Antwort What tax do you pay in the Cayman Islands? Weitere Antworten – Is Cayman Island a tax haven

The Cayman Islands is the third worst tax haven for corporate tax avoidance and the world's worst tax haven in terms of financial secrecy according to the Tax Justice Network. Yesterday Oxfam showed how the EU tax haven blacklist is undermining attempts to stop government bailouts going to corporate tax dodgers.As a small family of islands Cayman has limited resources in the traditional sense; it produces little of its own food or manufactured goods. Consequently the government is able to raise significant revenue through import duties without directly taxing its resident's income.The main industries are financial services, tourism, and real estate sales and development.

Why are the Cayman Islands a tax haven on Reddit : As far as I can tell, countries/territories (like the Cayman Islands) levy absolutely no taxes on corporations thereby gaining nothing from the corporations being registered there. Meanwhile corporations save billions not paying taxes in the countries they actually do business in.

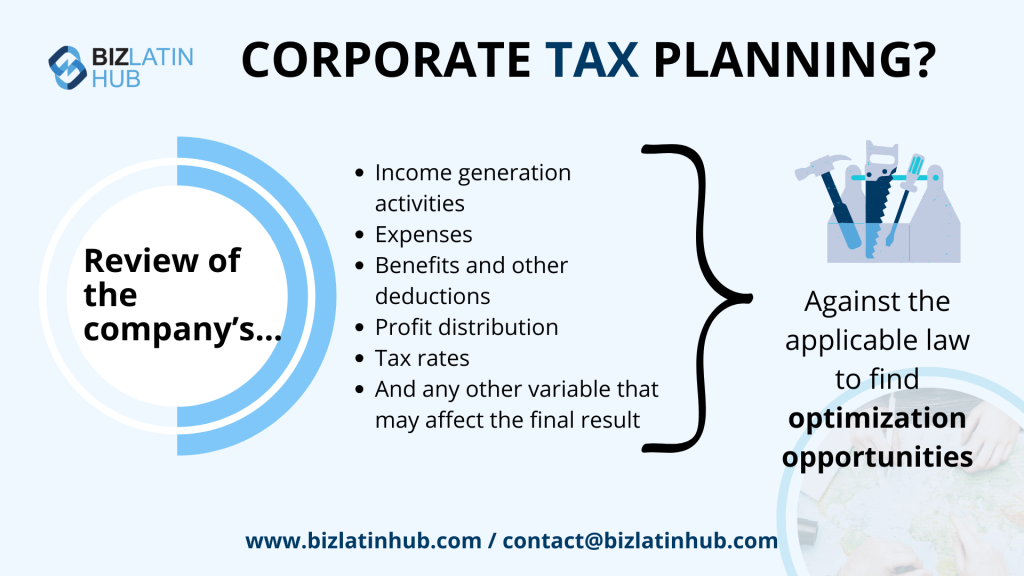

Do foreigners pay tax in Cayman Islands

In the Cayman Islands, there is no personal income tax levied on individuals, making it a unique tax environment. However, US citizens and green card holders living in the Cayman Islands are still subject to US tax laws and are required to file US tax returns, reporting their global income.

Is Cayman Islands salary tax free : Cayman Islands

Apart from having no income tax, this country also has no payroll, capital gains and withholding tax.

The Cayman Islands is considered to be part of the geographic Western Caribbean zone as well as the Greater Antilles. The territory is a major offshore financial centre for international businesses and wealthy individuals, largely as a result of the state not charging taxes on any income earned or stored.

Cayman Islands Cons Revealed: Learn the Truth

- The islands' high cost of living. Groceries, consumer goods, and other essentials are more expensive than on the mainland.

- Housing prices.

- Stamp Duty.

- High cost of Utilities.

- Hurricanes.

- Intense heat.

- Mosquitoes.

- Limited employment opportunities.

What taxes do Cayman Islands pay

This tax-neutral environment extends to residents, as the Cayman Islands do not impose income, capital gains, or corporate taxes on individuals. However, expats are still subject to taxes in their home country, such as US expats who must report their worldwide income to the IRS.The Cayman Islands don't have a corporate tax and act as a haven for multinational corporations to shield some or all of their incomes from taxation. The Cayman Islands do not impose taxes on residents and are considered tax-neutral.Cayman Islands Salary. $63,000 is the 25th percentile. Salaries below this are outliers. $100,000 is the 75th percentile.

The Cayman Islands had been blacklisted by the FATF due to perceived weaknesses in its prosecution and sanctions mechanisms related to financial crimes. This designation had significant implications, impacting the territory's standing in the international financial community.

Is it worth living in the Cayman Islands : The Cayman Islands is a great place to live and work for those who are looking for economic opportunities. With its high-paying jobs, attractive salaries as well as generous tax incentives available from the government – it's no wonder that many UK Recruiters choose this destination!

Where to avoid in Grand Cayman : Places to avoid in Grand Cayman

Avoiding local George Town bars on a Friday night would probably be a good idea, but even then, it is still pretty safe. Grand Cayman safety is something that almost all first time visitors think about. Fortunately, there aren't any areas that you need to actively avoid.

Is it illegal to have a Cayman Islands bank account

Having an offshore bank account in the Cayman Islands is not illegal, but if your intent is to hide money there, that's another story. When we talk about the Cayman Islands, two things usually come to mind: a tropical vacation paradise and a premier haven for investments and private and offshore banking.

On 7th February 2024, the Cayman Islands was removed from the EU List of High Risk Countries.There is great stability which has attracted the best banks and encouraged businesses to incorporate locally. It's also a highly liveable place with beautiful scenery and world-class lifestyle options. The Cayman Islands know how to cater to the high net worth population.

Why put your money in the Cayman Islands : A tax haven is any location with very lenient or non-existent tax laws. The Cayman Islands do not levy a corporate tax and act as a haven for multinational corporations to shield some or all of their incomes from taxation. Additionally, the Cayman Islands do not impose taxes on citizens or non-citizens.

.png)