Antwort What is the cheapest international money transfer service? Weitere Antworten – What is the least expensive way to transfer money internationally

Bank transfers are usually the cheapest option when it comes to funding your international money transfer with Wise. Bank transfers can be slower than debit or credit cards, but they usually give you the best value for your money.Wire transfer fees by financial institution

| Bank | Incoming domestic | Outgoing international |

|---|---|---|

| Bank of America | $15 | $45 |

| Chase | $0-$15 | $0-$50 |

| Citi | Up to $15 | Up to $35 |

| Fidelity | $0 | $0** |

HSBC Global Money Transfers lets you send money overseas faster and fee-free, with just a few taps on the HSBC Mobile Banking app.

What is the cheapest fee for money transfer : As a rule of thumb, PayPal is the best option to transfer money between bank accounts, MoneyGram or Xoom are usually cheaper for transferring money from a sender's debit or credit card to a recipient's bank account, and MoneyGram has no fee for international transfers.

Is Western Union cheaper than bank transfer

International money transfer services like Western Union can help you easily send money abroad, and the fees may be less compared to traditional banks. Plus, Western Union can be a more convenient option because there are additional methods to send and receive money such as cash pick-up.

How safe is Revolut : It uses cutting-edge machine learning and AI methods to detect suspicious activity. In addition, our 2,500-strong financial crime team works to prevent our customers from falling victim to scams and fraud. We estimate that in 2023, Revolut prevented nearly £480 million in potential fraud against our customers.

The best debit cards to take abroad

- First Direct. When you were abroad, First Direct used to charge a 2.75% conversion fee every time you used your card to buy something or withdraw cash.

- Starling Bank. The Starling Bank current account is free.

- Chase.

- Monzo.

- Virgin Money.

- Kroo Bank.

- Cumberland Building Society.

HSBC doesn't charge foreign transaction fees or foreign ATM fees, plus it has international ATMs. USAA international ATM fees don't exist, either (though a 1% foreign transaction fee still applies). Chase international ATM fees vary depending on what type of checking account you have.

Is Wise or Revolut better

Customer ratings. Both money transfer companies are regarded highly by their users. Wise gets 4.3 out of 5 on Trustpilot from more than 218,000 reviews. Revolut has a rating of 4.2 out of 5 from 152,000 reviews.around 3-5%

How much does SWIFT transfer cost A SWIFT transfer has multiple charges, such as transfer fees, exchange rates, and hidden fees. Banks charge around 3-5% on the exchange rate for each transfer.Transaction charges for NEFT and RTGS initiated through online modes (i.e. Internet Banking, iMobile Pay, Pockets and InstaBIZ) are nil.

You can avoid these fees by using a debit card. * Western Union also makes money from currency exchange. When choosing a money transmitter, carefully compare both transfer fees and exchange rates. Fees, foreign exchange rates, and taxes may vary by brand, channel, and location based on a number of factors.

How much does Western Union charge to send $100 : If you're looking for a rough estimate of Western Union's wire transfer fees, you can generally expect to pay around $0.65 and $3.76 for every $100 that you send. Bear in mind, though, that these charges can be a lot higher still depending on the currency you're sending from and to.

Is Revolut Russian owned : Nikolay Storonsky (born 21 July 1984) is a Russian-born British businessman. He is the co-founder and CEO of the financial technology company Revolut.

Which banks don’t charge in Europe

| Bank | Best for | Expert score |

|---|---|---|

| Starling | Best for fee free spending & customer service | 4.7/5 |

| first direct | Best for fee free spending & added extras | 4.5/5 |

| Chase | Best for fee free spending & cashback | 4.4/5 |

| Kroo | Best for fee free spending & in-credit interest | 3.9/5 |

16. 1. 2024

This enables users to initiate transfers once their desired rate is reached.

- ICICI Bank Exchange Rates, Fees and Money2India Service.

- HDFC Exchange Rates and Transfer Fees.

- PNB Transfer Fees and Charges.

- SBI International Money Transfer Fees.

- Additional Fees.

- Fees of Axis Bank International Money Transfers.

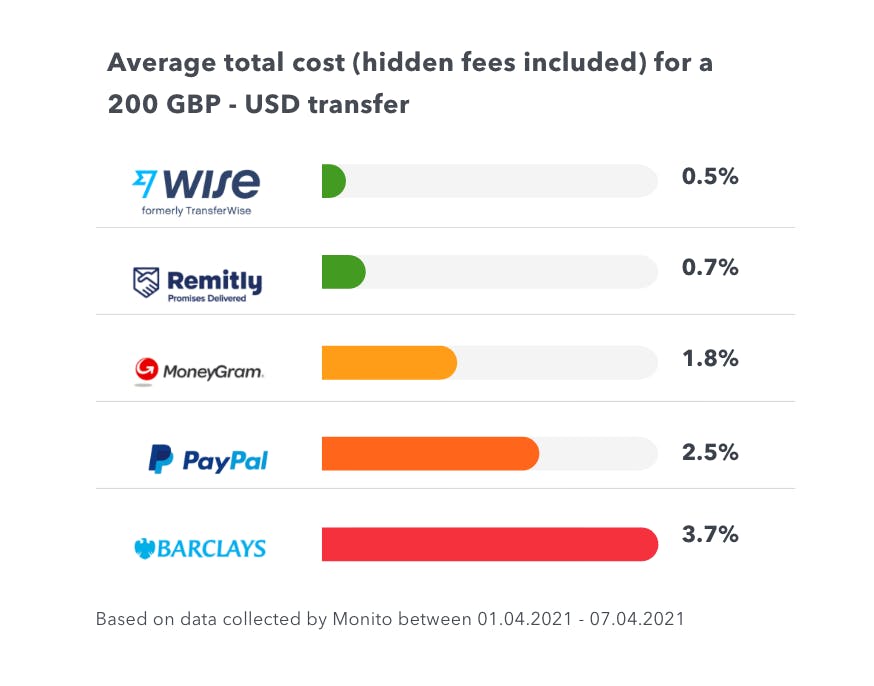

Every bank is different, but in general you can expect them to take as much as 3-4% of your total transfer as a fee when you send money internationally. Thankfully, despite that, a lot of banks will try to cap the amount they charge their customers. This will vary depending on the institution.

What is the best bank for international transaction : Charles Schwab Bank is one of the best banks for international travelers, because it doesn't charge foreign transaction fees. It also refunds all fees charged by ATMs worldwide.