfer, and your bank will be able to tell you whether the money has been deposited into the recipient's account².

Can money get lost in a transfer : Can money get lost in transfer between banks Money can occasionally be delayed or misrouted during a bank transfer, though it is relatively rare for it to get 'lost. ' This issue can arise from incorrect details being provided or bank errors. If your money doesn't arrive as expected, contact your bank.

What’s the longest a bank transfer can take

Transferring money between banks can take one to five days, depending on if you're doing a wire transfer or ACH transfer or using a peer-to-peer app or check.

The time it takes for a bank-to-bank transfer can vary depending on the financial institution and the type of transfer being made. It might take up to 1-2 business days for the bank to process the transfer.The time it takes for a bank transfer to be successful depends on a number of factors, and some of these factors could cause a delay. These factors include the timing of the transfer, where the transfer is being made, the currencies involved, security checks, bank holidays, and the reasons for the transaction.

Why is money transferred but not received : If money is sent but not received, there could be several reasons why the transfer was unsuccessful, such as an incorrect recipient name or bank account number, a problem with the receiving bank's systems, or issues with local regulations or restrictions in the recipient's country.