Antwort What is the global transfer limit for HSBC? Weitere Antworten – What is the international transfer limit for HSBC

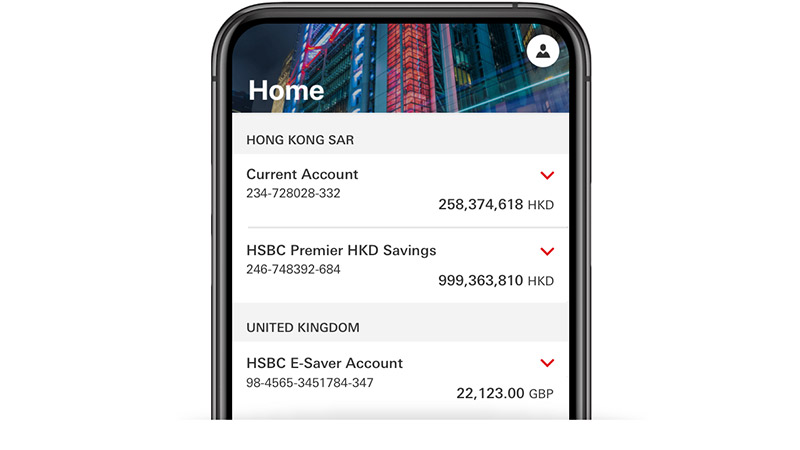

Transfers to a non-HSBC bank: INR30 lacs (or its equivalent in foreign currency), or up to the maximum daily limit you've set for third-party account transfers, whichever is lower. Transfers to an HSBC bank: USD50,000 per day or per single transaction.How much money can I transfer between banks If you're transferring money online to another one of your HSBC accounts, there is no limit to how much you can move. If you're paying bills or making payments to friends and family – there is a daily limit for online bank transfers of £25,000.For HSBC Global Transfers³, our free and instant transfer to overseas personal HSBC accounts across the world, there is a daily limit of up to USD200,000 for transfers to your self-named overseas HSBC accounts and up to USD50,000 for transfers to other overseas HSBC accounts.

What is the international wire transfer limit for HSBC : $200,000 per transaction

The maximum outbound and inbound Global Transfers limit for U.S. HSBC accounts is $200,000 per transaction and per day. Other countries may have local limit restrictions. Check with your destination country for limit information.

Can I transfer more than $25,000 HSBC

You can send money up to your personal payment limit to friends and family or up to £25,000 for payments to a company via online and mobile banking. Payments above these limits will be sent as a CHAPS payment. If you're an HSBC customer, you can send a CHAPS payment in branch or by post.

Is there a limit on international transfers : Is there a limit on International Wire Transfers There isn't a law that limits the amount of money you can send or receive. However, financial institutions and money transfer providers often have daily transaction limits.

International payments

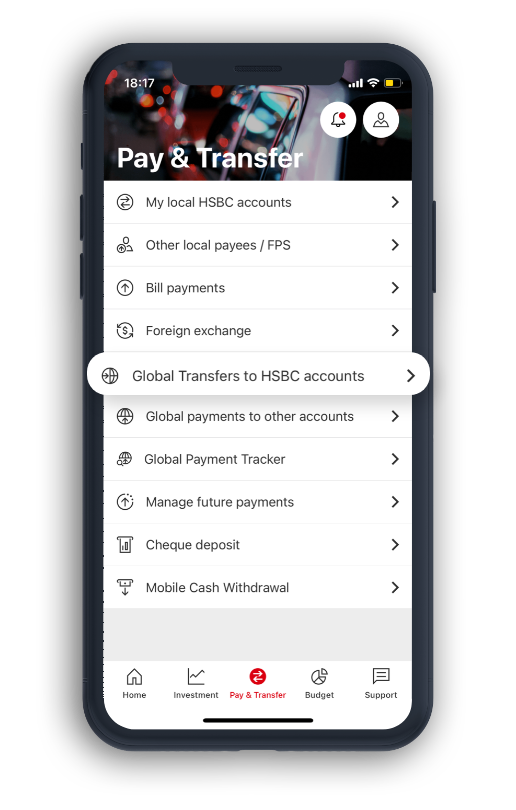

Global Transfers are currency transfers made between your globally linked HSBC accounts. Global Money is an account with a debit card that enables you to make international payments in the required currency without fees.

You can send money up to your personal payment limit via online and mobile banking. Payments above your limit will be sent as a CHAPS payment. If you're an HSBC customer, you can send a CHAPS payment in branch or by post. If you hold an HSBC Premier account, you can also do this over the phone.

Can you transfer 20k from one bank to another

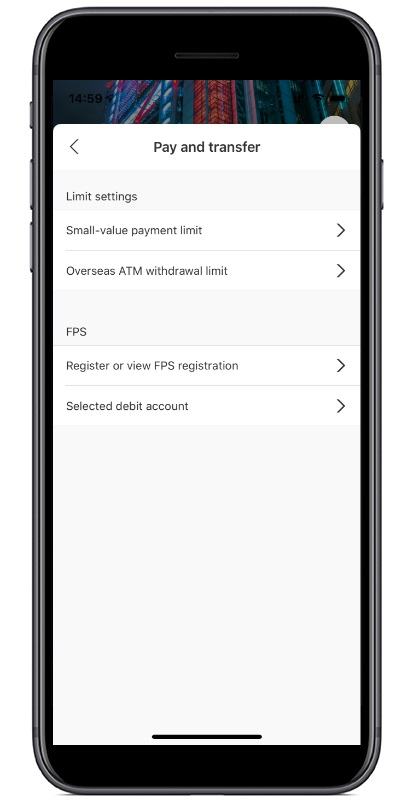

Yes, you can transfer money from one bank to another. There are many ways to do this, including using your bank's website or mobile app, a personal check, a cashier's check, a wire transfer or an ACH transaction. There are pros and cons to each method, and some come with transfer fees.Online banking. Step 1 select change internet banking limit step 2 click on edit and adjust your daily limit according to your preference. Step 3 click update to proceed.If transactions involve more than $10,000, you are responsible for reporting the transfers to the Internal Revenue Service (IRS). Failing to do so could lead to fines and other legal repercussions.

Is there a limit on wire transfers Broadly speaking, you can send as much money as you want in either a domestic or international wire transfer.

How to transfer more than 25,000 HSBC : You can send money up to your personal payment limit to friends and family or up to £25,000 for payments to a company via online and mobile banking. Payments above these limits will be sent as a CHAPS payment. If you're an HSBC customer, you can send a CHAPS payment in branch or by post.

Is HSBC Global Transfer free : Free of charge

HSBC Global Private Banking, HSBC Premier Elite, HSBC Premier and HSBC One customers can exclusively enjoy fee-free Global Transfers round the clock for eligible countries/regions and currencies.

What is the maximum online transfer limit

NEFT/RTGS/IMPS Charges, Timings, Limits

| Transaction Limits/Timing | 01:00 hours – 19:00 hours | 19:00 hours – 00:00 hours and 00:00 hours – 01:00 hours |

|---|---|---|

| Minimum | ₹ 2 lakh | ₹ 2 lakh |

| Maximum | ₹ 10 lakh or Rs 1 crore (based on customer segment) | ₹ 10 Lakh or 50 Lakh(based on customer segment) |

Yes, you can transfer money from one bank to another. There are many ways to do this, including using your bank's website or mobile app, a personal check, a cashier's check, a wire transfer or an ACH transaction. There are pros and cons to each method, and some come with transfer fees.Generally speaking, you can send as much as you like overseas. There aren't any US laws on sending money abroad that limit the amount you can send. But as above, payments over a certain threshold will trigger IRS reporting and tax obligations.

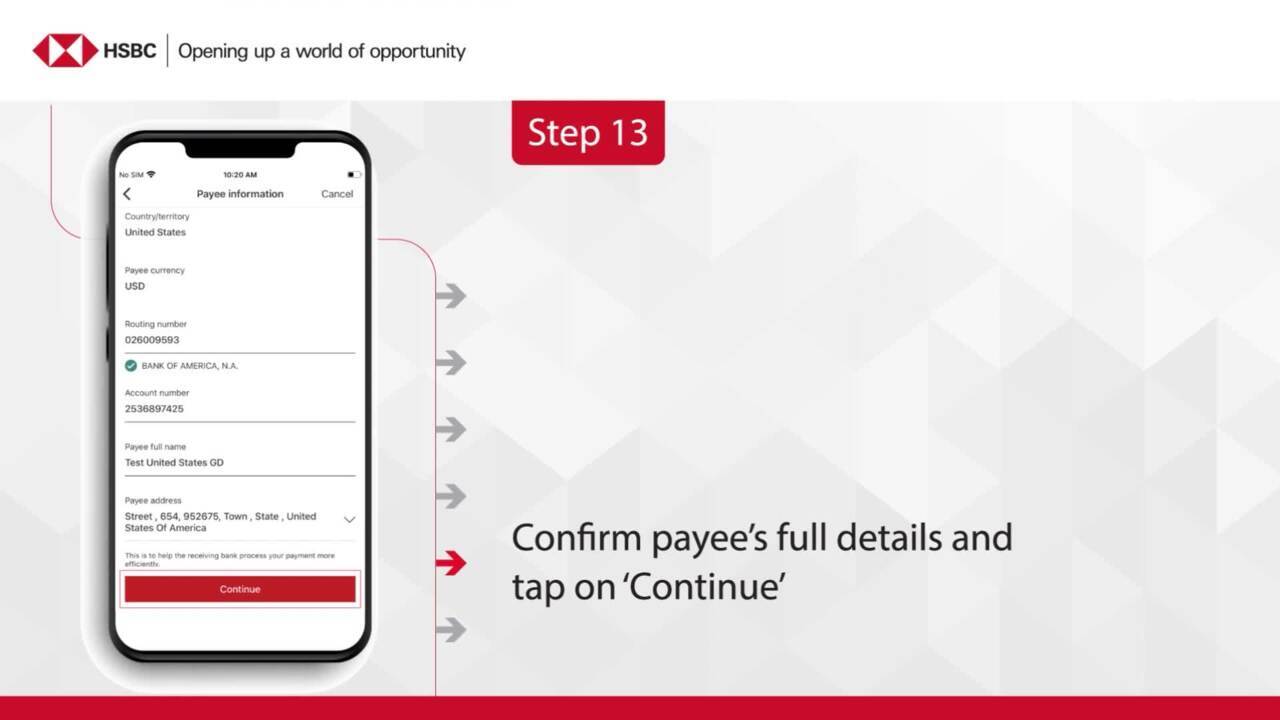

How to do global transfer HSBC : Log into your HSBC Mobile app. Select Pay & Transfer. Select Send Money Internationally. Select Country or Territory.