Antwort Who benefits from a currency swap? Weitere Antworten – What are the benefits of a currency swap

What Are The Benefits Of Currency Swaps

- It Helps To Reduce Exposure To Risk.

- You Can Reduce Your Forex Margins.

- It Allows You To Increase Your ROI.

- It Can Be Used As An Alternative To A Forward Contract.

- It Can Help You With Debt Management.

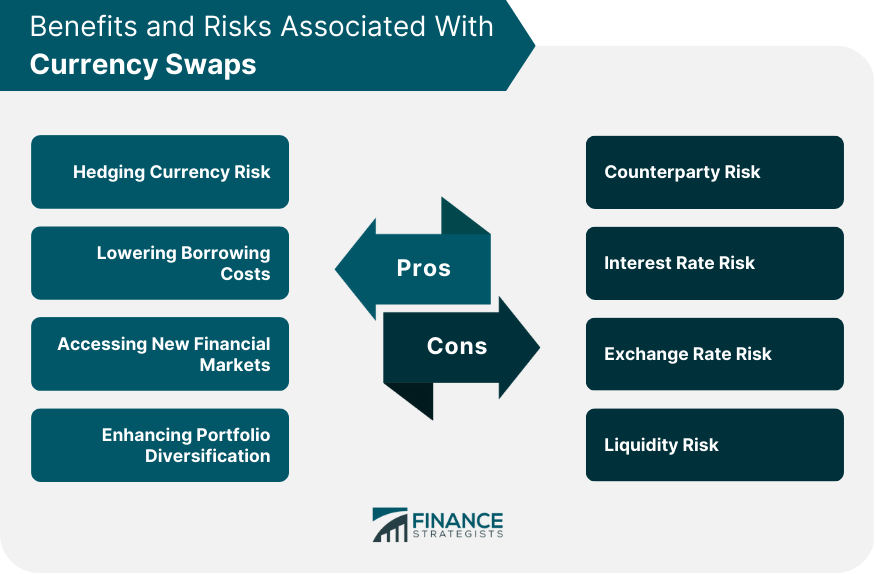

The two primary reasons for a counterparty to use a currency swap are to obtain debt financing in the swapped currency at an interest cost reduction brought about through comparative advantages each counterparty has in its national capital market, and/or the benefit of hedging long-run exchange rate exposure.Disadvantages of Currency Swaps

Currency swaps have the following disadvantages: Complexity: They can be complicated to structure and understand, requiring specialized knowledge. Credit Risk: Risk that the other party might not fulfill their payment obligations.

What is the role of currency swaps in managing currency risk : Currency swaps are used to obtain foreign currency loans at a better interest rate than a company could obtain by borrowing directly in a foreign market or as a method of hedging transaction risk on foreign currency loans which it has already taken out.

How do swaps benefit investors

By entering into a swap agreement, investors can exchange fixed-rate interest payments for floating-rate interest payments or vice versa. This enables them to hedge against adverse interest rate movements, ensuring more predictable cash flows and minimizing potential losses.

What are the benefits of currency swap agreement between countries : Currency swaps are over-the-counter derivatives that serve two main purposes. First, they can be used to minimize foreign borrowing costs. Second, they could be used as tools to hedge exposure to exchange rate risk.

Swaps are mainly used by institutional investors such as banks and other financial institutions, governments, and some corporations. They are intended to be used to manage a variety of risks, such as interest rate risk, currency risk, and price risk.

Currency swaps can be a powerful tool for managing currency risk, accessing foreign financing, and reducing transaction costs. However, parties must be aware of the potential disadvantages, such as counterparty risk, legal complexity, and exchange rate risk.

What are three 3 main risks of currency exchange

There are three main types of foreign exchange risk, also known as foreign exchange exposure: transaction risk, translation risk, and economic risk.Currency swap forward contracts can help protect companies from losses due to changes in exchange rates. These contracts lock in a certain exchange rate for a set period, allowing companies to budget and plan more accurately.Interest rate swaps have become an integral part of the fixed income market. These derivative contracts, which typically exchange – or swap – fixed-rate interest payments for floating-rate interest payments, are an essential tool for investors who use them in an effort to hedge, speculate, and manage risk.

Swaps are mainly used by institutional investors such as banks and other financial institutions, governments, and some corporations. They are intended to be used to manage a variety of risks, such as interest rate risk, currency risk, and price risk.

What are the advantages and disadvantages of swap contracts : The benefit of a swap is that it helps investors to hedge their risk. Had the interest rates gone up to 8%, then Party A would be expected to pay party B a net of 2%. The downside of the swap contract is the investor could lose a lot of money.

Who buys swaps : Swap contracts involve an underlying asset, which can be any legal commodity or financial instrument of value. It is usually the big businesses and financial institutions that enter into such contracts. However, swap transactions are not prevalent among retail investors.

Who is the buyer of a swap

By conven- tion, a fixed-rate payer is designated as the buyer of the swap, while the floating-rate payer is the seller of the swap. Swaps vary widely with respect to underlying asset, matu- rity, style, and contingency provisions.

A currency swap involves the exchange of interest—and sometimes of principal—in one currency for the same in another currency. Companies doing business abroad often use currency swaps to get more favorable loan rates in the local currency than if they borrowed money from a local bank.Currency risk is the possibility of losing money due to unfavorable moves in exchange rates. Firms and individuals that operate in overseas markets are exposed to currency risk.

What are the uses of swaps : Swaps are commonly used by businesses and investors to manage risk, hedge against interest or currency exchange fluctuations, or speculate on future market movements. Swaps are typically traded over-the-counter (OTC), meaning they are not traded on an exchange but are negotiated directly between the parties involved.

:max_bytes(150000):strip_icc()/foreign-currency-swaps.asp-final-02bae8a217974bafb0705ac48de59d8d.png)