Antwort Which country has the lowest tax rate in Europe? Weitere Antworten – Which country in Europe has the lowest taxes

Bulgaria

Bulgaria opens our list as the country that has one of the lowest tax rate in Europe. The country's 10% flat rate of personal income and corporate income taxes are among the lowest in the European Union.Denmark

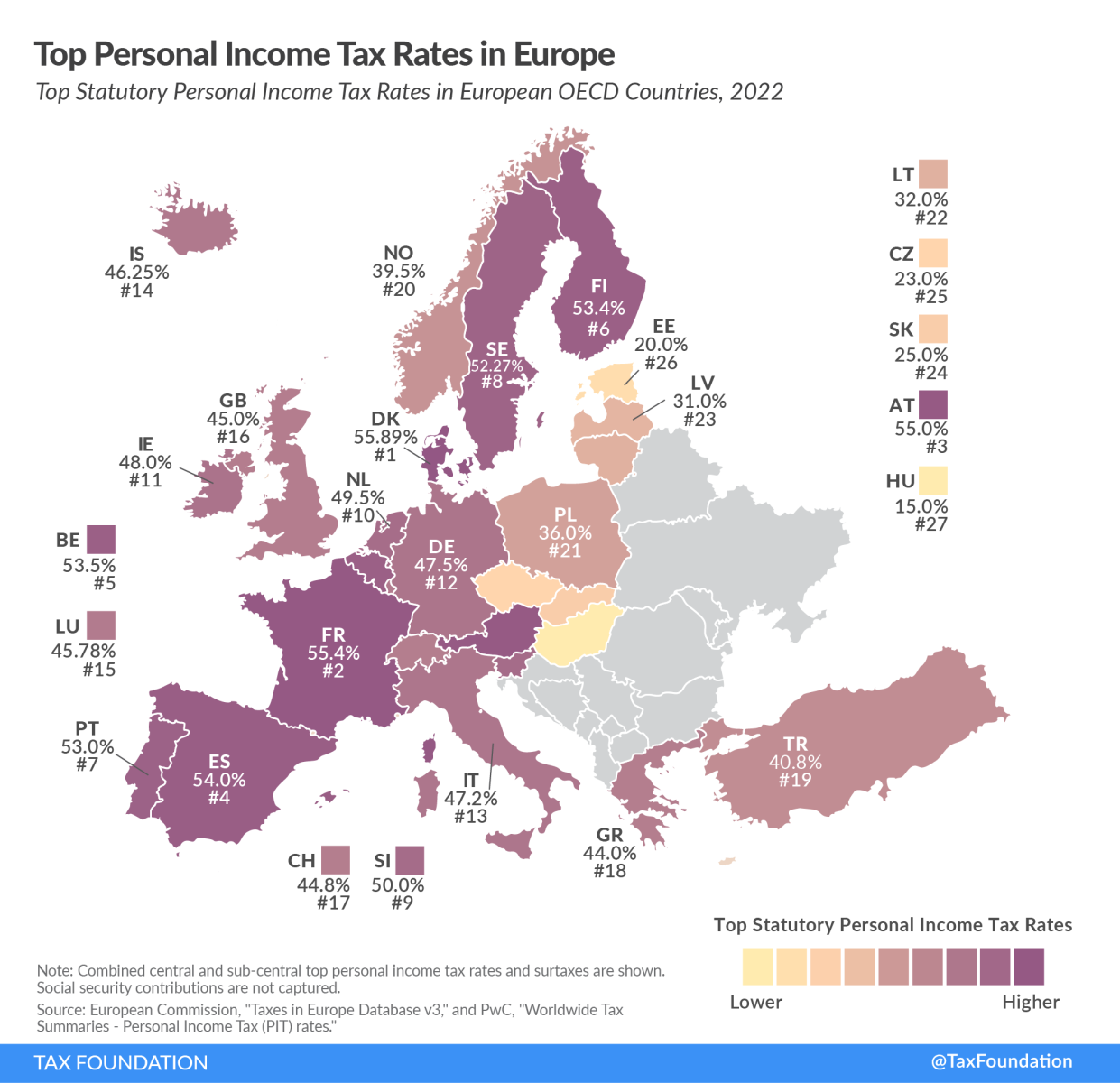

Denmark is the European country with the highest top statutory income tax rate as of 2024, with the Nordic country having a top taxation band of 55.9 percent.Summary of the Forecast. Last year, the Czech economy teetered on the edge of recession. Gross domestic product fell by 0.3% in 2023, but is forecast to grow by 1.4% this year and 2.6% next year. Inflation will stay below 3% for most of 2024, before falling towards 2% in 2025.

What is the tax rate in Czech Republic : Personal Income Tax

The progressive tax of 23% applies to personal income above the statutory limit, which has been set at 36 times the average monthly salary in 2024. Therefore, if an individual's income exceeds 36 times the average wage, they must pay 23% tax on this excess income instead of the basic 15% tax.

Is Switzerland tax-free

All tax-resident individuals are taxed on their worldwide income and wealth. Non-tax-resident individuals are only taxed on Swiss sources of income and wealth.

Is Portugal tax-free : Residents in Portugal for tax purposes are taxed on their worldwide income at progressive rates varying from 13.25% to 48% for 2024.

20 Countries with the Lowest Income Tax Rates in the World

- Bulgaria.

- Turkmenistan.

- Guatemala. Personal Income Tax Rate: 7%

- Brunei. Personal Income Tax Rate: 0%

- Saudi Arabia. Personal Income Tax Rate: 0%

- Oman. Personal Income Tax Rate: 0%

- Kuwait. Personal Income Tax Rate: 0%

- Qatar. Personal Income Tax Rate: 0%

We are using The Corporate Tax Haven Index 'Haven Score' 2021 results.

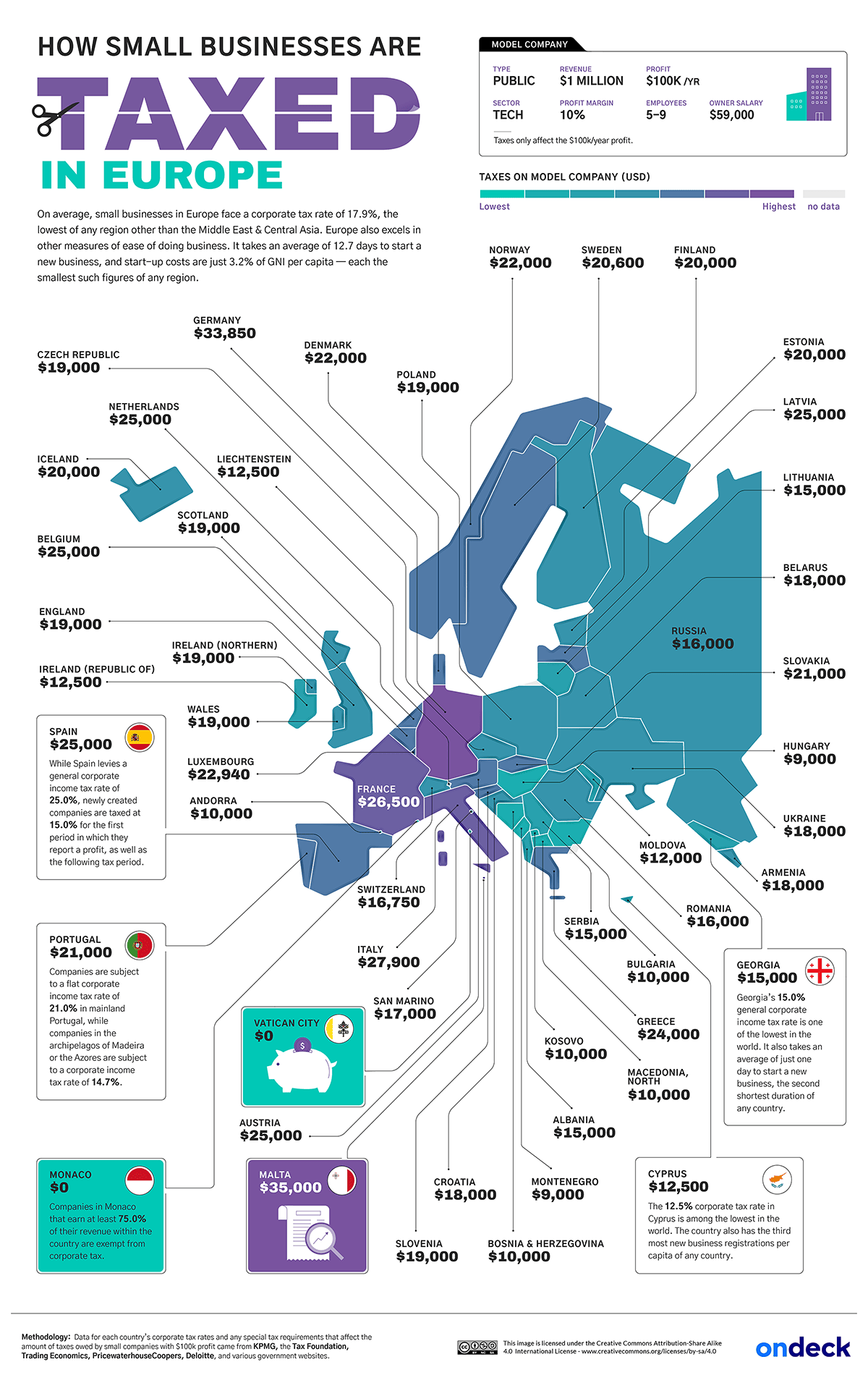

- Cyprus.

- Netherlands.

- Malta.

- Ireland. Best for research and development startups.

- Luxembourg. Best for foreign investors.

- Estonia. Best for digital nomads and solopreneurs.

- England. Best for capital gains.

- Monaco. Best for wealthy business owners.

Is Czechia richer than Italy

Using GDP per capita at purchasing power parity (PPP), Bloomberg calculated that Czechia is close to catching up with the likes of Italy and Spain, whose GDP per capita at PPP is USD 56,905 (CZK 1.3 million) and USD 52,012 respectively. Czechia's current rate is USD 50,475.The Czech Republic is a unitary parliamentary republic and developed country with an advanced, high-income social market economy. It is a welfare state with a European social model, universal health care and free-tuition university education.Prague, the capital city, stands as the epicenter of economic activity in the Czech Republic. The average salary in Prague is significantly higher than the national average, with figures often surpassing 50,000 CZK (approximately €1,971) per month.

Description. Individuals and legal persons are tax residents of the Czech Republic if certain conditions are met. The tax rate amounts to 15% for the part of the tax base up to an average salary multiplied by 48.

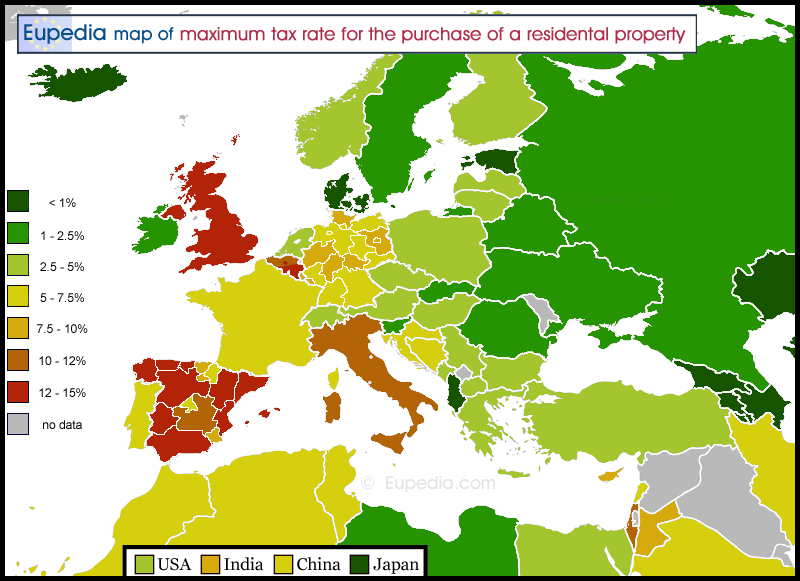

What is tax-free in Italy : Tax Free shopping allows customers from outside the European Union, and EU residents, to claim a VAT refund on purchases of personal goods – provided they're intended for personal use and carried in personal luggage and taken outside of the country.

Is Luxembourg a tax haven : Table of content. Luxembourg has earned a distinguished reputation as a tax haven due to its historical appeal to corporations and wealthy individuals since the 1960s. Rising as a prominent financial center for the offshore trade of European bonds, Luxembourg became a favored choice for entities seeking to issue deb.

How much tax do I pay in Spain

Up to € 12,450, the tax rate is 19%. From €12,450 to €20,200, the tax rate is 24%. From €20,200 to €35,200, the tax rate is 30%. From €35,200 to €60,000, the tax rate is 37%.

Portugal's Non-Habitual Resident (NHR) special tax regime allows qualifying entrepreneurs, professionals, retirees and HNWIs to enjoy reduced tax rates on Portuguese-source income and exemption on most foreign-source income for 10 years.Sweden's standard VAT rate is 25%, with certain items having reduced rates. This is slightly higher than some other European countries, making the potential savings more significant. To shop tax-free, you must be a non-EU resident.

Is Czech Republic rich or poor : The Czech Republic is considered an advanced economy with high living standards. The country compares favorably to the rest of the world for inequality-adjusted human development, according to the United Nations.