Antwort What not to buy during a recession? Weitere Antworten – Where not to invest during a recession

Asset Classes

From an asset-class perspective, stocks are usually one of the worst places to be during a recession. The reason is simple: Recessions happen when there's a decline in economic activity, which is usually accompanied by weaker trends in revenue and earnings growth.Examples of recession-proof assets

Examples include: Companies with stable cash flow and pricing power, such as Walmart. Industries with stable demand, such as utilities, consumer staples and health care. Commodities like gold.Create passive income sources

Another way people can make money during recessions is by figuring out ways to increase their personal income through passive sources like dividends, interest, and income from renting out unused space, property, or goods.

Where is your money safest during a recession : Cash equivalents include short-term, highly liquid assets with minimal risk, such as Treasury bills, money market funds and certificates of deposit. Money market funds and high-yield savings are also places to salt away cash in a downturn.

Is cash king during a recession

It will give them the funds to buy stocks or other assets during the decline. Because of how precious cash can be during times of financial stress, many have said that cash is king. The phrase means that having liquid funds available can be vital because of the flexibility it provides during a crisis.

Do investments do well in a recession : Investing During a Recession

Professional fund managers who understand financial markets and look for good quality investments purchase groups of stocks, bonds or other investments, which helps manage risk. A recession creates an opportunity to buy when prices are lower.

Yes, cash can be a good investment in the short term, since many recessions often don't last too long. Cash gives you a lot of options.

Stockpiling food items, first aid supplies, and other survival equipment is a fantastic place to start preparing for a potential economic depression, given likely grocery store shortages.

Should I hold cash in a recession

Finance Experts All Say the Same Thing

They all said the same thing: You need three to six months' worth of living expenses in an easily accessible savings account. The exact amount of cash needed depends on one's income tier and cost of living.Food manufacturers, distributors, retailers, and restaurants that offer good value for the money stand an even better chance of keeping their customers during a recession.During recessions, one of the primary culprits responsible for money vanishing into thin air is the collapse of banks. As financial institutions crumble under the weight of bad loans and dwindling assets, they often go belly up, taking the money entrusted to them along for the ride.

How to prepare yourself for a recession

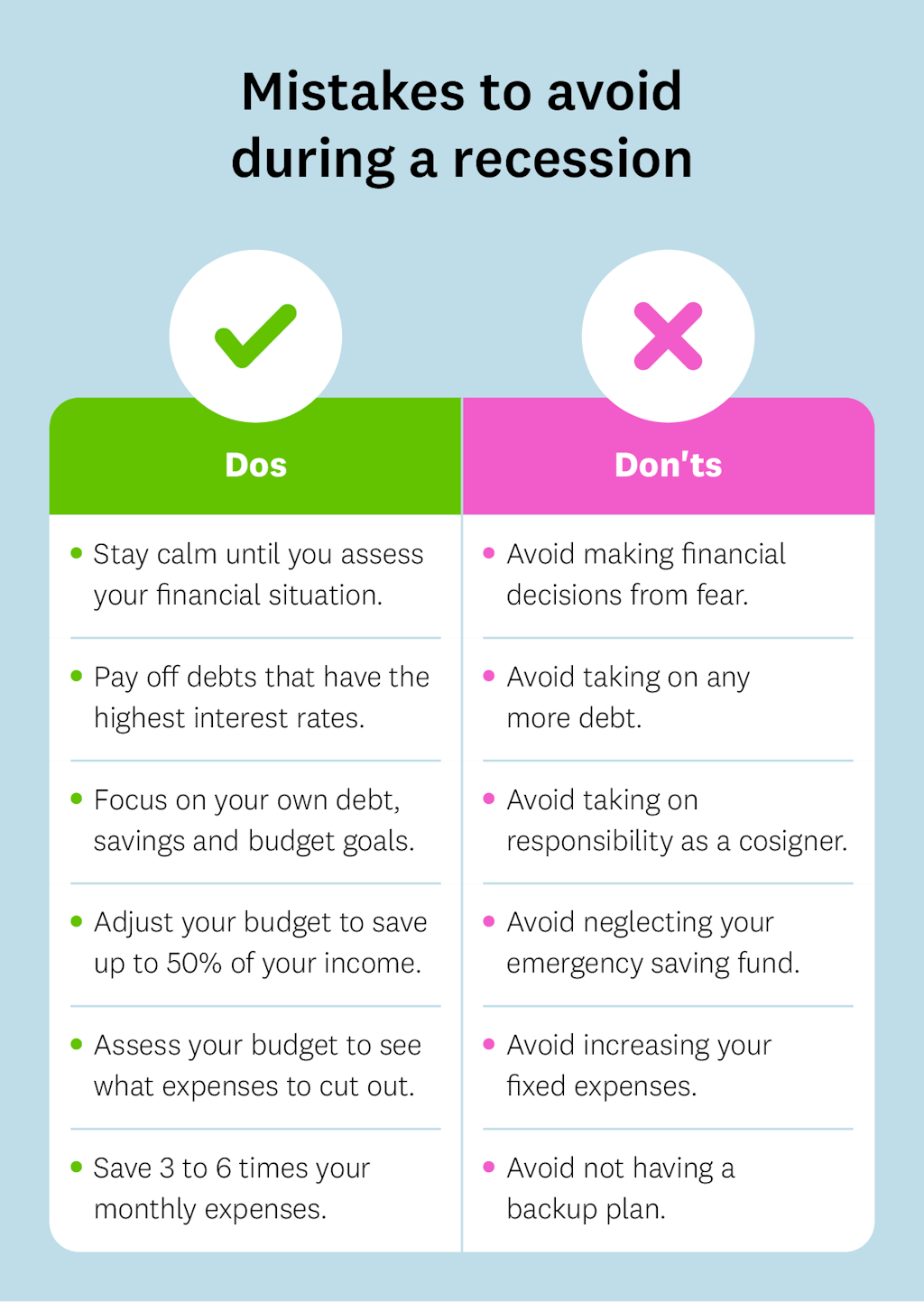

- Reassess your budget every month.

- Contribute more toward your emergency fund.

- Focus on paying off high-interest debt accounts.

- Keep up with your usual contributions.

- Evaluate your investment choices.

- Build up skills on your resume.

- Brainstorm innovative ways to make extra cash.

What is the best asset to hold in a depression : Domestic Bonds, Treasury Bills, & Notes

Mutual funds and stocks are considered to be a big gamble during depressions. While Treasury bonds, bills, and notes are more secure investments. These items are issued by the U.S. government.

How much cash should you hold in a recession : Finance Experts All Say the Same Thing

They all said the same thing: You need three to six months' worth of living expenses in an easily accessible savings account.

Who gets hit hardest in a recession

The jobs that are the “first to go” when a recession hits are the ones that depend on consumer spending and people having copious disposable income, says Kory Kantenga, a senior economist at LinkedIn. Retail, restaurants, hotels and real estate are some of the businesses often hurt during a recession.

Industries affected most include retail, restaurants, travel/tourism, leisure/hospitality, service purveyors, real estate, & manufacturing/warehouse.In a sluggish economy or an outright recession, it is best to watch your spending and not take undue risks that could put your financial goals in jeopardy. A recession increases the risks to your financial well-being. Being prepared and taking a few simple steps can help you weather the economic storm.

Is Europe in recession in 2024 : Though the growth rate of 0.3% estimated for the first quarter of 2024 is still below estimated potential, it exceeded expectations. Activity in the euro area expanded at the same pace, marking the end of the mild recession experienced in the second half of last year.