Antwort What is the difference between swap and trade? Weitere Antworten – How does a swap work

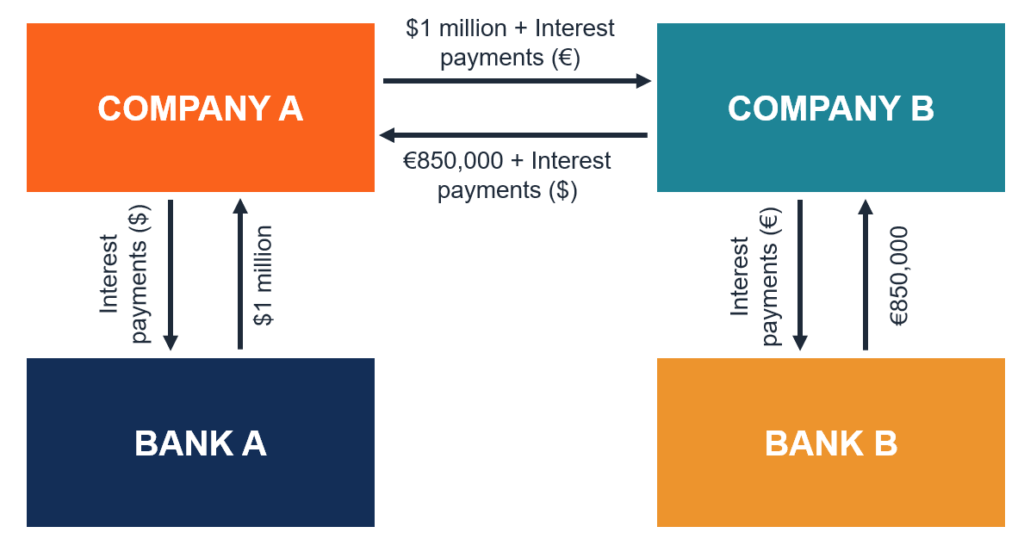

A swap is an agreement for a financial exchange in which one of the two parties promises to make, with an established frequency, a series of payments, in exchange for receiving another set of payments from the other party. These flows normally respond to interest payments based on the nominal amount of the swap.CCS is just a financial contract that effectively changes (swaps) your payment from one currency to another and changes your interest rate exposure from floating into fixed (or vice versa). How well your interest rate and FX risks are eliminated, depend on how well the CCS matches your underlying business.A CCS is an agreement between two parties to exchange interest payments, with or without an initial and final exchange of principal value, in two different currencies.

What is CCS hedging : Cross-currency swaps are an over-the-counter (OTC) derivative in a form of an agreement between two parties to exchange interest payments and principal denominated in two different currencies.

What is a swap in trading

A swap is a derivative contract where one party exchanges or "swaps" the cash flows or value of one asset for another. For example, a company paying a variable rate of interest may swap its interest payments with another company that will then pay the first company a fixed rate.

What is an example of a swap : A swap in the financial world refers to a derivative contract where one party will exchange the value of an asset or cash flows with another. For example, a company that is paying a variable interest rate might swap its interest payments with another company that will then pay a fixed rate to the first company.

A currency swap is an agreement in which two parties exchange the principal amount of a loan and the interest in one currency for the principal and interest in another currency. At the inception of the swap, the equivalent principal amounts are exchanged at the spot rate.

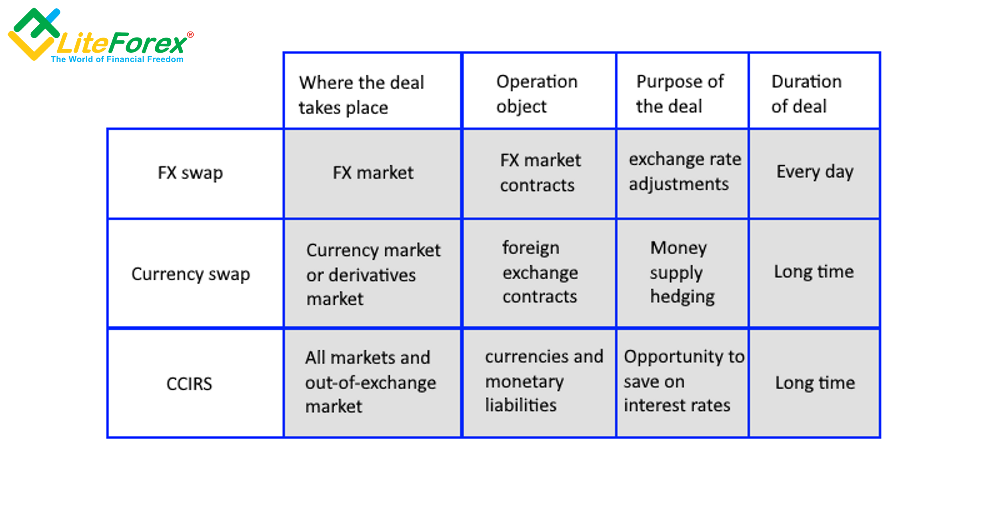

In a FX Swap an amount of one currency is purchased (or sold) in a spot transaction and subsequently sold (or purchased) in the forward. This is a fixed agreement with both parties entering into an obligation. The forward rate is determined by the spot rate.

What is an example of a swap hedging

One of the primary functions of swaps is the hedging of risks. For example, interest rate swaps can hedge against interest rate fluctuations, and currency swaps are used to hedge against currency exchange rate fluctuations.Crypto Trade

In this case, no exchange is involved. Typically, swaps are for immediate transactions. In other words, crypto users generally execute swaps instantly. Trades are for specific times, market conditions, or prices.A swap in the financial world refers to a derivative contract where one party will exchange the value of an asset or cash flows with another. For example, a company that is paying a variable interest rate might swap its interest payments with another company that will then pay a fixed rate to the first company.

Types of Swaps

- #1 Interest rate swap. Counterparties agree to exchange one stream of future interest payments for another, based on a predetermined notional principal amount.

- #2 Currency swap.

- #3 Commodity swap.

- #4 Credit default swap.

How to trade currency swap : How to Start Trading in Currencies

- Step 1: Open a trading account.

- Step 2: Start looking into it.

- Step 3: Invest in a small initial purchase or initial investment.

- Step 4: Talk to your broker about setting a stop loss or limitation order.

Are currency swaps exchange traded : These are over-the-counter (OTC) financial instruments that are not traded over any centralized exchange. These currency swaps are negotiated between two parties. These are held by two parties to the contract.

Is an FX swap a CFD

The Forex swap, sometimes called the Forex rollover rate, is a type of interest charged on positions held overnight in the Forex market and on Contracts for Difference (CFDs).

A swap is a derivative contract where one party exchanges or "swaps" the cash flows or value of one asset for another. For example, a company paying a variable rate of interest may swap its interest payments with another company that will then pay the first company a fixed rate.A swap is an agreement or a derivative contract between two parties for a financial exchange so that they can exchange cash flows or liabilities. Through a swap, one party promises to make a series of payments in exchange for receiving another set of payments from the second party.

Is swap better than exchange : The ability to quickly buy and sell an asset without having an impact on its price is referred to as liquidity. Because they frequently have a larger user base and a wider variety of trading pairs than crypto swaps, cryptocurrency exchanges frequently have higher liquidity than crypto swaps.

:max_bytes(150000):strip_icc()/interest-rate-swap-4194467-1-d72db15d28f64e9b801fe940e5999c51.jpg)