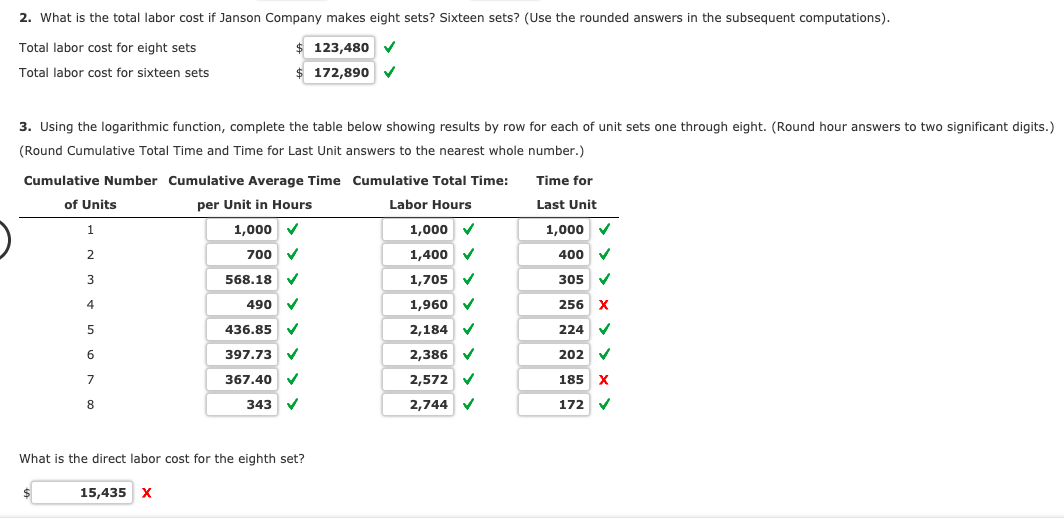

Antwort What is total labor cost? Weitere Antworten – How do you calculate labor cost

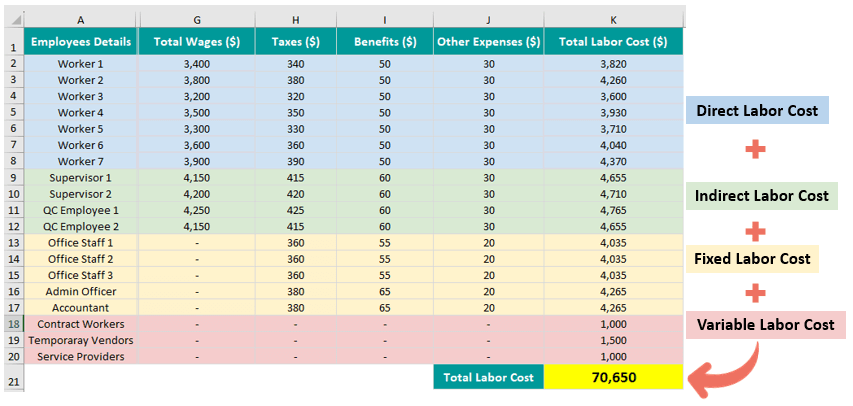

How do you calculate labor rate Add the full cost of what it takes an employee to create a product or complete a service. This includes their wages, taxes, and benefits. Then divide that total by the number of hours an employee works.The cost of labour is the amount of all salaries paid to the workers, as well as the employee benefits and payroll taxes charged by an employer. The labour costs are broken down into direct and indirect (overhead) costs.Total labor cost is the aggregate cost of the hours worked by all employees, plus all related payroll taxes and benefits. This amount is used in the budgeting of financial results for a business. Total labor cost is comprised of a number of line items, which include the following: Direct labor cost.

What is the definition of labor cost : Definition: Cost of labor is the amount paid by an employer to cover an employee's wages and benefits, plus related payroll taxes and benefits. Labor cost is an important value that finance and accounting professionals calculate to determine the direct and indirect price that a company pays for labor.

How to calculate total cost

Fixed costs (FC) are costs that don't change from month to month and don't vary based on activities or the number of goods used. The formula to calculate total cost is the following: TC (total cost) = TFC (total fixed cost) + TVC (total variable cost).

What are the different types of labor costs : Companies split labor costs into four categories: direct labor costs, indirect labor costs, fixed labor costs, and variable labor costs. Each serves its purpose. Direct labor costs refer to supply chain employees such as delivery drivers and manufacturers. It covers expenses like their salaries, benefits, and sick pay.

Labor refers to the effort expended by an individual to bring a product or service to the market. Again, it can take on various forms. For example, the construction worker at a hotel site is part of the labor, as is the waiter who serves guests or the receptionist who enrolls them into the hotel.

How to calculate manufacturing labor costs

- Wages + taxes + other benefits divided by number of hours worked during the pay period.

- Units produced divided by labor hours needed.

- Direct labor hourly rate x direct labor hours.

- Total direct labor variance = (actual hours × actual rate) – (standard hours × standard rate).

What is the total labor cost in manufacturing

What is labor cost in manufacturing In short, labor cost in manufacturing industry is the total amount spent on employees by your company. The total amount includes the salaries for hourly and salaried workers, plus employee taxes, bonuses, and company-specific extras such as employee compensation schemes.Direct labor costs are part of cost of goods sold or cost of services as long as the labor is directly tied to production.Direct Labor Costs

An example of direct labor is a steel industry employee working with iron ore to create a final product that the company markets to consumers. The worker is directly involved in the production of what the company makes, so their payment is considered a direct labor cost.

total cost, in economics, the sum of all costs incurred by a firm in producing a certain level of output.

What is total cost and actual cost : While standard cost is an estimate of the expected cost, actual cost is what was actually spent to produce the product. Actual cost includes the total cost of materials, direct labor, and overhead costs that are incurred due to production.

What are the 7 types of cost : The different types of cost concepts are:

- Outlay costs and Opportunity costs.

- Accounting costs and Economic costs.

- Direct/Traceable costs and Indirect/Untraceable costs.

- Incremental costs and Sunk costs.

- Private costs and social costs.

- Fixed costs and Variable costs.

What are 5 examples of labor

Some of these types of labor include unskilled, semi-skilled, skilled, wage, and contract. Wage labor is a common type of labor in the economy that relates to the association of employees with their workers regarding their payment.

Throughout the different stages of labor, it is also classified into four different types that women can experience. Those are prodromal labor, back labor, prolonged labor, and precipitous labor.Production costs refer to all of the direct and indirect costs businesses face from manufacturing a product or providing a service. Production costs can include a variety of expenses, such as labor, raw materials, consumable manufacturing supplies, and general overhead.

Is labor cost an OPEX : Operating expenses are the result of a business's normal operations, such as materials, labor, and machinery involved in production. Overhead expenses are what it costs to run the business, including rent, insurance, and utilities. Operating expenses are required to run the business and cannot be avoided.