Antwort What’s swap fee? Weitere Antworten – How is the swap fee calculated

For forex, here's the formula to calculate swap:

- Swap = (Pip Value * Swap Rate * Number of Nights) / 10.

- Pip value: $1.

- Swap (long) rate: -3.3154.

- Swap fee: (1* -3.3154 * 1) / 10 = -$0.33.

How to Avoid Swap Fees. Retail traders can avoid swap charges if they open and close their trades during the same trading session. This is done in high frequency trading and intraday trading. Opening and closing trades during the same trading session also reduces trading risks for the trader.XAU/USD has a Long swap of – 11.27. If you bought 2 lots, the swap charged would be 2 x – 11.27 equaling -22.54 USD, this total will be converted to your accounts base currency from USD.

What does swap mean in forex : A swap in forex refers to the interest that you either earn or pay for a trade that you keep open overnight. There are two types of swaps: Swap long (used for keeping long positions open overnight) and Swap short (used for keeping short positions open overnight).

Why do brokers charge swap fees

Swap fees are charged when trading on leverage. The reason for this being that when you open a leveraged position, you are essentially borrowing funds to place the trade. In the Forex market every time you open a position you are essentially making two trades, buying one currency in the pair and selling the other.

Who pays the swap rate : The fixed-rate payer pays the fixed interest rate amount to the floating-rate payer while the floating- rate payer pays the floating interest amount based on the reference rate. Duration and Termination: In the swap agreement, the tenor or duration of the swap is defined.

A swap fee in Forex, also known as a rollover fee, is interest that traders pay for maintaining a position until the end of the trading day. If traders maintain their positions at the daily rollover point, which occurs at 00:00 server time (or "tomorrow next"), the swap fee will be applied.

Most brokers charge a swap rate between 23:00 to 00:00. Sometimes a swap is charged for holding a position over the weekend, even if the position is not held over the entire weekend. This is done to compensate for the markets closing during this period.

Why is swap charged

Swap rates are charged when trading on leverage. This is because when you open a leveraged position, you are essentially borrowing funds to open the position. For example, every time you open a position in the Forex market, you effectively make two trades, buying οne currency in the pair and selling the οther.If the interest rate of the currency you are buying is higher than the one you are selling, you will earn a positive swap rate. Conversely, if the interest rate of the currency you are buying is lower, you will incur a negative swap rate.0.03%

Additionally, a swap fee will be charged to all traders holding positions (regardless of the direction) at the end of a swap interval. The Swap Fee rate on all MT4 trading pairs will be 0.03% except for ETHUSDT and BTCUSDT which will have a Swap Fee Rate of 0.01%.

Recently, forex swap-free accounts or Islamic accounts have been introduced in the forex market. Traders do not have to pay a commission for using such accounts. In other words, a broker does not debit any money from an Islamic account for an overnight position on any currency pair.

Are swap fees expensive : The swap fees are simply the associated transaction costs. Understanding these costs is pivotal in shaping your trading strategies and potential gains. For example, say each swap comes with a fee of 20 basis points (bps), which is equivalent to 0.20%. If you perform ten such swaps, your returns diminish by 2%.

What is swap fee in CFD : Swaps & Fees Explained

A swap is interest paid or received for holding a position over rollover/end of day. On a currency pair interest is paid on the currency sold and received on the currency bought.

How do you explain swaps

A swap is an agreement for a financial exchange in which one of the two parties promises to make, with an established frequency, a series of payments, in exchange for receiving another set of payments from the other party. These flows normally respond to interest payments based on the nominal amount of the swap.

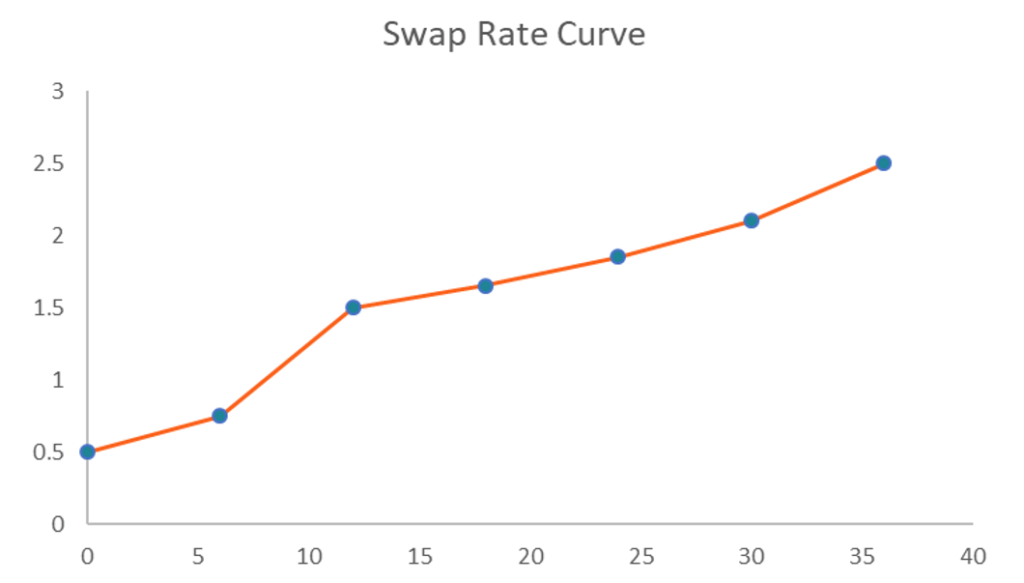

Swap rates are the fixed interest rates at which two parties agree to exchange cash flows in an interest rate swap. They represent the cost or benefit associated with swapping fixed-rate. and floating-rate payments.A crypto swap is the exchange of one cryptocurrency for another, such as exchanging or swapping your ether for bitcoin on a digital wealth platform like Yield App. The swap fees are simply the associated transaction costs.

Is swap fee haram : Islamic finance prohibits the payment and receipt of interest. In conventional forex trading, interest is typically charged on positions held overnight (swap or rollover fees). Therefore, engaging in conventional forex trading with interest charges would not be permissible in Islamic finance.

:max_bytes(150000):strip_icc()/swaprate.asp-final-0f98471ea0b341c9b5fb5cee4cdafb42.png)