Antwort What is the largest futures exchange in Europe? Weitere Antworten – What is the world’s largest futures exchange

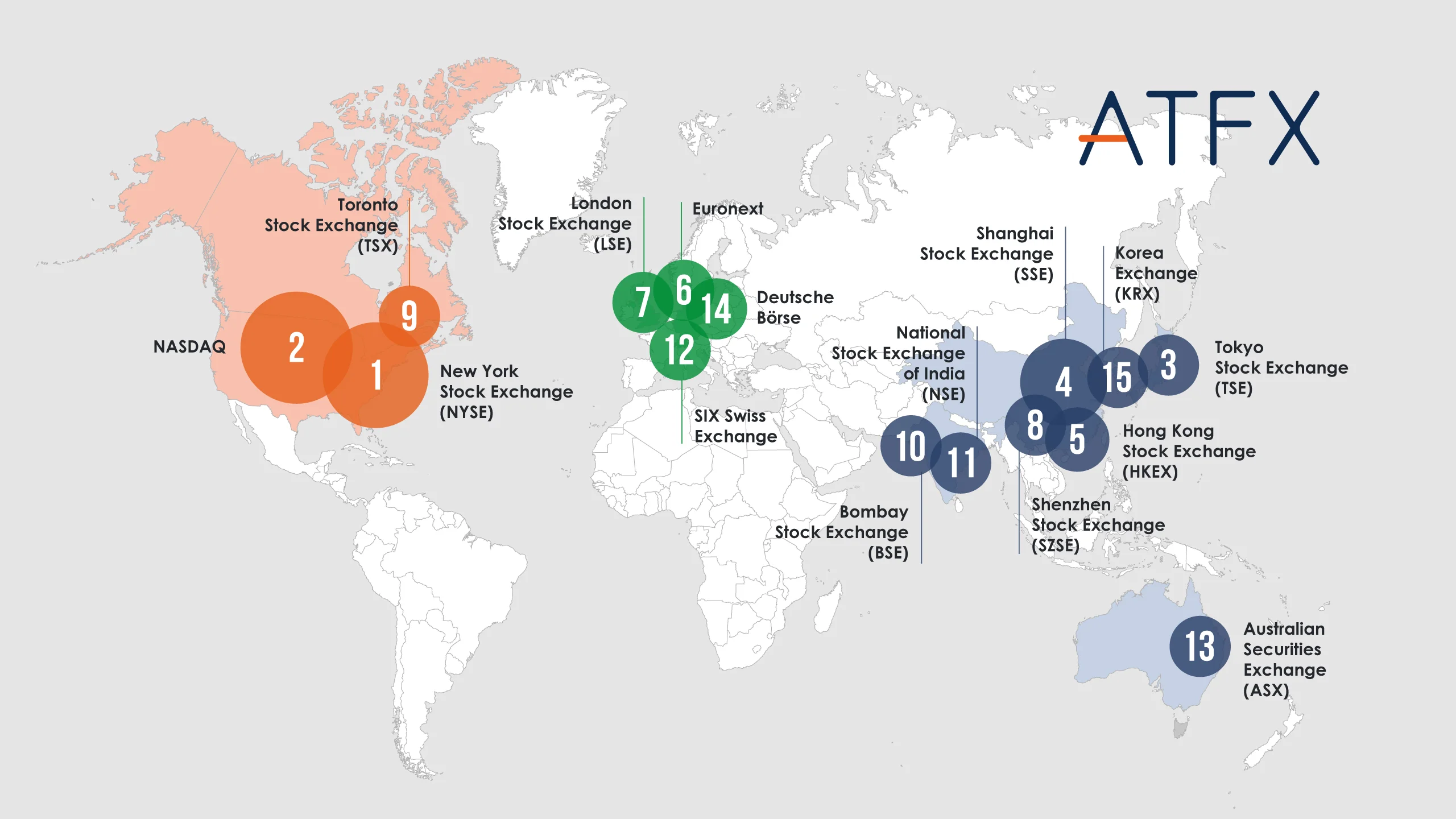

In terms of trading volume, the National Stock Exchange of India in Mumbai is the largest single-stock futures trading exchange in the world.ICE Futures Europe is home to futures and options contracts for crude oil, interest rates, equity derivatives, natural gas, power, coal, emissions and soft commodities.Best for Dedicated Futures Traders NinjaTrader

We chose NinjaTrader as the best platform for dedicated futures traders because it offers multiple low-cost pricing options; low margin rates; and access to strong desktop, web, and mobile platforms that support direct trading from customizable charts.

What are the largest crypto futures exchanges : CME Group

CME Group is already ranked first for trades of bitcoin futures, beating out competitors like Binance, the world's largest crypto exchange by trading volume.

Can you trade futures in Europe

The Eurex Exchange is the largest European futures and options market. It primarily deals in Europe-based derivatives. A wide range of trade on this exchange is carried out, from European stocks to debt instruments of Germany.

Where are Euribor futures traded : The most popular futures contracts are generally 10-year government bonds and 3-month interest rate contracts. In Europe, futures on German interest rates are traded at the Eurex Exchange.

Binance

As the world's largest exchange, Binance offers premium liquidity. KuCoin: High-volume exchange with over 25 million traders, KuCoin offers linear and inverse futures. Dozens of cryptocurrencies are supported, including up-and-coming meme coins like Bonk and Pepe.

Best online brokers for futures

- Interactive Brokers.

- E*TRADE by Morgan Stanley.

- Charles Schwab.

- tastytrade.

- TradeStation.

What are the top 3 crypto exchanges

Top Cryptocurrency Spot Exchanges

| # | Exchange | Score |

|---|---|---|

| 1 | Binance | 9.9 |

| 2 | Coinbase Exchange | 8.2 |

| 3 | Bybit | 7.8 |

| 4 | OKX | 7.6 |

Best Futures Trading Platforms of 2024

- Best for Professional Futures Traders: Interactive Brokers.

- Best for Dedicated Futures Traders: NinjaTrader.

- Best for Futures Education: E*TRADE.

- Best for Desktop Futures Trading: TradeStation.

The New York Mercantile Exchange, or NYMEX, is located in New York City and specializes in trading energy and metal futures contracts, including crude oil, natural gas, gold, and silver.

:max_bytes(150000):strip_icc()/dotdash_INV_final_Currency_Futures_An_Introduction_Jan_2021-01-9e1617643f6847d59ae10ac414509721.jpg)

Interest Rate Futures

The most popular contracts are 30-Year T-Bonds, 10-Year T-Notes, and the Eurodollar. The U.S. Treasury notes and bonds are traded on the CBOT, while the Eurodollar is traded at the CME. These futures contracts are large in size and experience is needed to properly navigate these markets.

Where are currency futures traded : Where Are Currency Futures Traded Currency futures contracts are traded on derivatives exchanges around the world, including the Chicago Mercantile Exchange (CME), the Intercontinental Exchange (ICE), and Euronext exchanges.

What is the largest crypto exchange in Europe : Binance

Binance remains the world's largest cryptocurrency exchange by average daily trading volume, but you will not find it among the firms we ranked.

Who is the worlds best futures trader

Best Futures Traders in the History of Futures Trading

- Richard Dennis and the Turtle Traders.

- Paul Tudor Jones.

- Ed Seykota.

- Bruce Kovner.

- Larry Williams.

- The Lessons from the Legends.

Binance remains the world's largest cryptocurrency exchange by average daily trading volume, but you will not find it among the firms we ranked. We excluded Binance and Bitmex from our 2024 ranking because of their legal and regulatory infractions.Ben Zhou

Bybit was founded by Ben Zhou, who previously had considerable experience in the forex industry. He noticed the need for a more stable and reliable cryptocurrency trading platform, which was the impetus behind the creation of Bybit.

What is the best exchange for futures trading : Best for Dedicated Futures Traders NinjaTrader

We chose NinjaTrader as the best platform for dedicated futures traders because it offers multiple low-cost pricing options; low margin rates; and access to strong desktop, web, and mobile platforms that support direct trading from customizable charts.