Antwort Why do companies use swaps? Weitere Antworten – Why do companies use currency swaps

Currency swaps are used to obtain foreign currency loans at a better interest rate than a company could obtain by borrowing directly in a foreign market or as a method of hedging transaction risk on foreign currency loans which it has already taken out.A FX Swap provides protection against negative rate fluctuations. Transactions can be closed out with a reverse transaction. Any rate differences (positive or negative) are settled at the predetermined delivery date. A FX Swap carries the following risks: • A FX Swap contract fixes the future exchange rate.Currency swaps are over-the-counter derivatives that serve two main purposes. First, they can be used to minimize foreign borrowing costs. Second, they could be used as tools to hedge exposure to exchange rate risk.

What are the disadvantages of a currency swap : Disadvantages of Currency Swaps

Currency swaps have the following disadvantages: Complexity: They can be complicated to structure and understand, requiring specialized knowledge. Credit Risk: Risk that the other party might not fulfill their payment obligations.

Why are swaps so popular

People typically enter swaps either to hedge against other positions or to speculate on the future value of the floating leg's underlying index/currency/etc. For speculators like hedge fund managers looking to place bets on the direction of interest rates, interest rate swaps are an ideal instrument.

Who benefits from a currency swap : Hedging Currency Risk

Currency swaps allow businesses and investors to hedge their exposure to fluctuations in currency exchange rates, reducing the risk of adverse currency movements affecting their financial position.

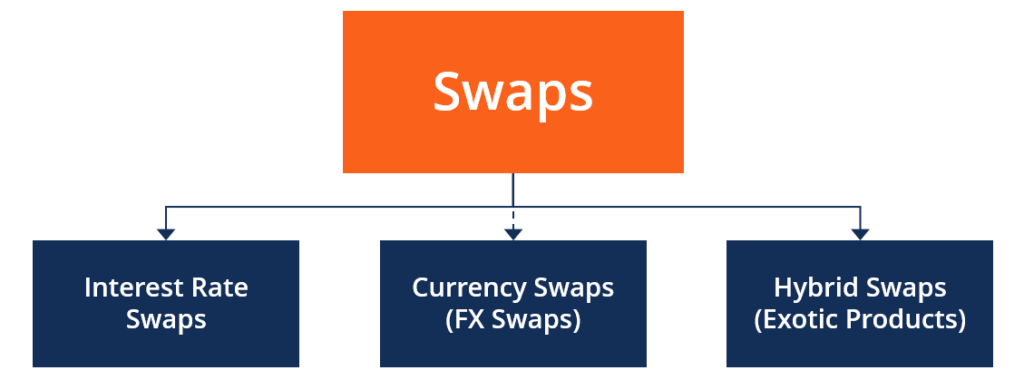

Swaps are commonly used by businesses and investors to manage risk, hedge against interest or currency exchange fluctuations, or speculate on future market movements. Swaps are typically traded over-the-counter (OTC), meaning they are not traded on an exchange but are negotiated directly between the parties involved.

Emergency Recovery: If your system encounters a severe memory issue, and the RAM is exhausted, swap space can act as a last resort to prevent a system crash. It's better to have some performance degradation due to swapping than a sudden crash.

What are the advantages and disadvantages of swap contracts

The benefit of a swap is that it helps investors to hedge their risk. Had the interest rates gone up to 8%, then Party A would be expected to pay party B a net of 2%. The downside of the swap contract is the investor could lose a lot of money.A currency swap involves the exchange of interest—and sometimes of principal—in one currency for the same in another currency. Companies doing business abroad often use currency swaps to get more favorable loan rates in the local currency than if they borrowed money from a local bank.What are the risks. Like most non-government fixed income investments, interest-rate swaps involve two primary risks: interest rate risk and credit risk, which is known in the swaps market as counterparty risk. Because actual interest rate movements do not always match expectations, swaps entail interest-rate risk.

The ability to quickly buy and sell an asset without having an impact on its price is referred to as liquidity. Because they frequently have a larger user base and a wider variety of trading pairs than crypto swaps, cryptocurrency exchanges frequently have higher liquidity than crypto swaps.

How do swaps benefit investors : By entering into a swap agreement, investors can exchange fixed-rate interest payments for floating-rate interest payments or vice versa. This enables them to hedge against adverse interest rate movements, ensuring more predictable cash flows and minimizing potential losses.

Why are swaps desirable : Swap contracts normally allow for payments to be netted against each other to avoid unnecessary payments. Here, Company B pays $66,000, and Company A pays nothing. At no point does the principal change hands, which is why it is referred to as a notional amount.

Do you really need a swap

If a system runs out of physical RAM and doesn't have enough swap space available, it may increase the likelihood of a system crash due to a memory exhaustion issue. Having sufficient swap space can prevent some memory-related crashes.

If you really don't want sensitive information written to swap, even encrypted, then you're going to have to run without swap and make sure you have enough memory. There's a theory that having swap enabled means that there'll be more writes to storage and the system will slow down bringing back pages from disk.Investment bankers sometimes make money with swaps. Swaps create profit opportunities through a complicated form of arbitrage, where the investment bank brokers a deal between two parties that are trading their respective cash flows.

What are the advantages and disadvantages of swap currency : Currency swaps can be a powerful tool for managing currency risk, accessing foreign financing, and reducing transaction costs. However, parties must be aware of the potential disadvantages, such as counterparty risk, legal complexity, and exchange rate risk.

:max_bytes(150000):strip_icc()/Term-Definitions_swap-27b93a31e83c423a854db04030a67673.jpg)

:max_bytes(150000):strip_icc()/cross-currency-swap.asp-final-2f3b32efed4e4fde8fb9ff2fac9d9d4e.png)