Antwort What is the difference between SWIFT and IBAN? Weitere Antworten – Are SWIFT and IBAN the same

The main difference between an IBAN and SWIFT BIC code lies in what they're used to identify. A SWIFT code refers to a bank, while an IBAN will identify a specific bank account. Basically, a SWIFT number tells you where to pay, and an IBAN tells you who to pay.Bank Requirements

In this case, they simply give you their IBAN number. However, in many instances, a bank requires both an IBAN number and a SWIFT code to pinpoint a recipient's bank and specific bank account number. If the country of the recipient does not support IBAN, SWIFT codes are the only other option.You will typically be able to find your SWIFT code on bank statements and on your online or app banking. Most often it will be in the same place as your IBAN number.

How do I find my SWIFT code : How do you find your SWIFT/BIC code To locate your SWIFT/BIC code, check any paper or digital banking statements, or look at your account details on your online banking profile. You can also search for your BIC code using a digital SWIFT/BIC search tool by providing your country and bank location data.

Which countries don’t use IBAN

An IBAN code is used in bank account identification. Depending on your country, you may not have heard of IBANs. For instance, banks in the United States, Canada, Australia, New Zealand and China don't use IBANs.

Is an IBAN enough to transfer money : IBAN numbers can only be used to send or receive money between accounts, not for withdrawing money or transferring account ownership.

When you enter a wrong SWIFT, then this is what will happen: Your bank will subtract the money from your account balance. Your bank tries to send it to the bank with that SWIFT code. When the SWIFT code does not exist at all, your bank will reverse the payment and put the money back into your account.

Is BIC the same as SWIFT A BIC code is the same as a SWIFT code; they are simply given different names by different banks and financial institutions.

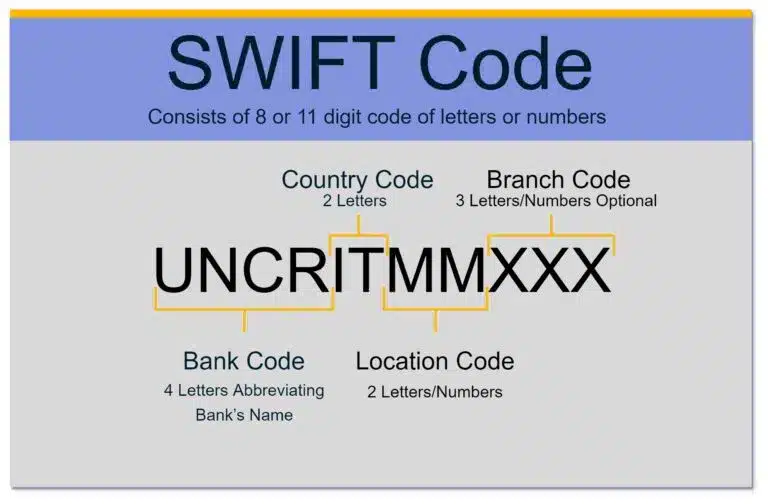

What is an example of a SWIFT code

A BIC is the Branch Identifier Code, also known as a SWIFT code, it helps overseas banks identify which bank to send money to. It's made up of 8 to 11 characters. Here's an example: HBUKGB4B – HBUK = Bank Code, GB = Country code, 4B = Location Code.You can usually find your bank's BIC/ SWIFT code in your bank account statements. If you're using an online bank, log into your digital bank account to easily view your bank statement.Whilst most banks have a BIC / SWIFT code assigned to them, there are some financial institutions that do not use them. A number of smaller banks and credit unions in the United States do not connect to the SWIFT network, which means that they do not use international routing codes.

| Afghanistan | Barbados | Chad |

|---|---|---|

| Coral Sea Islands, territory of | Dhekelia | Heard Island and McDonald Islands |

| Democratic Republic of Congo | Falkland Islands | Jamaica |

| East Timor | Haiti | Johnston Atoll |

| Gibraltar | Iran | Kingman Reef |

Do you need both SWIFT and IBAN for international transfer : To send money overseas with an IBAN, your recipient will have to be in a country that supports this system and will have to provide you with their IBAN number. However, in many cases, you will also need the recipient's SWIFT code in addition to the IBAN.

Do you need both IBAN and SWIFT code : Do I need IBAN if I have SWIFT You might be asked to provide both an IBAN and SWIFT to help a bank identify exactly where the money needs to be sent to. Not all countries support the IBAN system, so if you're sending money to a country that doesn't you'll just need the SWIFT code for the overseas transfer.

Do all banks have a SWIFT code

Do all banks have a BIC/SWIFT code for international transactions No — some U.S. credit unions and small banks are not part of the SWIFT system. But if you work with a small bank for your business, this isn't a be-all-end-all: They might still be able to receive and send money internationally.

BIC stands for 'Business Identifier Code' and is the code used in the system. The terms SWIFT and BIC are used interchangeably and represent information required for making international transactions. Although BIC and SWIFT codes may seem confusing, they're essential for anyone who needs to send international payments.A SWIFT code, also called a SWIFT number, is used to identify banks and financial institutions worldwide. The term Business Identifier Code (BIC) is used interchangeably with SWIFT code and means the same thing.

What is the IBAN code : IBAN stands for International Bank Account Number, which you can use when making or receiving international payments. Your IBAN doesn't replace your sort code & account number ─ it's an additional number with extra information to help overseas banks identify your account for payments.

:max_bytes(150000):strip_icc()/whats-difference-between-iban-and-swift-code.asp-FINAL-1df82a2312304df69037b86d6df59e6f.png)