Antwort What is the difference between SWIFT and SWIFT GPI? Weitere Antworten – What does SWIFT gpi mean

SWIFT global payments innovation

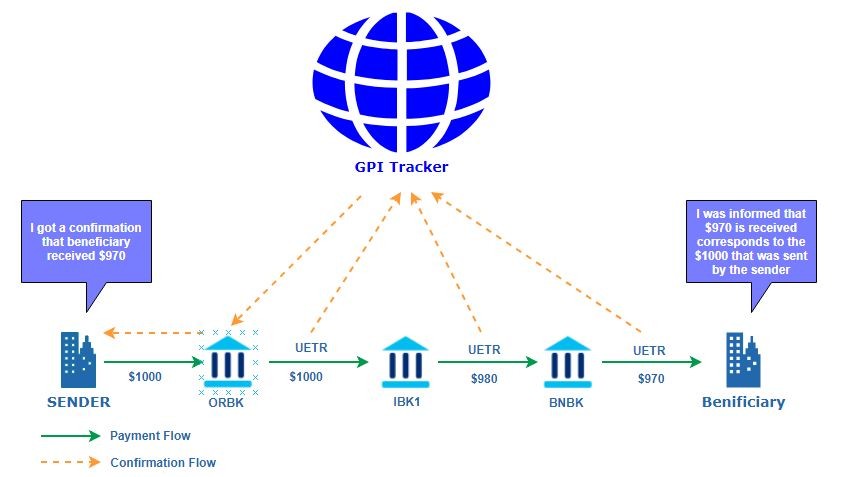

With SWIFT global payments innovation (gpi), you can account for your money every step of the way. Plus, your payments arrive in minutes, not days. FNB is among the select banks and financial institutions offering SWIFT gpi capabilities.ABN AMRO, Bank of China, BBVA, Citi, Danske Bank, DBS Bank, Industrial and Commercial Bank of China, ING Bank, Intesa Sanpaolo, Nordea Bank, Standard Chartered Bank and UniCredit are live with SWIFT gpi, exchanging gpi payments across 60 country corridors.SWIFT gpi is an optional service on SWIFT network and operates on the basis of business rules and technical specifications captured in rulebooks between gpi customers (i.e. financial institutions who are SWIFT users and signed up for the gpi service).

What is gpi MT103 : MT103 DIRECT CASH TRANSFER GPI SUPPORT (SERVER TO BANK) The transaction is between the sender bank's server to the receiving IP REST (HOST SERVER) which is. connected to the common account of the branch (not the treasury of the bank).

Why use SWIFT GPI

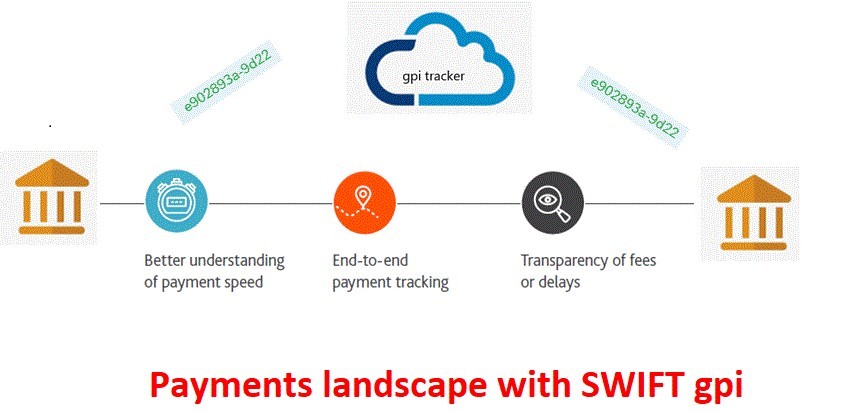

Swift GPI enables you to

Your customers expect the best. Whether it's a pizza, a parcel or a cross-border payment, they expect their payment to be trackable right to the beneficiary. That's what you can deliver with Swift GPI.

Do banks have a gpi code : All member banks are listed in the gpi Directory. This includes details such as: which banks can send and receive gpi payments by business identifier code (BIC); in which currencies; reachable through which channels; cut-off times; and if a bank acts as an intermediary for gpi payments.

As of now, 100 banks in the APAC region, delivering 90 percent of traffic are gpi-enabled or in the process of enabling while globally 3500 banks have committed to adoption of gpi, SWIFT said. In 2018, the payments platform handled over $40 trillion worth of transactions globally.

Genuine Progress Indicator (GPI) is an economic tool used to measure the health of a nation's economy. It incorporates environmental and social factors, such as family structure, benefits from higher education, crime, and pollution, not considered in the GDP.

Do banks have gpi codes

All member banks are listed in the gpi Directory. This includes details such as: which banks can send and receive gpi payments by business identifier code (BIC); in which currencies; reachable through which channels; cut-off times; and if a bank acts as an intermediary for gpi payments.You may get the unique payment code by visiting the Transfers menu, selecting Payments Management and checking the Outgoing Transaction Details in the "GPI Reference" field.SWIFT data issued in December 2020 revealed that in total 4,100 financial institutions had signed up to become gpi members, although the figure is elevated by individual branches of major international banking groups such as Deutsche Bank becoming members.

Disadvantages of Using GPI

- Many non-economic variables such as the value of leisure time/environment are very subjective and it can be difficult to assign an economic value. GDP is simpler and gives less normative results.

- Not useful for judging the state of the business cycle.

What are the benefits of SWIFT GPI : Swift GPI lets you make high-speed cross-border payments in minutes or seconds. Nearly 50% of gpi payments are credited to end beneficiaries within 30 minutes, 40% in under 5 minutes, and almost 100% of gpi payments are credited within 24 hours.

How many banks use SWIFT gpi : Swift GPI isn't a proof of concept. It's tried and tested by a community of over 4,450+ financial institutions.

Do European banks use SWIFT

SWIFT code and BIC are often used interchangeably. However, there are key differences between them. The BIC is only used for European banks, but SWIFT codes are used around the world.

GPI advocates claim that it can more reliably measure economic progress as it distinguishes between the overall "shift in the 'value basis' of a product, adding its ecological impacts into the equation." The relationship between GDP and GPI mimics the relationship between the gross profit and net profit of a company.GPI advocates claim that it can more reliably measure economic progress, as it distinguishes between the overall "shift in the 'value basis' of a product, adding its ecological impacts into the equation".

How many banks use SWIFT GPI : Swift GPI isn't a proof of concept. It's tried and tested by a community of over 4,450+ financial institutions.