Antwort What is the biggest difference between Visa and Mastercard? Weitere Antworten – Which is better, Mastercard or Visa

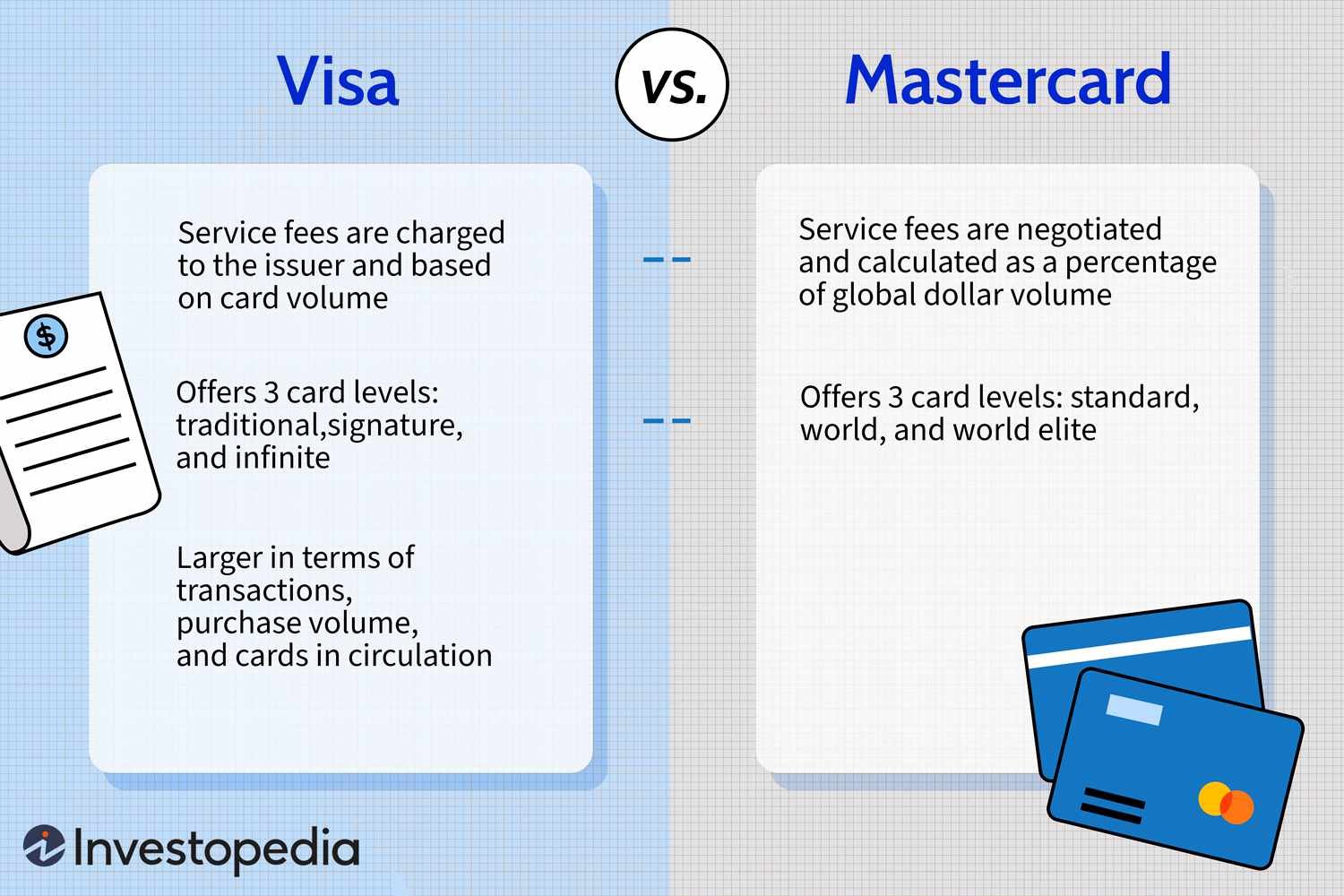

Benefits comparison: Visa vs. Mastercard. On entry level cards, there is very little difference between Visa and Mastercard, as both provide a similar suite of basic features. However, Mastercard includes impressive special luxury offers on its World and World Elite level cards, which can be attractive for big spenders …Visa (trading symbol V) commands a $497.5 billion market capitalization, while Mastercard (trading symbol MA) follows closely behind at $359.8 billion (market caps as of May 18, 2021). 78 As neither company extends credit or issues cards through a banking division, both have a broad portfolio of co-branded offerings.Both Visa and MasterCard earn revenue through the payment processing fee. However, the method of charging fees differs. Visa charges the card issuer on a per-transaction basis or based on the card volume. Contrarily, MasterCard charges card-issuing institutions based on the percentage of global dollar volume.

What is the role of Visa and Mastercard : Visa and Mastercard are payment networks that allow for the electronic transfer of funds between banks or other financial institutions and companies. They provide branded payment processing services for credit cards, debit cards, and prepaid cards that banks or financial institutions can then offer their customers.

Is A Mastercard Safer Than A Visa

Which is more secure Both Visa and Mastercard offer zero fraud liability for all cards, which means that any user who is victim to fraud, theft, or breach of data will not be liable for the lost money. Both networks are generally considered to be secure, but use different methods for securing your data.

Why is Visa more popular than Mastercard : One significant difference between Visa and Mastercard is that Visa dominates the global credit market. Mastercard processes nearly less than half of what Visa does in annual payments and Visa's revenue is consistently higher. In 2022, close to 40% of all global card transactions were made using a Visa-branded card.

American credit cards work throughout Europe (at hotels, larger shops and restaurants, travel agencies, car-rental agencies, and so on); Visa and MasterCard are the most widely accepted. American Express is less common, and the Discover card is unknown in Europe.

Both Visa and Mastercard offer a range of security benefits. They cover unauthorized or fraudulent purchases, offer cell phone insurance, and return protection, among other features. The specifics, however, may vary depending on the level of the card and the issuing bank.

What is the point of Mastercard

Key Takeaways. Mastercard is a payment network processor. Mastercard partners with financial institutions that issue Mastercard payment cards processed exclusively on the Mastercard network. Mastercard's primary source of revenue comes from the fees that it charges issuers based on each card's gross dollar volume.The disadvantage of Mastercard is that their credit cards tend to offer fewer benefits than Visa cards, and Mastercard debit cards don't always provide full protection from ATM fraud. Still, owning a Mastercard has far more advantages than disadvantages.Which is more secure Both Visa and Mastercard offer zero fraud liability for all cards, which means that any user who is victim to fraud, theft, or breach of data will not be liable for the lost money. Both networks are generally considered to be secure, but use different methods for securing your data.

A Visa credit card is a wise choice for a number of reasons: It's one of the most popular credit cards in the world, it's accepted in more than 200 countries and territories and, with Visa's Zero Liability Policy, you won't be held responsible for unauthorized transactions made with your Visa card. Still not sure

Is it safer to use a Visa or Mastercard : Which is more secure Both Visa and Mastercard offer zero fraud liability for all cards, which means that any user who is victim to fraud, theft, or breach of data will not be liable for the lost money. Both networks are generally considered to be secure, but use different methods for securing your data.

Which card is most accepted in Europe : Despite some differences between European and US cards, there's little to worry about. US-issued Visa and Mastercard credit cards, along with familiar payment apps, typically work fine in Europe.

Why are banks changing from Visa to Mastercard

If your bank switched a card from Visa to Mastercard, it was likely because they felt the features and benefits of Mastercard were better than those of Visa. For example, the issuer might take into consideration processing fees or network-level benefits like travel insurance or purchase protection.

One significant difference between Visa and Mastercard is that Visa dominates the global credit market. Mastercard processes nearly less than half of what Visa does in annual payments and Visa's revenue is consistently higher. In 2022, close to 40% of all global card transactions were made using a Visa-branded card.When Europeans buy something with plastic, they insert their card, then type in their PIN. Despite some differences between European and US cards, there's little to worry about. US-issued Visa and Mastercard credit cards, along with familiar payment apps, typically work fine in Europe.

Is Mastercard as safe as Visa : Which is more secure Both Visa and Mastercard offer zero fraud liability for all cards, which means that any user who is victim to fraud, theft, or breach of data will not be liable for the lost money. Both networks are generally considered to be secure, but use different methods for securing your data.