Antwort What is the advantage of currency swap? Weitere Antworten – What are the advantages of currency swap

Here are some of the major benefits that come with currency swaps:

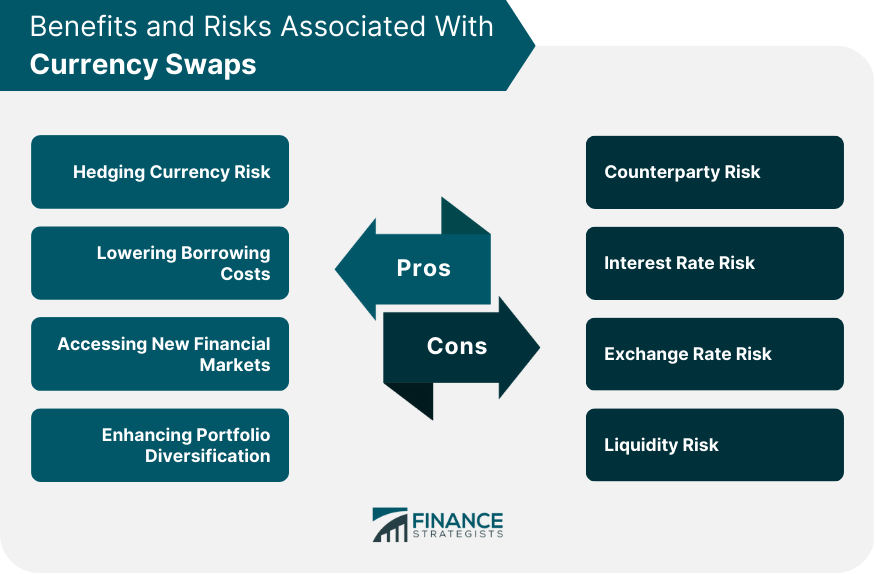

- It Helps To Reduce Exposure To Risk.

- You Can Reduce Your Forex Margins.

- It Allows You To Increase Your ROI.

- It Can Be Used As An Alternative To A Forward Contract.

- It Can Help You With Debt Management.

Disadvantages of Currency Swaps

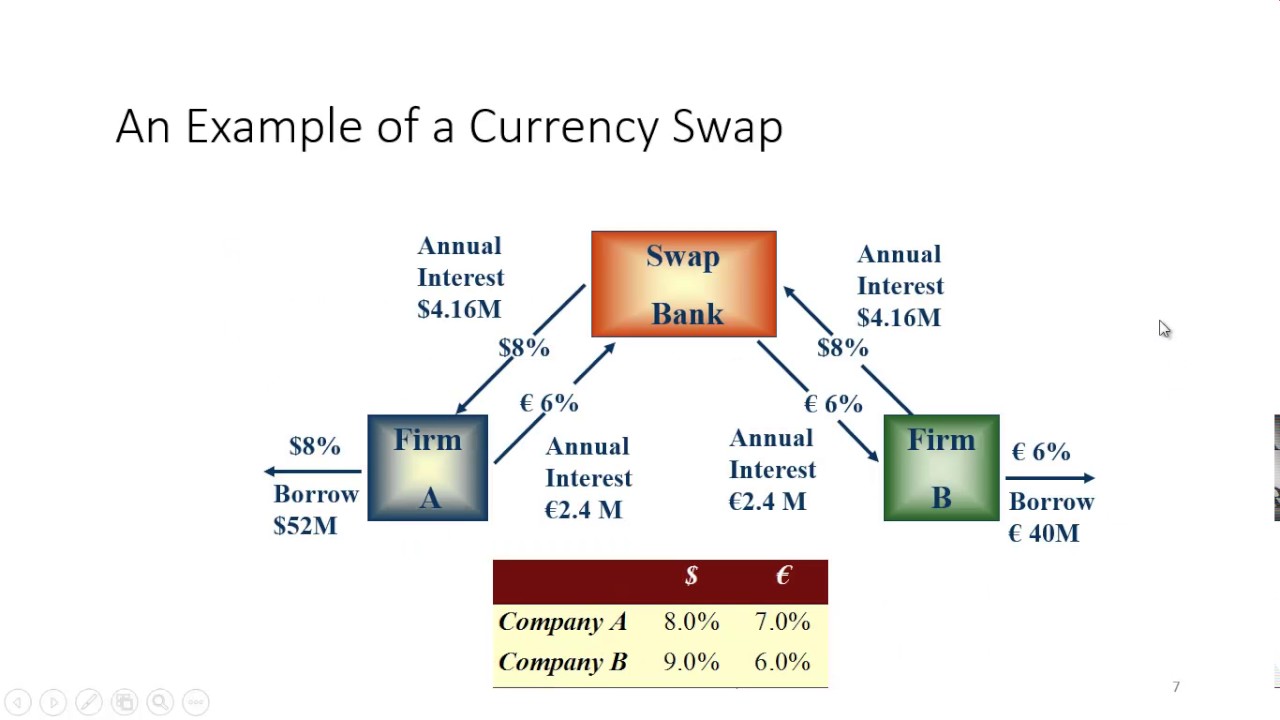

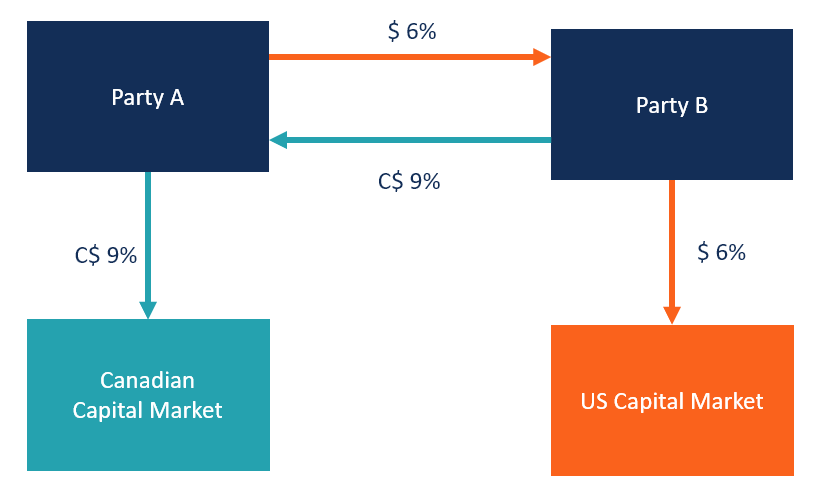

Currency swaps have the following disadvantages: Complexity: They can be complicated to structure and understand, requiring specialized knowledge. Credit Risk: Risk that the other party might not fulfill their payment obligations.Currency swaps are financial contracts between two parties to exchange a specific amount of one currency for an equivalent amount of another currency. The purpose of currency swaps is to reduce currency risk, achieve lower financing costs, or gain access to a foreign currency.

What are the advantages of using currency : The role of cash

- It ensures your freedom and autonomy. Banknotes and coins are the only form of money that people can keep without involving a third party.

- It's legal tender.

- It ensures your privacy.

- It's inclusive.

- It helps you keep track of your expenses.

- It's fast.

- It's secure.

- It's a store of value.

What are the benefits of currency swap agreement between countries

Just to address such issue, central banks in developed countries agreed to provide swap lines to one another, given their ability to provide local currency to their domestic banks at a lower cost of borrowing and their limited capability of providing FX due to the limited amount of FX reserves they held.

Is swap better than exchange : The ability to quickly buy and sell an asset without having an impact on its price is referred to as liquidity. Because they frequently have a larger user base and a wider variety of trading pairs than crypto swaps, cryptocurrency exchanges frequently have higher liquidity than crypto swaps.

Currency swaps can be a powerful tool for managing currency risk, accessing foreign financing, and reducing transaction costs. However, parties must be aware of the potential disadvantages, such as counterparty risk, legal complexity, and exchange rate risk.

There are three main types of foreign exchange risk, also known as foreign exchange exposure: transaction risk, translation risk, and economic risk.

How do banks make money from swaps

Investment bankers sometimes make money with swaps. Swaps create profit opportunities through a complicated form of arbitrage, where the investment bank brokers a deal between two parties that are trading their respective cash flows.It allows each party to access the currency of other parties on fixed exchange rates but the only risk is the fluctuations of the exchange rates. But is mutually beneficial for all the agreed parties. – Currency swaps allow locking in exchange rates for future transactions, reducing uncertainty.The Kuwaiti dinar

The Kuwaiti dinar (KWD) is the world's strongest currency, and this is for a number of reasons. For starters, Kuwait has one of the largest oil reserves in the world.

Future contracts have numerous advantages and disadvantages. The most prevalent benefits include simple pricing, high liquidity, and risk hedging. The primary disadvantages are having no influence over future events, price swings, and the possibility of asset price declines as the expiration date approaches.

What are the advantages and disadvantages of swap contracts : The benefit of a swap is that it helps investors to hedge their risk. Had the interest rates gone up to 8%, then Party A would be expected to pay party B a net of 2%. The downside of the swap contract is the investor could lose a lot of money.

Why are swaps risky : What are the risks. Like most non-government fixed income investments, interest-rate swaps involve two primary risks: interest rate risk and credit risk, which is known in the swaps market as counterparty risk. Because actual interest rate movements do not always match expectations, swaps entail interest-rate risk.

Are swaps high risk

This risk has been partially mitigated since the financial crisis, with a large portion of swap contacts now clearing through central counterparties (CCPs). However, the risk is still higher than that of investing in a “risk-free” U.S. Treasury bond.

By entering into a swap agreement, investors can exchange fixed-rate interest payments for floating-rate interest payments or vice versa. This enables them to hedge against adverse interest rate movements, ensuring more predictable cash flows and minimizing potential losses.Changes in currency exchange rates affect international trade by increasing or decreasing exports and imports. A strong domestic currency will cause exports to decrease and imports to increase.

What is the risk of currency exchange : Currency risk is the possibility of losing money due to unfavorable moves in exchange rates. Firms and individuals that operate in overseas markets are exposed to currency risk.

:max_bytes(150000):strip_icc()/foreign-currency-swaps.asp-final-02bae8a217974bafb0705ac48de59d8d.png)