Antwort Which currency is better to pay abroad? Weitere Antworten – Which currency to choose when paying abroad

:max_bytes(150000):strip_icc()/foreign-transaction-fee-vs-currency-conversion-fee-know-the-difference-4768955_V1-bb8bc0fcc5e24003896141fea9febd39.png)

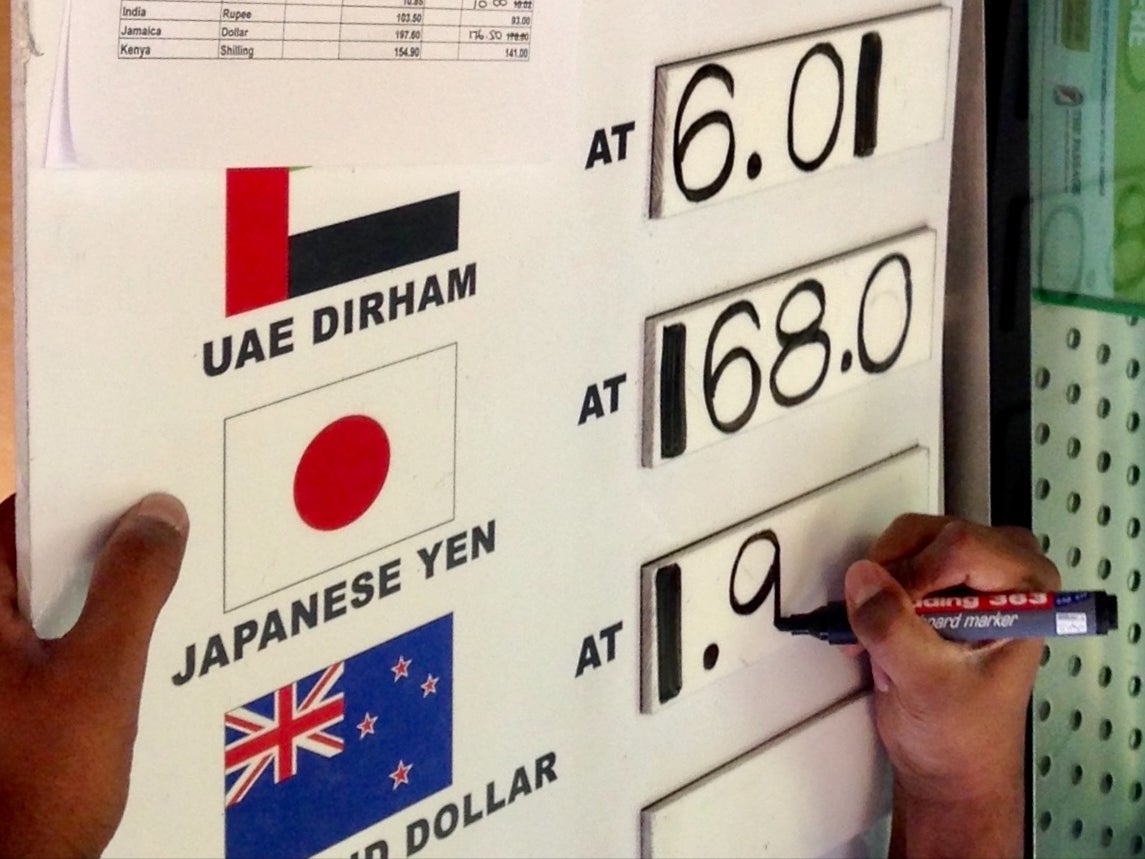

You may come across DCC in many countries around the world, but be particularly careful if you are using ATMs in either Spain, Greece, Portugal, Croatia or Thailand. So remember, if you're using an ATM or spending on your card abroad, always choose to withdraw or spend in the local currency.You can typically save by opting to spend in the local currency. This would mean, for example, choosing euros in Spain or rupees in India. When you choose to pay in the currency of the country or region you're in, Visa or MasterCard will set the exchange rate. Your bank may charge a fee to carry out the transaction.You're going to pay some fee and/or spread in either case. But, generally, your own bank is going to charge you less. So, you should generally pay in local currency and let them do the exchange on your credit card bill or debit card.

Is it better to pay in foreign currency on a credit card : Depending on the credit card you use when traveling abroad, you could pay fees that total 6% or more of purchases. Using a credit card with no foreign transaction fees and choosing to make purchases in local currency will nearly always save you money.

How to pay abroad without fees

Here are some of the most efficient, cheapest and safest ways to spend your money abroad.

- Travel debit cards. You can use your trusty debit card, but this can be an expensive mistake as you may end up paying unnecessary fees when you spend or withdraw cash from an ATM.

- Travel credit cards.

- Prepaid travel cards.

- Cash.

How to avoid transaction fees abroad : The best way to avoid foreign transaction fees is to acquire a no-foreign-transaction-fees credit card, if you qualify for one. Next in line are checking accounts or debit cards with no foreign transaction fee. It is also possible to avoid the fee by paying in the local currency for purchases.

A rule of thumb is that you should always choose the local currency – it is cheaper. Then you will avoid extra expenses and you will get the best rate, calculated by VISA or MasterCard. If you pay with a credit card from re:member, you will always get the best rate.

Use a debit card

Most providers will charge you for every transaction you make overseas, but you can find credit or debit cards that will cut the cost of your spending abroad.

Is it better to pay in euros or zloty

A few bars and tourist companies in Kraków and Warsaw will accept Euros but most of the time you won't be able to pay with Euros in Poland. The few companies that do accept Euro probably won't be able to give a very competitive rate, so it's better to simply pay in Złoty.As they can adjust the exchange rate and the conversion fees they charge, it's often more expensive to pay this way compared to in the local currency. Paying in the local currency means your bank or card provider will complete the exchange, usually at a better rate.If you're travelling internationally, it's best to bring a no-foreign-transaction-fee credit card so you don't waste funds just because you're shopping in another currency. In the end, you may find it's best to have access to both cash and a travel-friendly credit card when travelling.

The best way to avoid foreign transaction fees is to acquire a no-foreign-transaction-fees credit card, if you qualify for one. Next in line are checking accounts or debit cards with no foreign transaction fee. It is also possible to avoid the fee by paying in the local currency for purchases.

How not to pay international fees : A good rule of thumb when traveling is to select the local currency during payment to avoid conversion fees and to use a card that doesn't charge foreign transaction fees. Cash withdrawals from international ATMs are also subject to fees.

How to avoid foreign transaction fees : The following steps will help you avoid foreign transaction fees:

- Open a Credit Card Without a Foreign Transaction Fee.

- Open a Bank Account Without a Foreign Transaction Fee.

- Exchange Currency Before Traveling.

- Avoid Foreign ATMs.

- Ask Your Bank About Foreign Partners.

Is it better to change to zloty in Poland

Similarly, if you pay by credit or debit card for your shopping, always select to be charged in zloty, which gives you a better exchange rate. If you hold a zloty card and plan to travel, remember that you might not always get the best exchange rate on withdrawals in the local currency.

What is the best Polish zloty exchange rate The best Polish zloty exchange rate right now is 4.8587 from Travel FX. This is based on a comparison of 16 currency suppliers and assumes you were buying £750 worth of Polish zloty for home delivery.A more convenient way to spend while overseas is by debit card. All you need is one small piece of plastic, and you can spend and withdraw cash whenever you need to. There are even prepaid travel debit cards out there, which you load up with money before you travel.

How to avoid paying foreign transaction fees : The following steps will help you avoid foreign transaction fees:

- Open a Credit Card Without a Foreign Transaction Fee.

- Open a Bank Account Without a Foreign Transaction Fee.

- Exchange Currency Before Traveling.

- Avoid Foreign ATMs.

- Ask Your Bank About Foreign Partners.