Antwort What is the future of digital payments? Weitere Antworten – What is the future of online payments

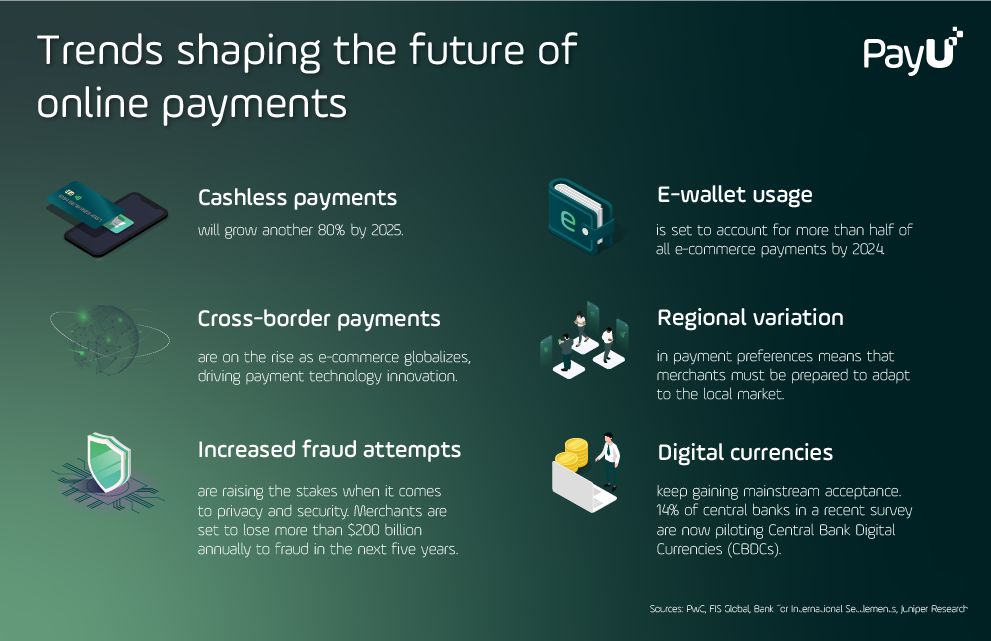

Driven by mobile commerce, mobile wallets will become the most popular online payment method by 2024 globally, accounting for over a third of all payments in that time. In the U.S. alone, mobile wallets are predicted to overtake physical cards as the most popular online payment method in the next three years.Q: What trends should we anticipate in the future of Payments Some notable trends include the rise of Central Banks Digital Currencies (CBDCs), increased usage of digital wallets, the growth of cross-border payments, and the acceptance of cryptocurrencies.In 2050, the payments ecosystem (acquirers, PSPs, facilitators, and aggregators) will revolve around creating integrated capabilities within an ecosystem of partners to truly optimise the customer experience and deliver a seamless, personalised payments journey from awareness to purchase and long-term retention.

Is Digital banking the future : Digital technology is transforming the banking industry by improving customer experience, increasing operational efficiency, and reducing costs. Artificial intelligence, blockchain, mobile banking, cybersecurity, big data analytics, and augmented reality are among the key trends shaping the future of banking.

What will replace cash in the future

Q: What is the future of money The future of money is expected to be heavily influenced by technology. Predictions include the rise of cashless societies, the growth of cryptocurrencies, the continued adoption of digital currencies, and the potential offering of a Central Bank Digital Currency (CBDC) by governments.

What is the future of mobile payment technology : According to eMarketer, 80.4% of new users adopting mobile P2P transfers between 2023 and 2027 are expected to be from this generation. This trend indicates a significant shift in how future generations will handle money, with mobile payments increasingly ingrained in their daily financial activities.

While the future demand for cash is uncertain, it is unlikely that cash will die out any time soon.

Digital money has the potential to transform the financial sector. Emerging markets and lower-income countries stand to gain the most from this dramatic shift.

What is the future of banking in 2030

Successful banks of 2030 will master data-driven customer experience across channels, underpinned by artificial intelligence and robotic automation. Consumers are becoming far more aware of the value of their personal data and the importance of keeping it safe and secure.Broad and inexpensive access to digital money and phone-based transactions could open the door to financial services for 1.7 billion people without traditional bank accounts. And countries may grow increasingly connected, facilitating trade and market integration. The real-world impact is significant.2. Will a U.S. CBDC replace cash or paper currency The Federal Reserve is committed to ensuring the continued safety and availability of cash and is considering a CBDC as a means to expand safe payment options, not to reduce or replace them.

After being valued at $26.79 billion last year, the global payment gateway market is expected to grow at a compound annual growth rate of 22.2% by 2030.

What is the prediction for digital wallet : The Global e-Wallet (Digital Wallets) Market is anticipated to rise at a considerable rate during the forecast period, between 2024 and 2032. In 2023, the market is growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

Will Cbdc replace cash : 2. Will a U.S. CBDC replace cash or paper currency The Federal Reserve is committed to ensuring the continued safety and availability of cash and is considering a CBDC as a means to expand safe payment options, not to reduce or replace them.

Will cash be used in 2030

Analysis from Barclays Investment Bank, meanwhile, predicts that the global transition from cash to digital payments would reach a tipping point moment in 2025, when absolute cash usage would decline from 41 per cent in 2019 to 20 per cent by 2030.

Future Trends in E-Banking

Several trends are poised to reshape the e-banking landscape looking ahead. Imagine using augmented reality (AR) for banking, making digital transactions feel more real and exciting! Contactless payment solutions will continue to grow, providing a faster and more convenient way to pay.Digital banking technologies — including artificial intelligence, analytics, personal financial management software, internet of things, voice banking, banking as a service and fintech innovation — are converging toward one end goal: invisible banking. This is banking you don't have to think about. You tap to pay.

Will digital currency replace cash : Will a U.S. CBDC replace cash or paper currency The Federal Reserve is committed to ensuring the continued safety and availability of cash and is considering a CBDC as a means to expand safe payment options, not to reduce or replace them.