Antwort What is the IBAN number? Weitere Antworten – How do I find out my IBAN number

On your paper bank statement

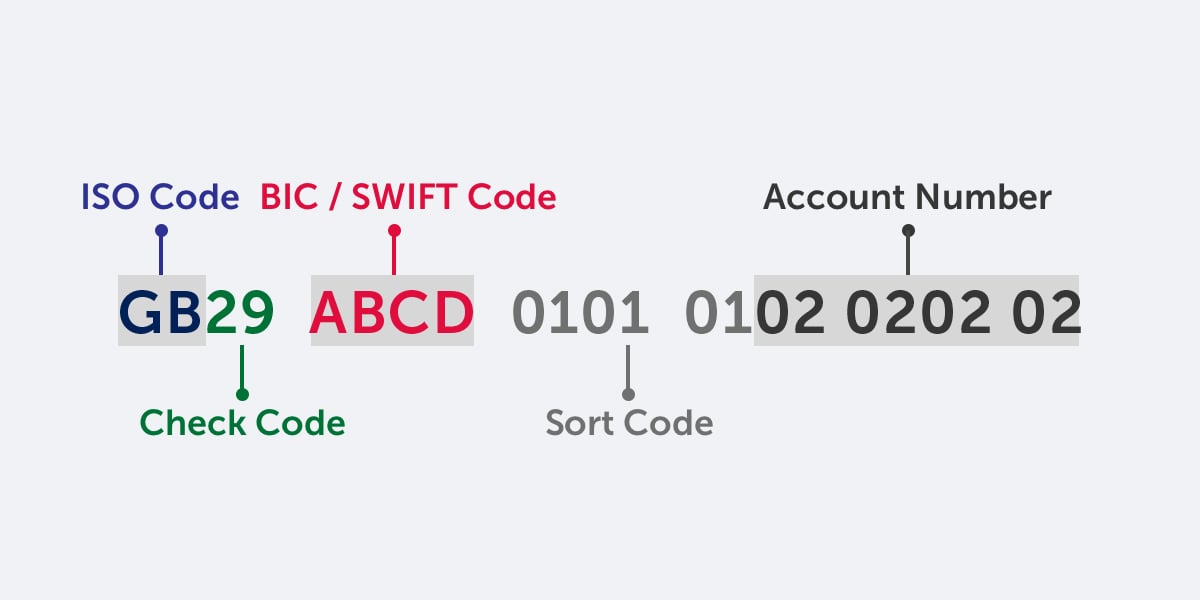

You'll find your IBAN and BIC on the first page of your paper statement. They're in the top-right corner, just below your sort code and account number.IBAN, or International Bank Account Number, is a code you can use to make or receive international payments. Your IBAN code is different from your account and sort number–it's solely used to help overseas banks identify your bank account so you can receive or send international payments.Up to 34 characters long, an IBAN is a combination of letters and numbers. It starts with a two-character country code, two bank control digits, and a Basic Bank Account Number (BBAN) that contains data specific to your bank and account.

What is the IBAN BIC code : The IBAN number contains all the information needed to transfer funds: account number, bank name, bank branch and country code. BIC (Business Identifier Codes) is a bank identification code. BIC is a unique bank code that consists of 8 or 11 characters and is also used in settlements. Each bank has its own identifier.

Where do I get my IBAN from

You may find your IBAN through the following channels: Visiting the nearest branch. Visiting the Bank's website.

Is IBAN the 16 digit number : IBAN stands for International Bank Account Number and is made up of up to 34 letters and numbers that identify the country, check number, bank location, and account details. Banks use IBANs to ensure transfer payments arrive at the intended location.

In Ireland, the standard length of an IBAN is 22 characters. The first two letters denote the country code, then two check digits, and finally a country-specific Basic Bank Account Number (BBAN), which includes the domestic bank account number, branch identifier, and potential routing information.

Using the wrong IBAN could result in a payment being returned or even sent to the wrong account altogether.

How can I get my account number from IBAN

In the case of the UAE, the Bank Identifier is the three digits following the Check Digits. The remaining part of the BBAN is the customer account number, whose length in the IBAN is fixed as 16 characters.A SWIFT code is used to identify a specific bank during an international transaction, whereas an IBAN is used to identify an individual bank account involved in the international transaction.You'll find both your IBAN and BIC on your paper bank statement.

Your IBAN and BIC are located on the top of your statement/eStatement. If you do not hold a statement/e-statement, contact your branch between 09:00 and 17:00 Mon-Fri.

What is the format of IBAN in Czech Republic : The IBAN has the following structure: 2 characters – ISO country code (CZ for the Czech Republic) 2 characters – check digits allowing program control of the account number – protection for situations where the account number is entered incorrectly. bank code and account number (20 characters for the Czech Republic)

Why is my IBAN only 20 digits : The odd thing about Ibans is that they are not standard across the EU. In fact, they can run from as few as 14 characters up to 34. Irish Ibans are 22 characters long and that is what Bank of Ireland's app is set up to accommodate. However, Lithuanian Ibans are just 20 characters long.

What does an IBAN look like

You'll find both your IBAN and BIC on your paper bank statement. Your IBAN will look like this: GB15HBUK40127612345678 please note the bank code and sort code will vary according to your account. The below is provided as an example.

Components of an IBAN

- 1 – Country code – 2 letters. The first two letters represent the country where your bank is located.

- 2 – Check digits – 2 digits. The next two digits are check digits.

- 3 – Bank code – 4 characters.

- 4 – Bank branch – 6 digits.

- 5 – Bank account number – 8 digits.

It is absolutely safe to give anyone your IBAN number. That's because it only exposes data that allows someone to send money to you, and not personal account details.

Do I need an IBAN to receive money from abroad : IBAN stands for International Bank Account Number, which you can use when making or receiving international payments. Your IBAN doesn't replace your sort code & account number ─ it's an additional number with extra information to help overseas banks identify your account for payments.

:max_bytes(150000):strip_icc()/TermDefinitions_IBAN_updated_3-21-5608440e0c954ae98a7d312850008752.jpg)

:max_bytes(150000):strip_icc()/whats-difference-between-iban-and-swift-code.asp-FINAL-1df82a2312304df69037b86d6df59e6f.png)