Antwort What is swap free? Weitere Antworten – What does free swap mean

A swap-free trading account is free from swap fees, which means that traders neither pay nor receive the fee (swap). Swap in trading refers to the interest that is either paid or received for holding a position overnight, and it is calculated based on the differential interest rates of the traded currencies.Swap Free is an option to have an account free from fees. It means you will neither receive nor pay the swap (fee).Note: With the MT5 Swap-Free account you can trade swap-free CFDs on MT5 with synthetics, forex, stocks, stock indices, cryptocurrencies, and ETFs without overnight charges. We hope you find this information helpful and have a great day ahead!

What is the disadvantage of swap free : The advantage is that you will not be charged money for the trades with negative swaps. The disadvantage is that you will not be paid money for the trades with positive swaps.

Why are Islamic accounts swap free

Islamic accounts, also known as swap-free accounts, have been designed specifically to eliminate the collection and payment of 'Riba', or interest, which is strictly prohibited in Islam.

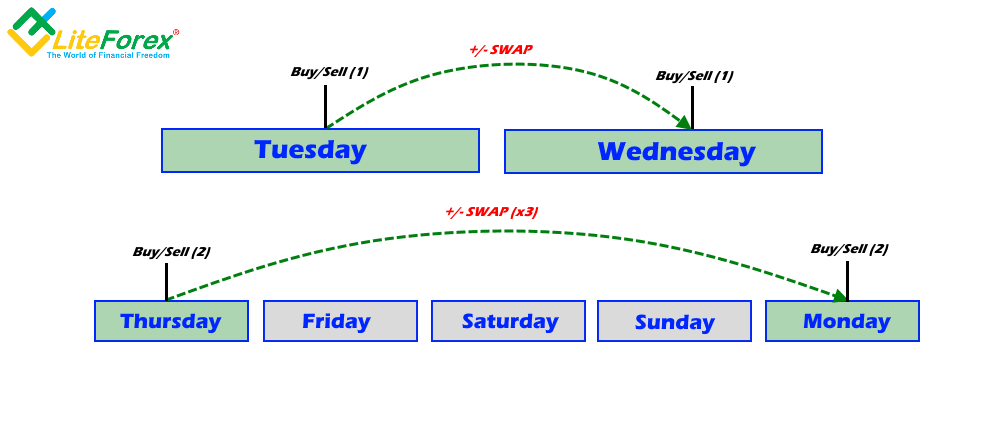

What is swap free level : A swap is a fee for the operation of a closing order at midnight of one trading day and its reopening at the close price the next day. With swap-free accounts, traders can keep open positions as long as they want, without adding a swap size to or charging it from the account.

A swap fee in Forex, also known as a rollover fee, is interest that traders pay for maintaining a position until the end of the trading day. If traders maintain their positions at the daily rollover point, which occurs at 00:00 server time (or "tomorrow next"), the swap fee will be applied.

The swap free option** is available on both our Raw Spread and Standard account types on the MetaTrader4, MetaTrader 5 and cTrader platforms.

Is swap-free forex halal

On the other hand, forex trading is deemed halal in Islam when transactions are conducted on a spot basis with immediate settlement, avoiding interest, ensuring actual ownership, and utilizing swap-free accounts to comply with Islamic finance principles.What are the risks. Like most non-government fixed income investments, interest-rate swaps involve two primary risks: interest rate risk and credit risk, which is known in the swaps market as counterparty risk. Because actual interest rate movements do not always match expectations, swaps entail interest-rate risk.Swap commissioning is the amount a forex broker will charge an investor for holding a position overnight. In many cases, the swap commission is deemed to be interest, or an interest fee. This makes it impermissible (haram) for Muslim investors.

No Swap Fees: In swap-free accounts, traders do not pay or receive swap fees, regardless of the positions they hold overnight. This ensures that the trading process adheres to Islamic finance principles.

Why is swap charged : Swap rates are charged when trading on leverage. This is because when you open a leveraged position, you are essentially borrowing funds to open the position. For example, every time you open a position in the Forex market, you effectively make two trades, buying οne currency in the pair and selling the οther.

Do swaps cost money : Borrowers choose to purchase swaps with the rationale that they are “free”, especially when compared to an interest rate cap that typically requires an upfront payment. However, swaps are certainly not free, and can have a significant cost if not negotiated carefully. What fee is that, you might ask

Is FTMO swap free

Swap is a fee that is either charged or paid to you at the end of the trading day. The balance increases if you are paid swap and decrease if you are charged swap. Equity represents the current value of your trading account. If you have no positions open, your equity equals your trading account balance.

Yes, FOREX.com offers swap-free accounts in certain circumstances. For more information, please contact us.Islamic finance prohibits the payment and receipt of interest. In conventional forex trading, interest is typically charged on positions held overnight (swap or rollover fees). Therefore, engaging in conventional forex trading with interest charges would not be permissible in Islamic finance.

Is forex allowed in Islam : In Islam, forex trading is considered haram when it involves interest payments, high uncertainty, or speculative practices resembling gambling.