Antwort What leverage is good for $10? Weitere Antworten – What is the best leverage for $5

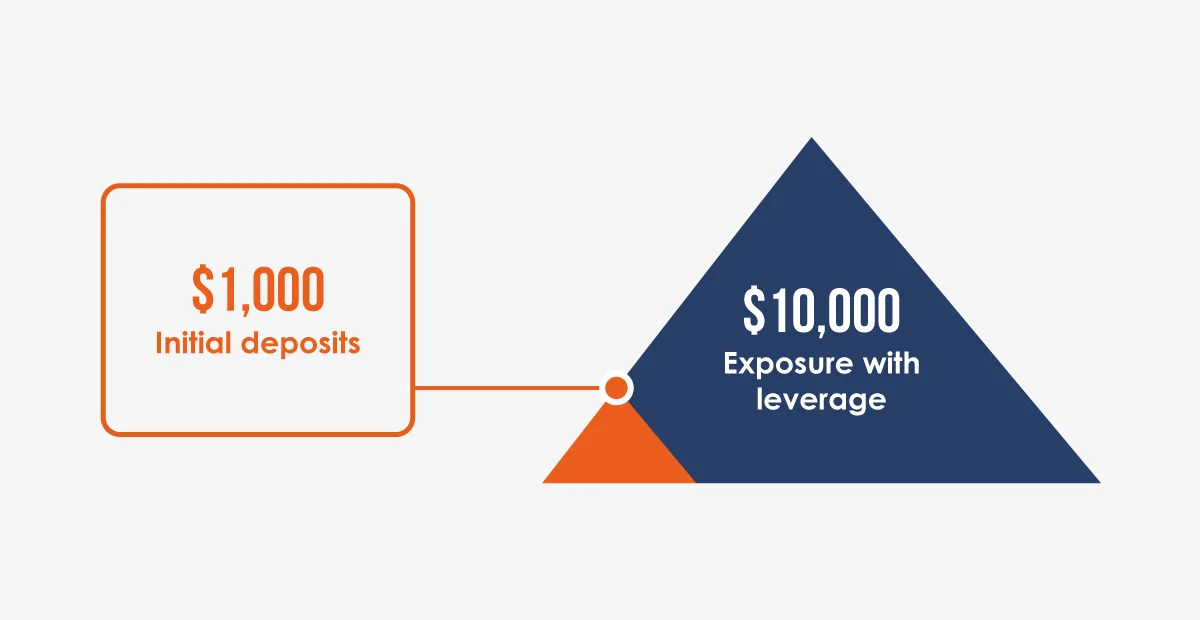

Generally, it's recommended to use lower leverage when you have a smaller account size to minimize the risk of significant losses. A leverage of 1:10 or 1:20 can be a good starting point for a $5 account.Using high leverage like 1:500 can be quite risky, especially with a small account size of $10. With such high leverage, even small price movements can have a significant impact on your account balance. It's crucial to be cautious and consider the potential risks involved.With a leverage ratio of 10:1, you have the ability to control ten dollars for every dollar in your margin account. Let's say you want to open a position on a forex trade worth $10,000. If you decide to use leverage at a ratio of 10:1, you could open that $10,000 position with just $1,000 in your account.

What leverage is good for $100 : The best leverage for $100 forex account is 1:100.

Many professional traders also recommend this leverage ratio. If your leverage is 1:100, it means for every $1, your broker gives you $100. So if your trading balance is $100, you can trade $10,000 ($100*100).

Can I start forex with $10

Yes you can start forex trading with $10. Its absolutely your call as to how much you want to start forex trading with. A $10 , $50 , $100 or $500 , you are free to decide that.

Can I trade gold with $10 : Can I Trade Gold with $10 While it's technically possible to trade gold with $10, it's not advisable. Such a small amount would severely limit your trading options and expose you to excessive risk. It's recommended to start with a more substantial capital to engage in gold trading effectively.

Although 100:1 leverage may seem extremely risky, the risk is significantly less when you consider that currency prices usually change by less than 1% during intraday trading (trading within one day).

1:1000 Leverage

This level of leverage carries significant risks and is generally not recommended for beginners. It requires a deep understanding of the forex market, advanced risk management strategies, and exceptional trading discipline.

Is 10X leverage risky

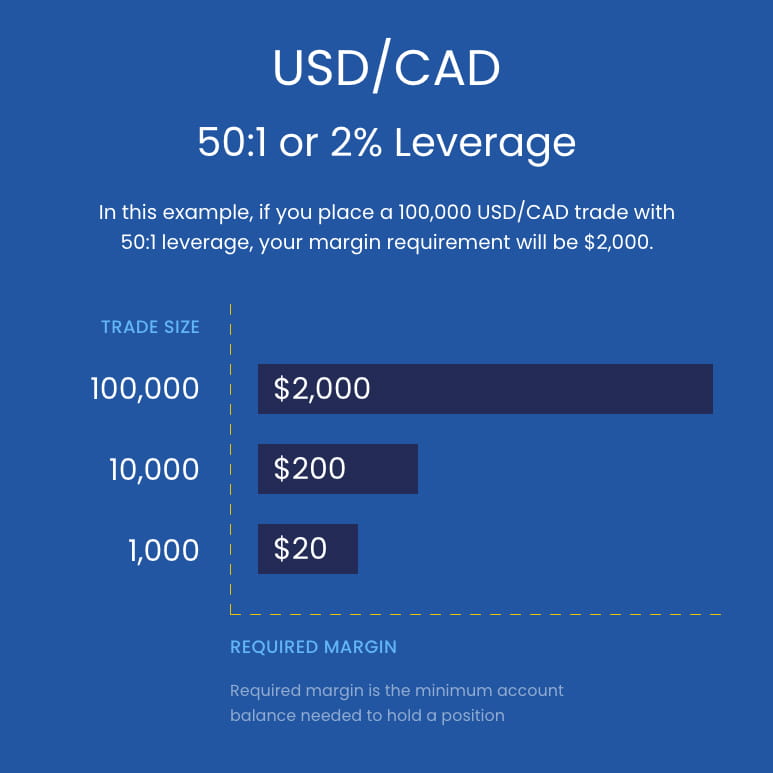

If you have 10X average leverage use versus 1X while trading the same instrument you are taking more risk in the 10X scenario even if you manage stops, drawdowns, etc. The risk can come in different forms such as how little volatility is needed in an underlying asset for a stop or series of stops to be hit.50:1 leverage (2% margin) is a good way to go. But your risk management doesn't stop there. After you accept trading with the constraint of 50:1, you should only risk 1% to 2% of your account with any given trade.When determining what leverage to use, traders should take several important things into consideration. First of all, they should keep in mind that 1:500 or 500:1 is an extremely high level of leverage in trading and it is not allowed in many jurisdictions due to the high risk for losing one's capital.

1,000 U.S. dollars

This lot size accounts for 1,000 base currency units in every forex trade, determining the amount of a particular currency. Suppose you're trading the USDJPY (U.S. Dollar-Japanese Yen) currency pair, and the base currency is the USD. In that case, a 0.01 lot is equivalent to 1,000 U.S. dollars.

Is $10 enough to start trading : Trading forex with a small capital, such as $10, is feasible but requires careful consideration and adherence to risk management principles. Your potential earnings are influenced by factors like leverage, currency pairs traded, position size, and your chosen trading strategy.

Can I trade with $10 : It is possible to begin Forex trading with as little as $10 and, in certain cases, even less. Brokers require $1,000 minimum account balance requirements. Some are available for as little as $5. Unfortunately, if your starting amount is $10, this may prevent you from getting the higher quality, regulated brokers.

Is 1 500 leverage safe

A leverage ratio of 1:500 offers significant amplification of your trading position. With this level of leverage, a small investment can control positions that are 500 times larger. While the potential for profit is substantial, it's crucial to exercise caution and have a robust trading strategy in place.

However, you should be very careful with brokerage accounts that offer this huge leverage on small accounts. 1:400 leverage comes with high risk, and your account can be automatically wiped out, especially if you deposit a small amount like $500.While high leverage ratios like 1:500 can magnify potential profits, they also significantly increase the potential for losses. It's important to use high leverage cautiously and to be aware of the risks involved. The forex market is known for its high volatility, and leverage can amplify both gains and losses.

Is 20X leverage too much : You can use 20X leverage and still lose only 2% of your capital if your optimal stop is hit, assuming the financial instrument is liquid enough and creates very little slippage, even when the market is moving fast.