Antwort What is the largest food delivery app in the US? Weitere Antworten – What is the most used food delivery app in the US

Doordash: undisputed market leader

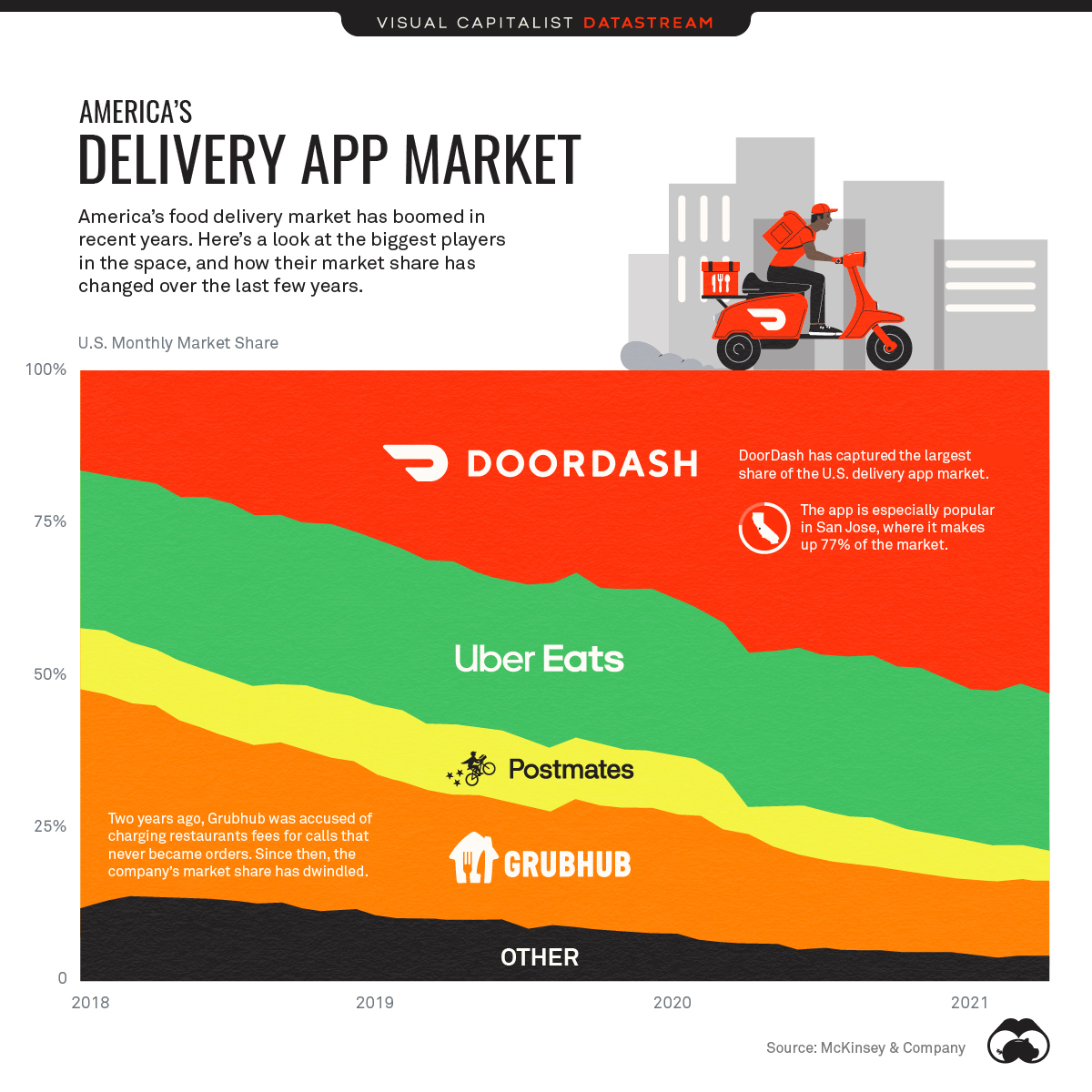

As of January 2024, DoorDash controlled two-thirds of the online meal delivery market in the country, leaving its main competitor Uber Eats with a market share of 23 percent.DoorDash, Inc.

DoorDash, Inc. (NYSE:DASH) is the most popular food delivery service in the country, having an overwhelming 65% of the market share along with its subsidiaries. It is followed at second with 23% by Uber Eats, which is owned by Uber Technologies, Inc. (NYSE:UBER).With a market share of 66 percent, DoorDash dominated the online food delivery market in the United States as of January 2024. Meanwhile, Uber Eats held the second highest share with 23 percent.

What food delivery app is most popular in my area : With their fast delivery times and convenient ordering experiences, Uber Eats and Postmates are the top choices for delivery apps in Los Angeles.

What are the top 3 food delivery apps

What are the top 3 food delivery apps

- Uber Eats.

- DoorDash.

- Grubhub.

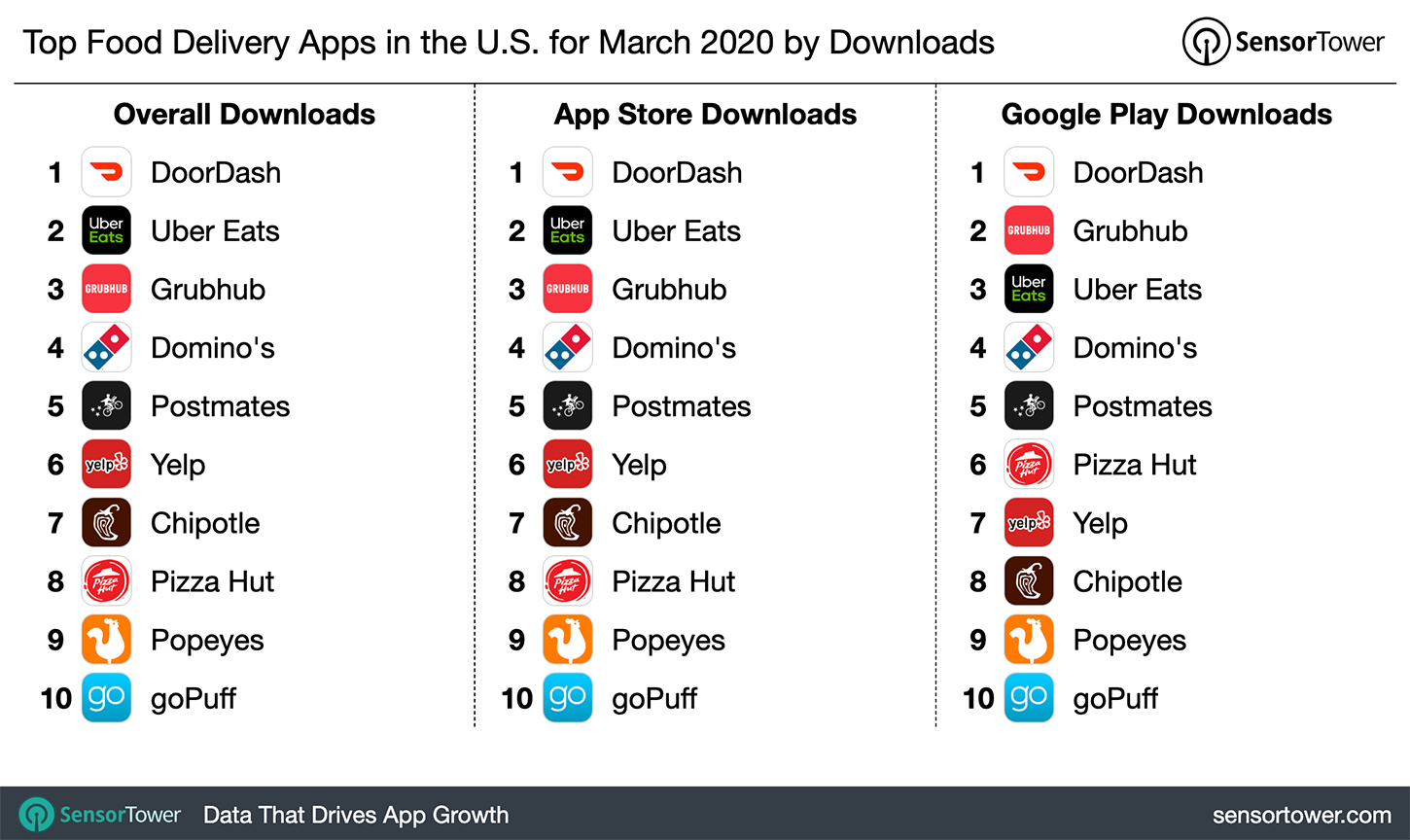

Is DoorDash bigger than Uber Eats : A closer look, however, reveals that over the past year, the three leaders — DoorDash, Uber Eats and Grubhub — have settled into a clear first, second and third place, in that order.

Food Delivery Companies to Know

- DoorDash.

- Good Eggs.

- Gopuff.

- Imperfect Foods.

- Instacart.

- Postmates.

- Shipt.

- Uber Eats.

Uber Eats is considered the overall best food delivery platform on the market. DoorDash: Popular in the United States and Canada, DoorDash provides food delivery from various local stores and restaurants.

What are the food delivery services in the USA

Top 10 Food Delivery Apps In USA

- Doordash. Doordash is known as the best food delivery apps in United States.

- Uber Eats. UberEats is another one of the top food delivery apps in USA.

- Grubhub.

- Postmates.

- Instacart.

- Caviar.

- Seamless.

- Chownow.

DoorDash

Top Competitors and Alternatives of UberEats

The top three of UberEats's competitors in the Marketplace category are DoorDash with 27.63%, GrubHub with 21.31%, EZ Cater with 11.53% market share.By differentiating themselves from the likes of Uber Eats and GrubHub and claiming their own space in the food delivery market, DoorDash was able to find a gap in their competitor's marketing strategies and capitalize on it.

DoorDash operates in many cities across the United States, Canada, Australia and New Zealand. This includes Washington, D.C. and Puerto Rico!

Is DoorDash or Uber Eats more popular : But the data also reveals a clear leader when it comes to the food delivery wars. Here's how much share of June 2023's sales each of the big three services has: DoorDash (including its subsidiary, Caviar): 65% Uber Eats (including its subsidiary, Postmates): 25%

Who pays more, DoorDash or Uber Eats : The combination of Uber Eats' base pay and tips comes in 25% to 33% lower than DoorDash. However, if DoorDash drivers are making more deliveries per hour than Grubhub and Uber Eats drivers, one might think they would receive more tips.

Are there more DoorDash or Uber Eats

DoorDash is available in over 7,000 cities in 27 countries. (There are a lot of numbers on this one across many different sites). Uber Eats is available in over 6,000 cities in 45 countries.

DoorDash (including its subsidiary, Caviar): 65% Uber Eats (including its subsidiary, Postmates): 25% Grubhub (including its subsidiaries, Seamless, Eat24, and Tapingo): 10%The market continues to grow, albeit at a slower pace. Sales rose by 6% for the major meal-delivery apps between August 2022 and August 2023. DoorDash commands 65% of the market, Bloomberg Second Measure found, with Uber Eats, Grubhub and other players splitting the remaining share.

Is Wolt owned by DoorDash : We focus on learning from each other. While Wolt is now part of DoorDash, we have continued to operate independently with our own team, brand, and product. In other words, this hasn't been a “typical” transaction, where we would have integrated everything from tools and processes to products.