Antwort What is the value of a swap? Weitere Antworten – What is the value of the swap

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Value_Interest_Rate_Swaps_Sep_2020-05-ebe661886e084d879c91c96ab4cbf63b.jpg)

The value of a swap at inception is zero (ignoring transaction and counterparty credit costs). On any settlement date, the value of a swap equals the current settlement value plus the present value of all remaining future swap settlements.If you are receiving a fixed leg, the net present value of the swap is the present value of all the received cash flows LESS the present value of all of the floating cash flows.The swap pricing equation, which sets r FIX for the implied fixed bond in an interest rate swap, is: rFIX=1−PVn(1)∑ni=1PVi(1) r F I X = 1 − PV n ( 1 ) ∑ i = 1 n PV i ( 1 ) .

How are swaps calculated : Now let's take a closer look at how the total swap value is calculated on Forex trading for a sell trade in the EURUSD currency pair. SWAP (short positions) = (Lot * (quote currency rate – base currency rate – markup) / 100) * current quote / number of days in a year.

How much is a swap worth

SWAP to USD

| Amount | Today at 6:04 am |

|---|---|

| 1 SWAP | $0.16 |

| 5 SWAP | $0.81 |

| 10 SWAP | $1.62 |

| 50 SWAP | $8.09 |

What is the nominal value of a swap : Swaps. In interest rate swaps, the notional value is the specified value upon which interest rate payments will be exchanged. The notional value in interest rate swaps is used to come up with the amount of interest due. Typically, the notional value on these types of contracts is fixed during the contract's life.

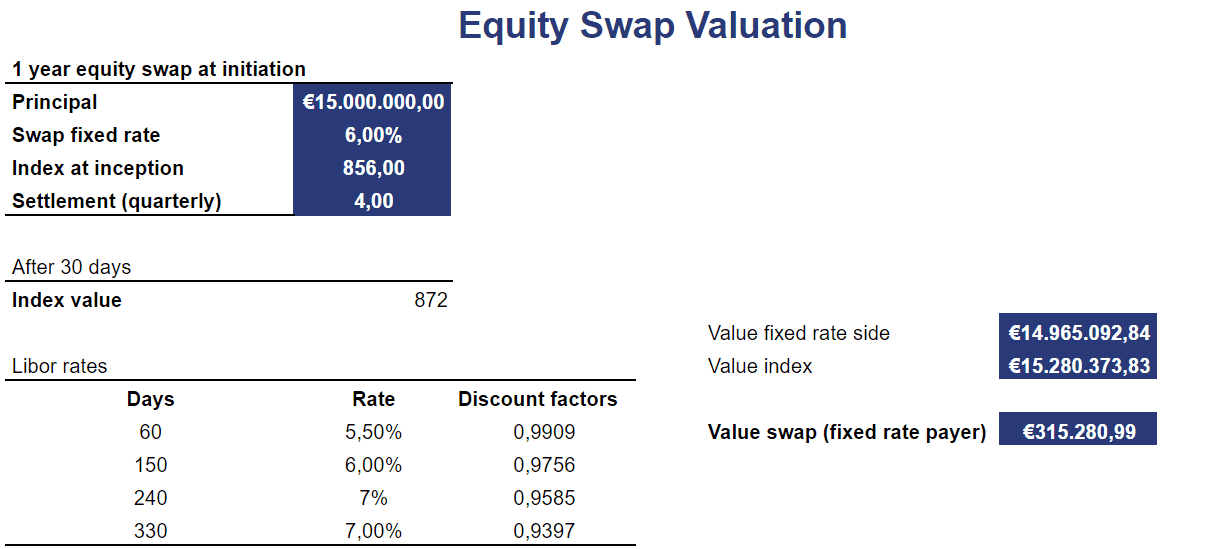

The swap's fair value at inception (that is, at the time the derivative was executed to hedge the interest rate risk of the borrowing) is at or near zero. The notional amount of the swap matches the principal amount of the borrowing being hedged.

A swap is a derivative contract where one party exchanges or "swaps" the cash flows or value of one asset for another. For example, a company paying a variable rate of interest may swap its interest payments with another company that will then pay the first company a fixed rate.

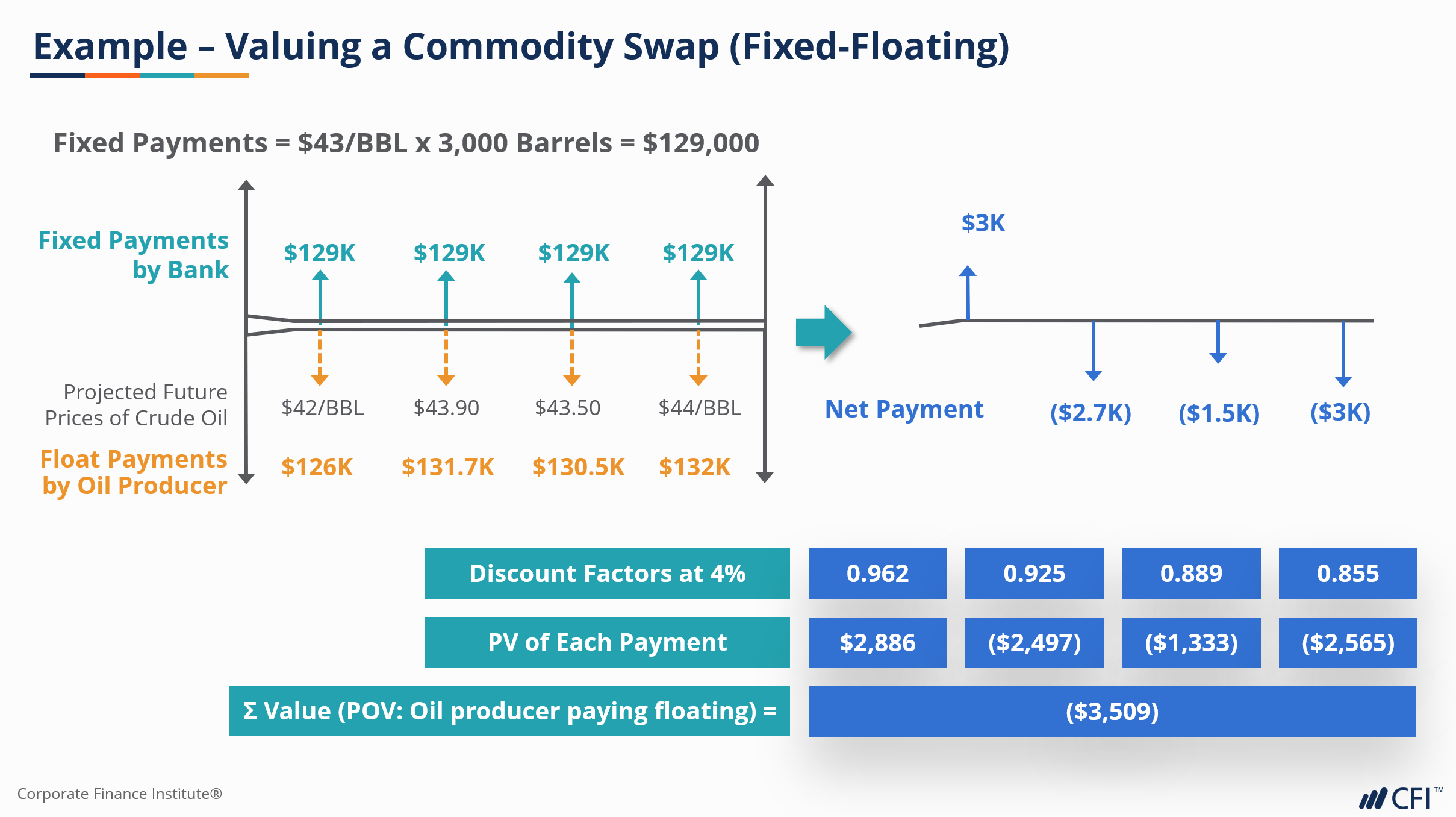

What is the procedure for valuing a swap

The steps in a swap valuation process are:

- Collect information on the swap contract.

- Calculate the present value of the floating rate payments.

- Calculate the present value of the notional principal.

- Calculate the theoretical swap rate.

- Calculate the swap spread.

Swap rates are the fixed interest rates at which two parties agree to exchange cash flows in an interest rate swap. They represent the cost or benefit associated with swapping fixed-rate. and floating-rate payments.A notional principal amount is the predetermined dollar value used in interest rate swaps. Interest payments that each party pays the other in an interest rate swap are based on the notional principal amount. Notional principal amounts are theoretical.

The value of the swap would be the spread that the seller pays over or under LIBOR. It is based on two things: The coupon values of the asset compared to the market rate. The accrued interest and the clean price premium or discount compared to par value.

What is fair value of swaps : Finally, the fair value of the swap is determined by multiplying the net payment due from the Fixed Payer by the CVA-adjusted present value factor, as shown in Table 6. In this case, the fair value of the swap is negative from the perspective of the Fixed Payer, indicating that the swap is a liability to Company A.