Antwort What is the difference between ETH 2.0 and ETH 1? Weitere Antworten – Is Ethereum 1 the same as Ethereum 2

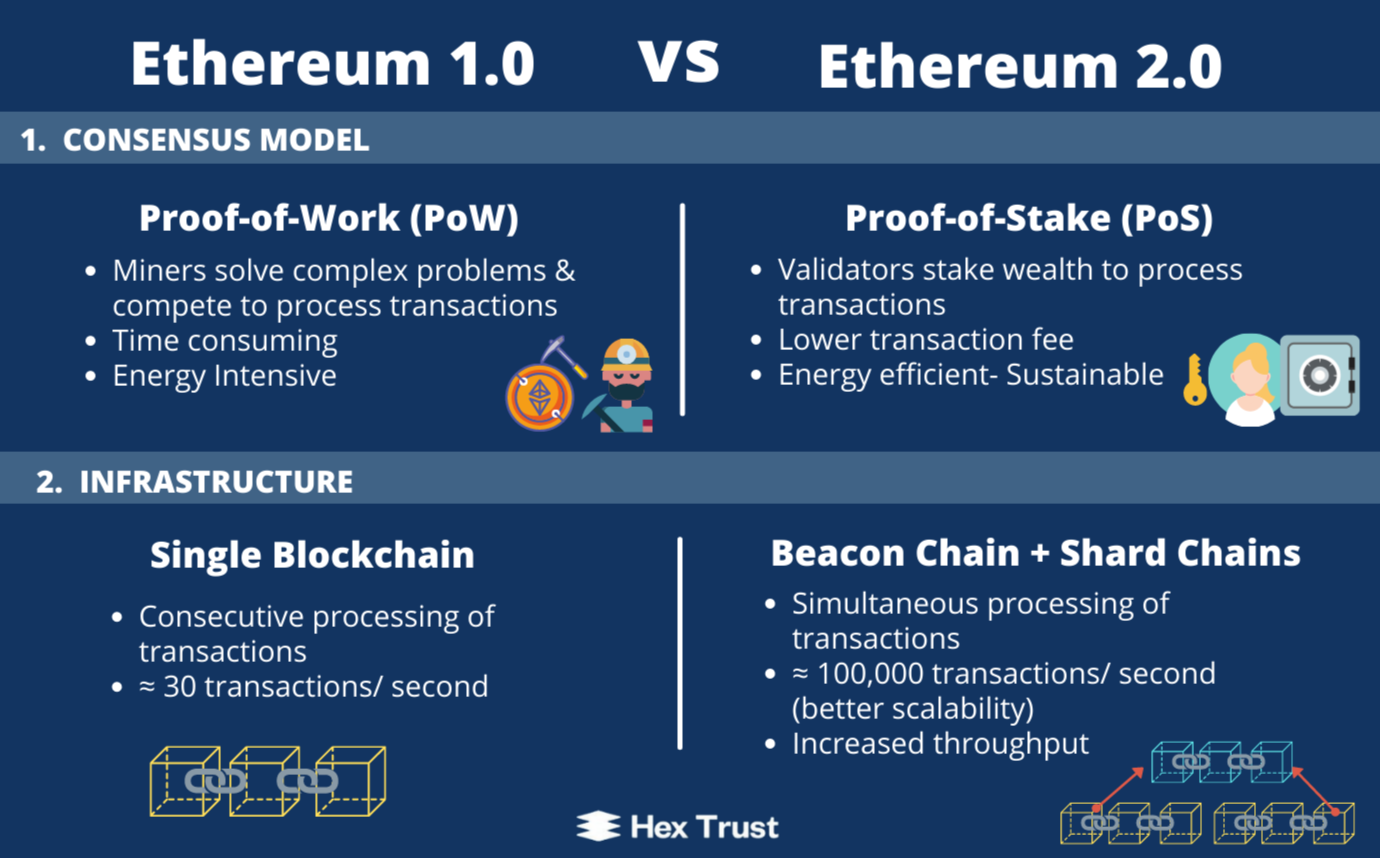

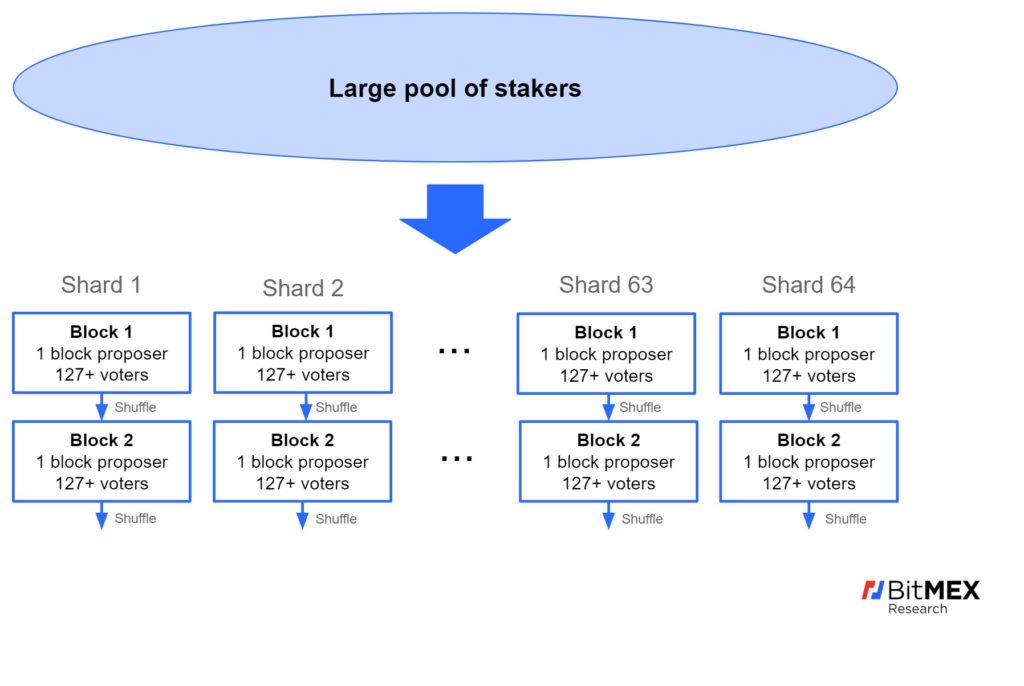

Ethereum 1.0 used the Proof of Work mechanism, which involves mining new ETH blocks to confirm transactions and verify blockchain data. In turn, Ethereum 2.0 uses the stake consensus mechanism Proof of Stake, in which token holders are rewarded for holding coins that are used as tools to maintain the network.As per the estimates, Ethereum 2.0 can handle up to 100,000 transactions per second compared to the older Ethereum's 15 transactions per second. In addition to improved scalability, Ethereum 2.0 also aims to enhance the security and sustainability of the Ethereum network.No. Since its inception, Ethereum has undergone several upgrades in the form of hard forks. With Ethereum 2, rather than forking, a whole new blockchain based on proof-of-stake is being launched.

Why is Ethereum 2.0 better : Ethereum 2.0 will primarily benefit the scalability, throughput, and security of the Ethereum public mainnet. Ethereum 2.0 will not eliminate any of the data history, transaction records, or asset ownership of the Ethereum 1.0 chain.

Do I need to convert my ETH to ETH2

No, ETH holders did not need to do anything. Their stored or staked Ether was automatically converted from ETH to ETH2 post-Merge.

Is ETH Layer 1 or 2 : Ethereum's main network, or Layer 1, is the Ethereum blockchain's base layer, where all transactions are settled. It is highly secure, thoroughly battle-tested, decentralized, and arguably the most trusted blockchain outside of Bitcoin.

No, ETH holders did not need to do anything. Their stored or staked Ether was automatically converted from ETH to ETH2 post-Merge.

Ethereum 2.0 will bring sustainability, security, scalability, reduce gas fees, and increase the transaction speed compared with the Ethereum network. Proof of Stake allows a user to validate on-chain transactions by staking the capital instead of using complex instruments as required in crypto mining.

How much will 1 Ethereum be worth in 2030

Ethereum (ETH) Price Prediction 2030

According to your price prediction input for Ethereum, the value of ETH may increase by +5% and reach $ 4,172.69 by 2030.The upgrade will lower gas fees for the growing number of networks built on top of Ethereum that are known as Layer 2 (L2), or “roll-ups.” This is important since gas fees have historically soared whenever there is a surge of activity on the blockchain, making it unviable to use at a large scale.ETH2 represents staked ETH and is imported into CoinTracking from various exchanges and wallets. Despite its name, ETH2 holds the same value as regular ETH. To ensure accurate value and price history for staked ETH2 tokens, they need to be converted to ETH.

While Layer 1 provides a secure and decentralized foundation, Layer 2 solutions offer scalability and cost-effectiveness. By understanding their dynamics, strengths, and challenges, users and developers can make informed decisions and contribute to a more efficient, inclusive, and innovative DeFi landscape.

Is erc20 Layer 1 or 2 : ERC-20 tokens are a type of digital asset that primarily operates on the Ethereum blockchain and can also be found on Ethereum L2 (Layer 2) networks like Arbitrum One, Optimism, and Base.

Can Ethereum Classic reach $10,000 : Can Ethereum Classic Reach $10,000 It's difficult to predict what will happen to cryptocurrency prices. It is possible that ETC will reach $10,000, but it's just as likely it will collapse and be worthless.

Which crypto will boom in 2024

Top 10 Cryptos in 2024

| Coin | Market Capitalization | Current Price |

|---|---|---|

| Binance Coin (BNB) | $85 billion | $580 |

| Solana (SOL) | $72 billion | $162 |

| Ripple (XRP) | $28 billion | $0.51 |

| Dogecoin (DOGE) | $22 billion | $0.15 |

Ethereum 2.0 significantly upgraded the Ethereum network, shifting the network to proof-of-stake (PoS) from the proof-of-work (PoW) model. Ethereum 2.0 aimed to improve the network's scalability, accessibility, and transaction throughput.Ethereum's main network, or Layer 1, is the Ethereum blockchain's base layer, where all transactions are settled. It is highly secure, thoroughly battle-tested, decentralized, and arguably the most trusted blockchain outside of Bitcoin.

Is XRP Layer 1 : Ripple (XRP): This layer 1 blockchain facilitates cross-currency transactions for financial institutions. XRP provides a bridge of liquidity in real-time, ensuring it has solid long-term utility. Ripple is used by some of the world's largest banks, meaning it could eventually replace the SWIFT network.