Antwort What is the benefit of SWIFT GPI? Weitere Antworten – What are the benefits of SWIFT GPI

Swift GPI lets you make high-speed cross-border payments in minutes or seconds. Nearly 50% of gpi payments are credited to end beneficiaries within 30 minutes, 40% in under 5 minutes, and almost 100% of gpi payments are credited within 24 hours.ABN AMRO, Bank of China, BBVA, Citi, Danske Bank, DBS Bank, Industrial and Commercial Bank of China, ING Bank, Intesa Sanpaolo, Nordea Bank, Standard Chartered Bank and UniCredit are live with SWIFT gpi, exchanging gpi payments across 60 country corridors.According to Swift, about 50% of gpi payments are credited to end beneficiaries within 30 minutes, 40% in less than 5 minutes, and almost 100% of gpi payments within 24 hours.

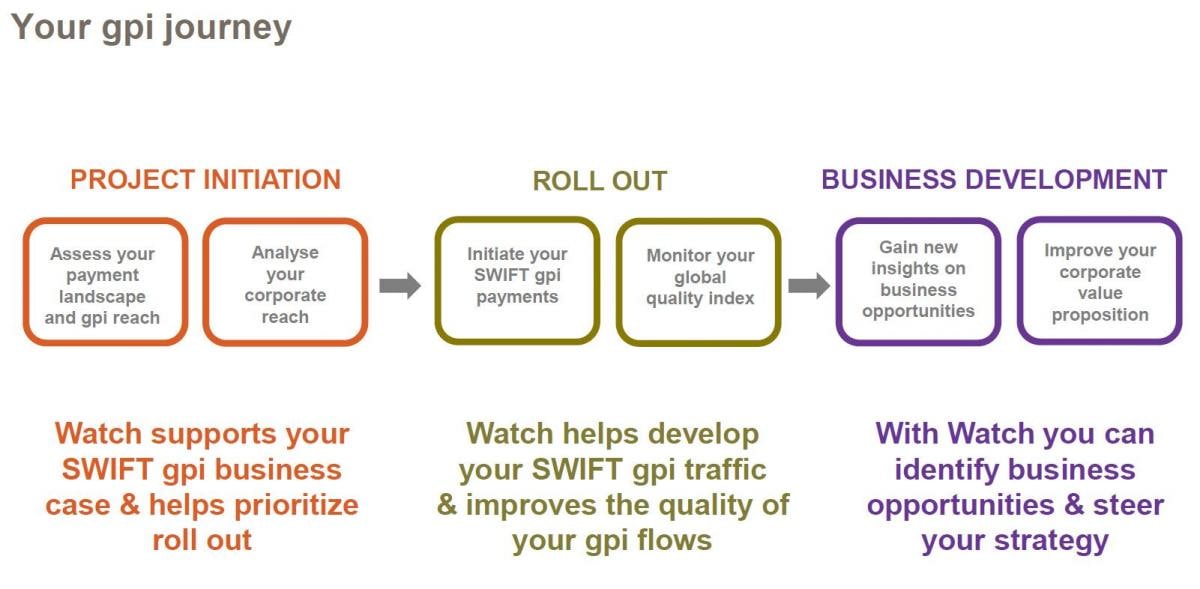

What is gpi money transfer : Swift Global Payments Innovation. Swift GPI is a payments initiative that facilitates seamless cross-border transactions. Learn more about GPI services and Swift Go.

How many banks use SWIFT GPI

Swift GPI isn't a proof of concept. It's tried and tested by a community of over 4,450+ financial institutions.

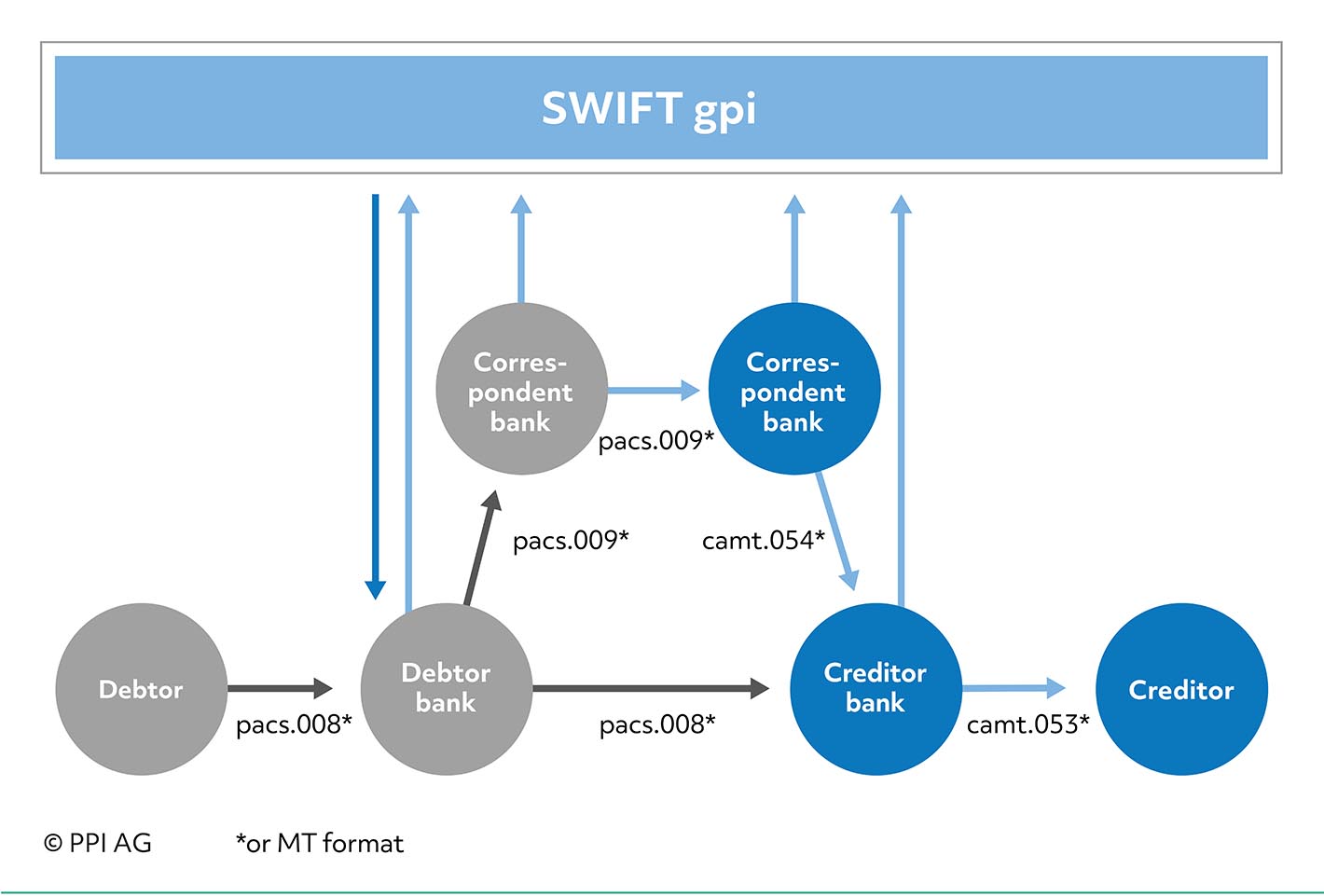

How does the SWIFT GPI work : SWIFT gpi combines domestic real-time payment networks to deliver cross border payments almost instantly and without the restrictions of bank operating hours. Each transaction is assigned a Unique End-to-End Transaction Reference (UETR) that payment providers can use to trace the transfer from start to finish.

As of now, 100 banks in the APAC region, delivering 90 percent of traffic are gpi-enabled or in the process of enabling while globally 3500 banks have committed to adoption of gpi, SWIFT said. In 2018, the payments platform handled over $40 trillion worth of transactions globally.

SWIFT code and BIC are often used interchangeably. However, there are key differences between them. The BIC is only used for European banks, but SWIFT codes are used around the world.

How does SWIFT GPI work

SWIFT gpi combines domestic real-time payment networks to deliver cross border payments almost instantly and without the restrictions of bank operating hours. Each transaction is assigned a Unique End-to-End Transaction Reference (UETR) that payment providers can use to trace the transfer from start to finish.Genuine Progress Indicator (GPI) is an economic tool used to measure the health of a nation's economy. It incorporates environmental and social factors, such as family structure, benefits from higher education, crime, and pollution, not considered in the GDP.At a high level, Swift GPI is intended to increase the speed and transparency of high-value payments, with or without foreign exchange. Swift Go is intended to support low-value and cross-border payments by guaranteeing that the principal amount is not adjusted throughout its lifecycle.

Swift GPI isn't a proof of concept. It's tried and tested by a community of over 4,450+ financial institutions.

What is the difference between SWIFT and SWIFT GPI : Unlike traditional SWIFT payments, which could be slow and lacked transparency, SWIFT gpi provides faster payments, real-time tracking, transparent fee structures, and consistent data records, making international payments more efficient and user-friendly.

What does SWIFT gpi mean : SWIFT global payments innovation

With SWIFT global payments innovation (gpi), you can account for your money every step of the way. Plus, your payments arrive in minutes, not days. FNB is among the select banks and financial institutions offering SWIFT gpi capabilities.

Is SWIFT better than IBAN

IBANs are more secure than SWIFT codes because they are unique identifiers for bank accounts in specific countries. SWIFT codes only identify the bank that will receive a payment, but they do not identify the specific bank account. This means that there is a greater risk of errors and fraud when using SWIFT codes.

Bank Requirements

In this case, they simply give you their IBAN number. However, in many instances, a bank requires both an IBAN number and a SWIFT code to pinpoint a recipient's bank and specific bank account number. If the country of the recipient does not support IBAN, SWIFT codes are the only other option.The Swift is a compact car known for its agile handling and peppy performance. With a stylish design and comfortable interior, it offers good fuel efficiency and a range of tech features, including touchscreen infotainment. However, rear-seat space is limited, and some competitors offer more advanced safety features.

Do you need both an IBAN and a SWIFT code : A SWIFT (Society for Worldwide Interbank Financial Telecommunication) a.k.a. BIC code is used to identify a specific bank during an international transfer. The SWIFT network standardized the formats for the IBAN system and owns the BIC system. Oftentimes, both codes are required for an international transaction.