Antwort Which banks use Faster Payments? Weitere Antworten – Is Faster Payments the same as instant payments

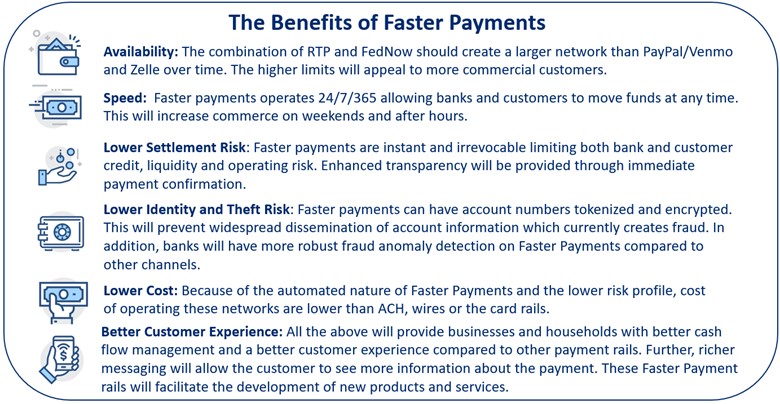

Summary From an end user's perspective, many types of payments can be “faster” in that funds appear to move from the sender to the receiver in near real-time, but to be considered an Instant Payment, the payer and payee's FIs need to be able to settle that payment on a real-time basis as well.Notable instant payment systems by country

| Name | Country | Launched |

|---|---|---|

| Faster Payment Service (FPS) | United Kingdom | 2008 |

| Zelle | United States | 2017 |

| FedNow | United States | 2023 |

| EasyPay | Ukraine | 2009 |

Instant payments are credit transfers that make funds available in a payee's account within ten seconds of a payment order being made.

What is real-time payment in the UK : In the UK, real-time payments are processed through Faster Payments which allows millions of businesses, charities, and individuals to transact and send money 24/7. Since its launch in 2008, there have been over 9 billion payments sent across the UK amounting to a combined value of over £6 trillion.

Do all banks use Faster Payments

Faster Payments is a service that allows the transfer of funds in minutes or hours rather days. Not all banks and building societies are signed up to service, so check with your provider or the bank you want to send money to first. Make sure the person or company receiving the Faster Payment is able to accept it too.

Who runs Faster Payments : The system is operated by Pay.UK, the company that's also responsible for facilitating Bacs payments and the Current Account Switch Service, among other things.

Which banks are direct participants of Faster Payments

- The Access Bank UK.

- Atom Bank.

- Barclays.

- BFC Bank.

- Cashplus.

- Citi.

- Clear Bank.

- Clydesdale Bank.

Generally speaking, international bank transfers will arrive within one to five working days. Let's explore what this looks like. To send an international payment, you simply need to gather all the necessary information (IBAN number, BIC/SWIFT number, recipient's banking details, etc.)

Which bank transfer is instant

IMPS is an emphatic service which allow transferring of funds instantly within banks across India which is not only safe but also economical.Wire transfers and P2P payments tend to be the fastest methods, but you have little recourse for getting your money back once the funds are sent. Cashier's checks are a preferred method for transferring large sums of money but can get lost or damaged.Almost any bank in the UK can receive Faster Payments. However, some banks, building societies and financial services companies are direct participants of the Faster Payments Service, which means that these connect directly to the service, without the need for a third-party sponsor.

Debit and Credit Cards

UK shoppers use debit cards more often than any other payment method. Card payments (both credit and debit) made up 57% of the nation's transactions. Customers used debit cards in about 48% of all purchases.

Does HSBC use Faster Payments : Our aim is to support you through the implementation of Faster Payments, and provide you with the solutions that fit best with your requirements and those of your customers. We'll be happy to answer any questions or help you to take advantage of the Faster Payments service.

Which UK banks use FPS : Faster Payment participants

- Adyen. Atom bank. Banking Circle. Barclays Bank plc. Barclays Bank UK plc. Cashplus Bank.

- Allied Irish Bank. Atom bank. Bank of England. Bank of Scotland plc. Barclays Bank plc. Barclays Bank UK plc.

- Allied Irish Bank. Bank of Ireland (UK) plc. Barclays Bank plc. Barclays Bank UK plc. ClearBank®

How fast does IBAN transfer

Once the transfer has been processed, the funds will usually be deducted from the sender's account. However, this doesn't necessarily mean that it will arrive with the recipient at the same time. As stated above, international bank transfers will generally arrive within one to five working days.

:max_bytes(150000):strip_icc()/payment.asp-Final-25aad0eedda34c9db463c665991c6323.jpg)

FAST is offered by the following banks – ANZ Bank, Bank of China Limited, BNP Paribas, CIMB Bank, Citibank, DBS Bank / POSB, Deutsche Bank, HL Bank, HSBC, HSBC Bank (Singapore) Limited, ICICI Bank Limited, Industrial and Commercial Bank of China Limited, Maybank Singapore Limited, Malayan Banking Berhad, Singapore …Yes, Faster Payments is a type of bank transfer and the two terms are often used interchangeably. Other types of bank transfers include Bacs and CHAPS.

Which bank transfer is fast : Consequently , RTGS payments happen faster, as the amount is reflected in the payee's account within 30 minutes of initiation of payment at the remitter's end. On the other hand, NEFT fulfilment is reflected within 2 hours.