Antwort What is swap with example? Weitere Antworten – What is an example of a swap

For example, a company paying a variable rate of interest may swap its interest payments with another company that will then pay the first company a fixed rate. Swaps can also be used to exchange other kinds of value or risk like the potential for a credit default in a bond.A swap is an agreement or a derivative contract between two parties for a financial exchange so that they can exchange cash flows or liabilities. Through a swap, one party promises to make a series of payments in exchange for receiving another set of payments from the second party.Currency swaps or cross-currency swaps is a transaction in which two parties exchange an equivalent amount of money with each other. However, this transaction occurs in different currencies. Parties loan each other money and repay this amount at a specified date and exchange rate.

What is an example FX swap : Practical Example

Party A is Canadian and needs EUR. Party B is European and needs CAD. The parties enter into a foreign exchange swap today with a maturity of six months. They agree to swap 1,000,000 EUR, or equivalently 1,500,000 CAD at the spot rate of 1.5 EUR/CAD.

How is swap used

Swap space helps the computer's operating system in pretending that it has more RAM than it actually has. It is also called a swap file. This interchange of data between virtual memory and real memory is called swapping and space on disk as “swap space”.

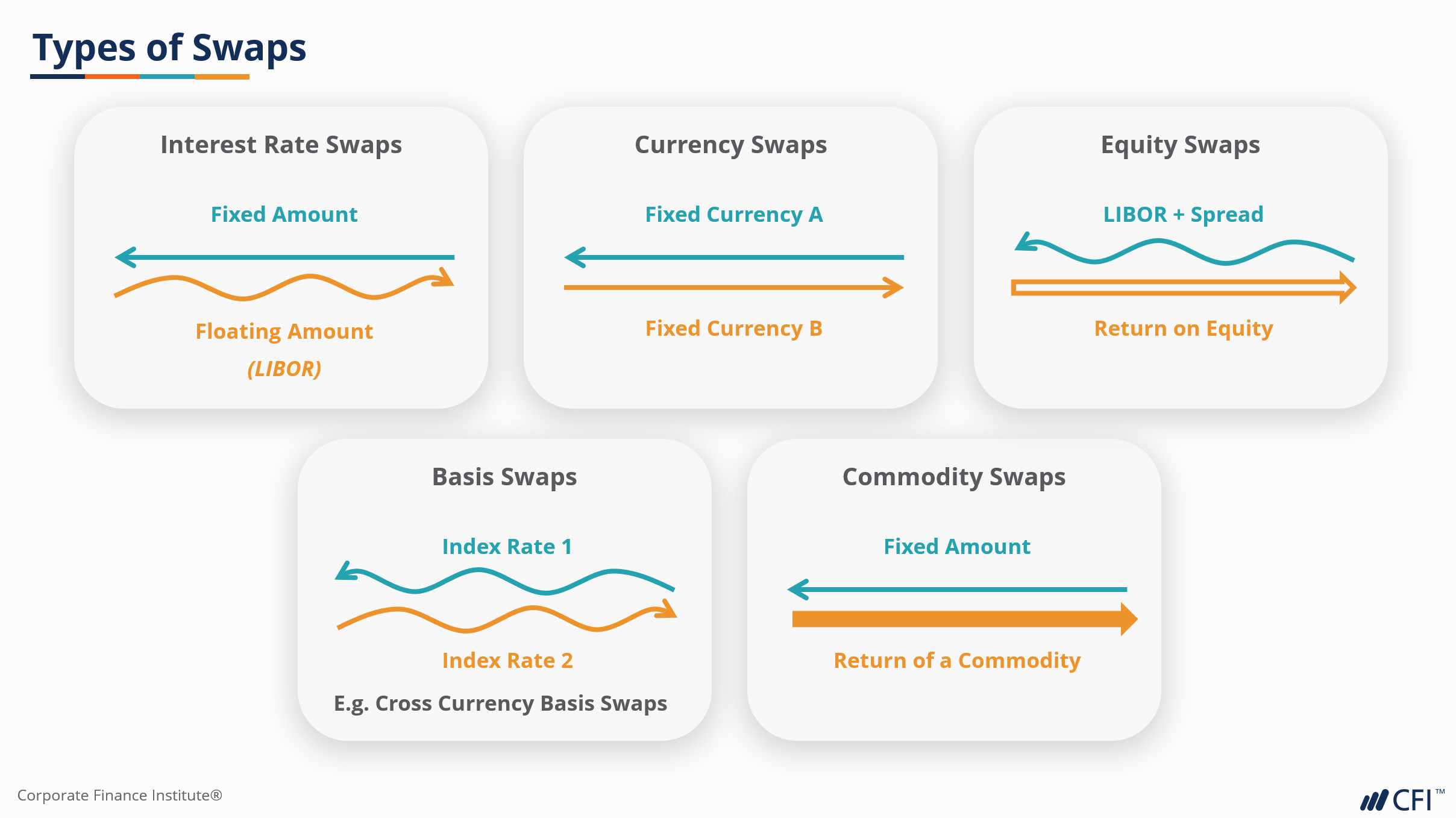

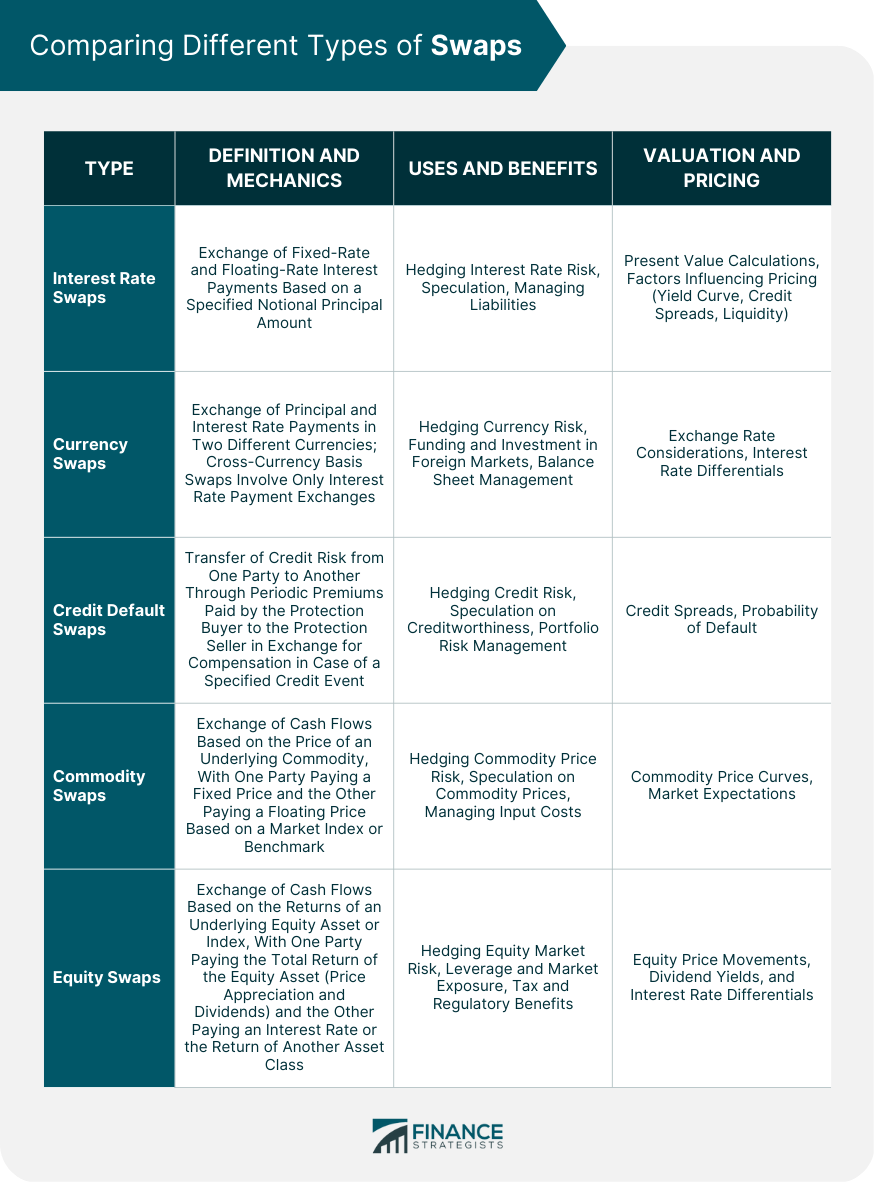

What are the 2 commonly used swaps : Swaps are customized contracts traded in the over-the-counter market privately, versus options and futures traded on a public exchange. The plain vanilla interest rate and currency swaps are the two most common and basic types of swaps.

Swap memory facilitates memory management by temporarily storing inactive data on the disk. This mechanism ensures uninterrupted system performance even when RAM is fully utilized.

For example, a company may take a loan in the domestic currency and enter a swap contract with a foreign company to obtain a more favorable interest rate on the foreign currency that is otherwise unavailable.

Why do companies use swaps

Typically, swaps are used by: Companies to reduce their risks and manage their debt more efficiently. For instance, this may be achieved by exchanging a floating (variable) interest-rate exposure for a fixed interest-rate exposure. Pension schemes and insurance companies to manage interest-rate risk.CFDs are also often confused with swaps, another type of financial derivative. However, CFDs and swaps work differently – a CFD is a contract that essentially mimics a financial market, in a swap two parties agree to exchange the cash flows from an asset (typically an equity) for a set period of time.The ability to quickly buy and sell an asset without having an impact on its price is referred to as liquidity. Because they frequently have a larger user base and a wider variety of trading pairs than crypto swaps, cryptocurrency exchanges frequently have higher liquidity than crypto swaps.

How does a swap contract work At the time a swap contract is put into place, it is typically considered “at the money,” meaning that the total value of fixed interest rate cash flows over the life of the swap is exactly equal to the expected value of floating interest rate cash flows.

Why do people use swaps : These entities often turn to the swap market for two main reasons: commercial needs and comparative advantage. The normal business operations of some firms lead to the exposure of certain types of interest rates or currencies that swaps can alleviate.

Why do banks use swaps : Offers an economic benefit – Executing a swap will generate non-interest income for the bank. This fee income is recognized in the period the swap is executed and is NOT amortized over the life of the loan.

Is swap still useful

I think that's a mistake, both because swap is still useful in maximising the usefullness of RAM, but more importantly because it will cause trouble if someone creates their Discourse on a large-RAM machine, for speed or convenience, and then downsizes it to small-RAM.

Investment bankers sometimes make money with swaps. Swaps create profit opportunities through a complicated form of arbitrage, where the investment bank brokers a deal between two parties that are trading their respective cash flows.In finance, a swap is a derivative contract in which one party exchanges or swaps the values or cash flows of one asset for another. Of the two cash flows, one value is fixed and one is variable and based on an index price, interest rate, or currency exchange rate.

Why are swaps risky : What are the risks. Like most non-government fixed income investments, interest-rate swaps involve two primary risks: interest rate risk and credit risk, which is known in the swaps market as counterparty risk. Because actual interest rate movements do not always match expectations, swaps entail interest-rate risk.

:max_bytes(150000):strip_icc()/DifferentTypesofSwaps2-4de5ab58b9854ca6b325de77810c3b16.png)