Antwort Why are you not supposed to keep money in a safe deposit box? Weitere Antworten – Why can’t you keep cash in a safe deposit box

:max_bytes(150000):strip_icc()/safe-deposit-box-what-to-store-and-not-store-in-yours-4589854-final-61fbded2c9b54d1ba6550c4aeff384a6.png)

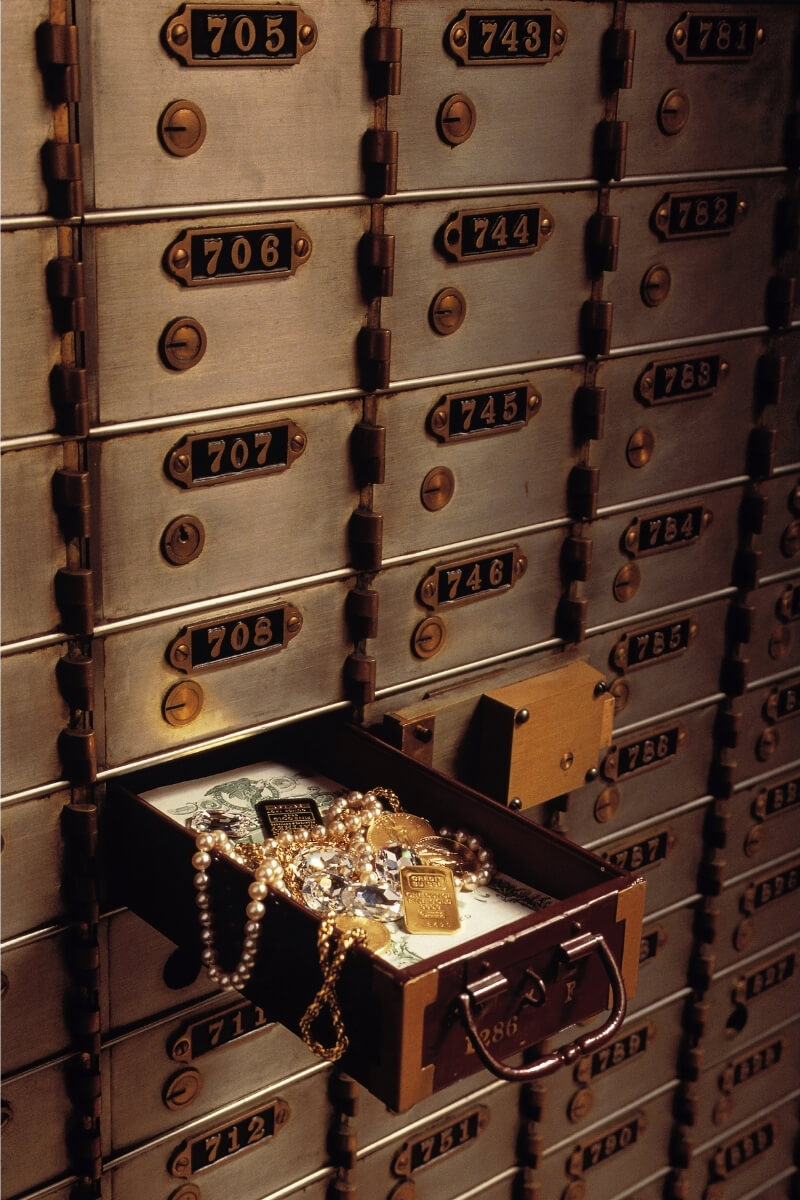

A safe deposit box is not a deposit account. It is storage space provided by the bank, so the contents, including cash, checks or other valuables, are not insured by FDIC deposit insurance if damaged or stolen.Access to contents is limited. Access to your safe deposit box could be even more limited during emergencies, including natural disasters (which could even threaten the bank and box itself, depending on where you live).It's also unwise to store cash or similar investments in a safe deposit box.

Do banks know what is in a safety deposit box : The safe deposit box is a storage space you rent from the bank. Its contents are kept private, and the bank doesn't know what you put in there.

What is the safest place to keep money

Here are some low-risk options.

- Checking accounts. If you put your savings in a checking account, you'll be able to get to it easily.

- Savings accounts.

- Money market accounts.

- Certificates of deposit.

- Fixed rate annuities.

- Series I and EE savings bonds.

- Treasury securities.

- Municipal bonds.

Is it wise to store gold in a safe deposit box : Safe deposit boxes at the bank are often considered the best way to store gold bullion bars or coins. They offer more security than home storage, they're cheap to rent, and you can store just about anything in them without having to declare the contents.

During a robbery, it would be much easier for a burglar to break into your home and open a safe, or even steal the entire safe, than it would for them to get inside a safe deposit box at your bank. Items stored in a home safe aren't protected from natural disasters, such as floods or fires.

The FDIC does not insure the contents of safe deposit boxes at banks. If your bank fails, you likely will be able to retrieve the contents of your safe deposit box. If another bank acquires your bank's branches, you can contact that bank to ask about accessing your safe deposit box.

Is it safe to keep cash in a bank locker

As per the revised bank locker guideline, you cannot store cash and currency. Moreover, the revised locker agreement restricts you from storing arms, weapons, drugs, explosives and contraband materials.The economics of safe deposit boxes started to break, at least for the major banks, as the cost of commercial real estate ballooned. The number of bank branches peaked around the time of the 2008 recession, and have plummeted ever since.Cash equivalents are financial instruments that are almost as liquid as cash and are popular investments for millionaires. Examples of cash equivalents are money market mutual funds, certificates of deposit, commercial paper and Treasury bills. Some millionaires keep their cash in Treasury bills.

Government bonds (aka "Treasurys") are generally considered the safest investments because they're backed by the full faith and credit of the U.S. government. Other types of bonds include corporate bonds and municipal bonds (earnings on the latter are exempt from federal taxes).

Why are safe deposit boxes not as popular as they used to be : If bank boxes are much more expensive than, say, a home safe or a home security system, customers will opt for the latter. Safe deposit also came with a handful of legal headaches. Banking industry executives fretted over hypothetical scenarios about when they would let a customer in to see their valuables.

What happens to safe deposit box if bank closes : The FDIC does not insure the contents of safe deposit boxes at banks. If your bank fails, you likely will be able to retrieve the contents of your safe deposit box. If another bank acquires your bank's branches, you can contact that bank to ask about accessing your safe deposit box.

What cannot be stored in a safe deposit box

What Items Should Not Be Stored in a Safe Deposit Box

- Cash money. Most banks are very clear: cash should not be kept in a safe deposit box.

- Passports.

- An original will.

- Letters of Intent.

- Power of Attorney.

- Valuables, Jewelry or Collectibles.

- Spare House Keys.

- Illegal, Dangerous, or Liquid Items.

In addition to keeping funds in a bank account, you should also keep between $100 and $300 cash in your wallet and about $1,000 in a safe at home for unexpected expenses. Everything starts with your budget. If you don't budget correctly, you don't know how much you need to keep in your bank account.The economics of safe deposit boxes started to break, at least for the major banks, as the cost of commercial real estate ballooned. The number of bank branches peaked around the time of the 2008 recession, and have plummeted ever since.

What happens to abandoned safe deposit boxes in California : If the property remains unclaimed and is classified as abandoned, the bank may be required to transfer the contents of the safe deposit box to the state treasurer or unclaimed-property office in a process called escheat.