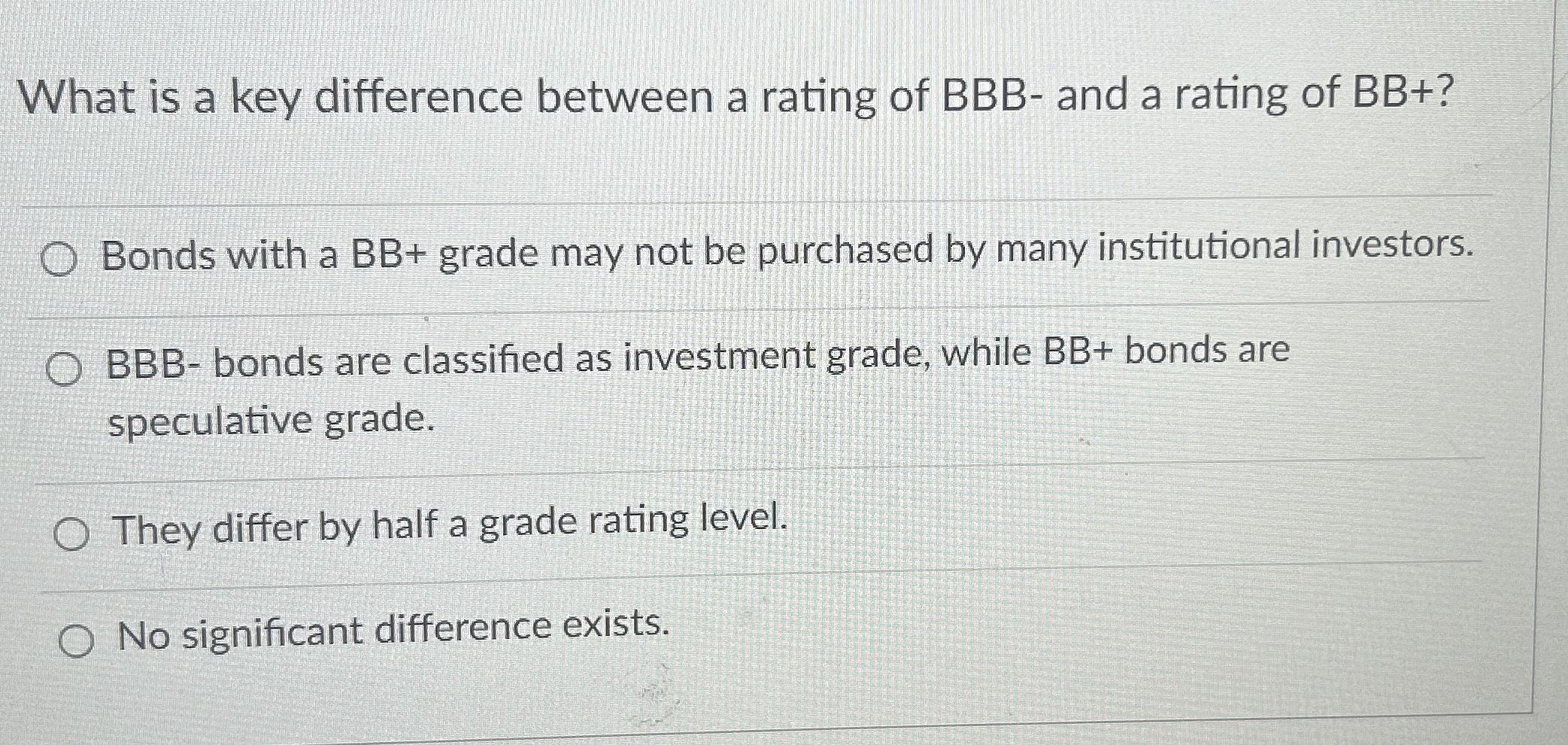

Antwort What is the difference between BBB and BB+? Weitere Antworten – What are BBB bonds

"AAA" and "AA" (high credit quality) and "A" and "BBB" (medium credit quality) are considered investment grade. Credit ratings for bonds below these designations ("BB," "B," "CCC," etc.) are considered low credit quality and are commonly referred to as junk bonds.Below investment grade securities are securities that are not rated in one of the four highest rating categories of a nationally recognized rating agency such as Moody's or S&P. Specifically, securities rated lower than Baa3 by Moody's or BBB- by S&P are below investment grade.The highest-quality bonds are rated Aaa at Moody's and AAA at S&P and Fitch, with the scales declining from there. Moody's ratings of Baa3 and BBB at S&P and Fitch are considered the lowest investment-grade ratings. Ratings below this are considered high-yield or junk.

What does a BBB rating mean : The BBB rating is based on information BBB is able to obtain about the business, including complaints received from the public. BBB seeks and uses information directly from businesses and from public data sources. BBB assigns ratings from A+ (highest) to F (lowest).

Is BB+ investment grade

Investors typically group bond ratings into 2 major categories: Investment-grade refers to bonds rated Baa3/BBB- or better. High-yield (also referred to as "non-investment-grade" or "junk" bonds) pertains to bonds rated Ba1/BB+ and lower.

What does BBB credit rating mean : 'bbb' ratings denote good prospects for ongoing viability. The financial institution's fundamentals are adequate, such that there is a low risk that it would have to rely on extraordinary support to avoid default. However, adverse business or economic conditions are more likely to impair this capacity.

The AA+ rating is issued by S&P and Fitch and is similar to the Aa1 rating issued by Moody's. This rating is still of high quality but it falls below the AAA ranking. It comes with very low credit risk even though long-term risks may affect these investments.

If you look at the BBB rated bonds (lowest rated investment grade bond), based on historical data, there is a 1.60% expected probability of default over a 5-year period, whereas the expected probability of default significantly increases to 9.27% for a B rated (Speculative) bond.

Is BB rating better than BBB

For Standard & Poor's, AAA is the best rating, followed by AA, A, BBB, BB, B, CCC, CC, and C. D is used for bonds that are already in default, which means the underlying company isn't able to pay back principal.Investors typically group bond ratings into 2 major categories: Investment-grade refers to bonds rated Baa3/BBB- or better. High-yield (also referred to as "non-investment-grade" or "junk" bonds) pertains to bonds rated Ba1/BB+ and lower.BBB- Considered lowest investment-grade by market participants. BB+ Considered highest speculative-grade by market participants. BB Less vulnerable in the near-term but faces major ongoing uncertainties to adverse business, financial and economic conditions.

Investment grade and high yield bonds

Investors typically group bond ratings into 2 major categories: Investment-grade refers to bonds rated Baa3/BBB- or better. High-yield (also referred to as "non-investment-grade" or "junk" bonds) pertains to bonds rated Ba1/BB+ and lower.

What is a BBB+ rating : BBB+ BBB+ An obligor has adequate capacity to meet its financial commitments. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitments. Baa2.

Is BBB better than AA : For Standard & Poor's, AAA is the best rating, followed by AA, A, BBB, BB, B, CCC, CC, and C.

Is a BBB bond junk

Bonds with a rating of BBB- (on the Standard & Poor's and Fitch scale) or Baa3 (on Moody's) or better are considered "investment-grade." Bonds with lower ratings are considered "speculative" and often referred to as "high-yield" or "junk" bonds.

'BBB' National Ratings denote a moderate level of default risk relative to other issuers or obligations in the same country or monetary union. 'BB' National Ratings denote an elevated default risk relative to other issuers or obligations in the same country or monetary union.BB+ credit rating is a notch above BB, which is a slightly lower credit risk, and BB- credit rating is a notch below BB, and a slightly higher credit risk. Note that BB+, BB and BB- are credit ratings specific to Standard & Poor and Fitch credit agencies.

Is BB+ a good rating : Ba1/BB+ is a rating in the middle of that range, reflecting an issuer that has some risk of default, but is still a safer investment than others; it is considered to be just below investment grade.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV_final_Ba3-BB-_Jan_2021-01-4dd68057e7a241629de924cee6005773.jpg)