Antwort What is GPI SWIFT transfer? Weitere Antworten – What is SWIFT gpi transfer

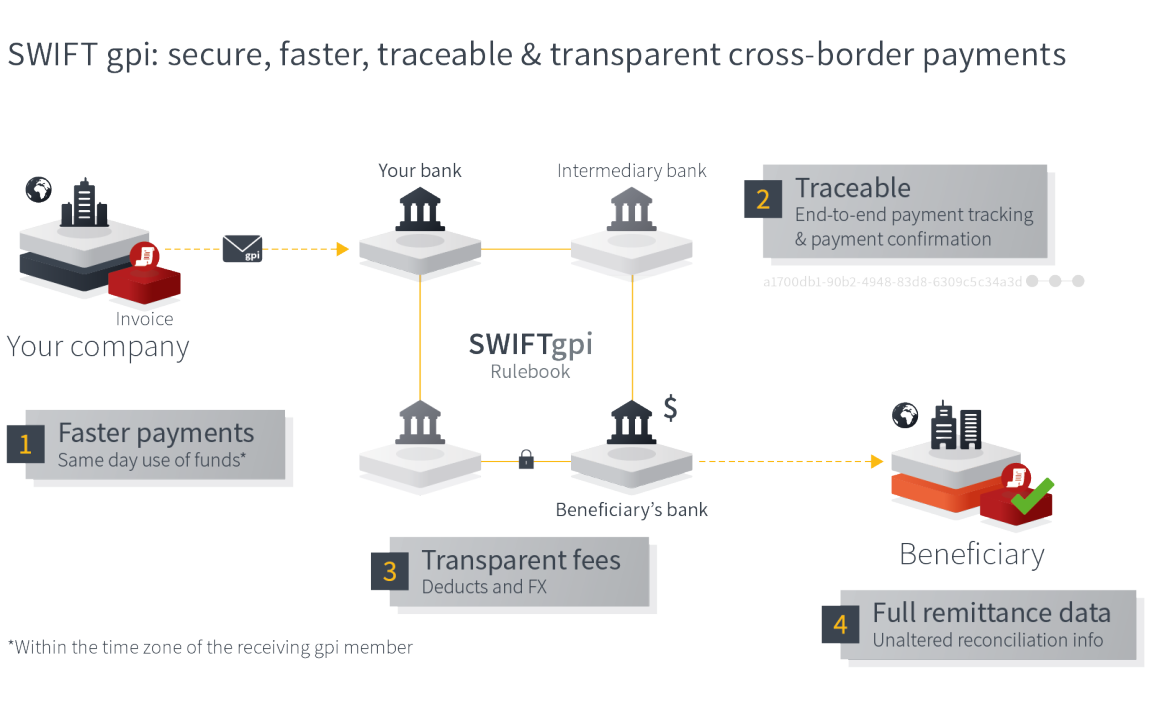

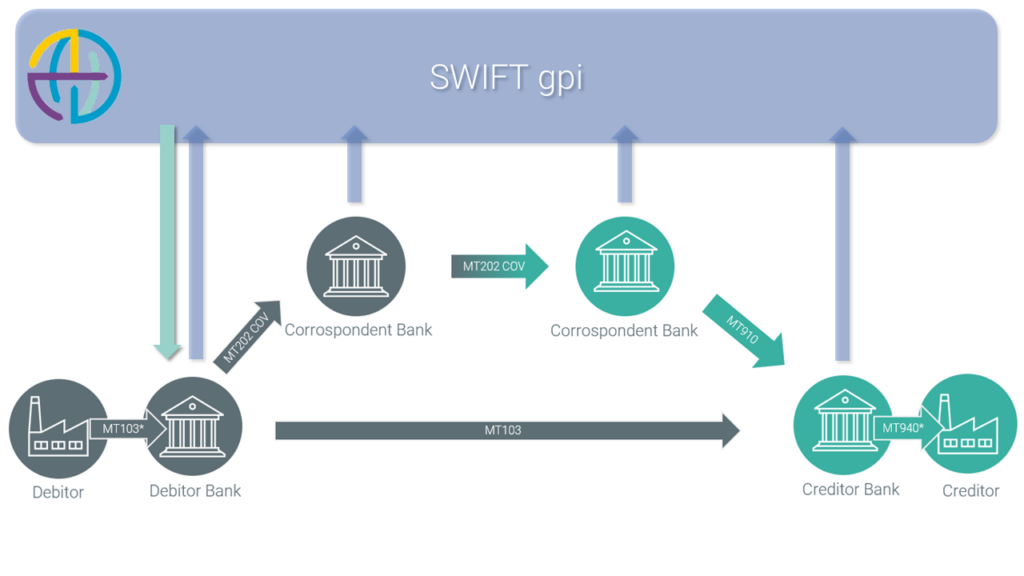

SWIFT gpi combines domestic real-time payment networks to deliver cross border payments almost instantly and without the restrictions of bank operating hours. Each transaction is assigned a Unique End-to-End Transaction Reference (UETR) that payment providers can use to trace the transfer from start to finish.ABN AMRO, Bank of China, BBVA, Citi, Danske Bank, DBS Bank, Industrial and Commercial Bank of China, ING Bank, Intesa Sanpaolo, Nordea Bank, Standard Chartered Bank and UniCredit are live with SWIFT gpi, exchanging gpi payments across 60 country corridors.Swift Go is similar to Swift GPI, with one key distinction: Where Swift GPI is designed to support high-value payments and all the various fees applied to them; Swift Go supports low-value payments, guaranteeing that the ultimate beneficiary receives the instructed principal amount.

Is SWIFT gpi mandatory : SWIFT gpi is an optional service on SWIFT network and operates on the basis of business rules and technical specifications captured in rulebooks between gpi customers (i.e. financial institutions who are SWIFT users and signed up for the gpi service).

How does a GPI work

Genuine Progress Indicator (GPI) is an economic tool used to measure the health of a nation's economy. It incorporates environmental and social factors, such as family structure, benefits from higher education, crime, and pollution, not considered in the GDP.

How many banks use SWIFT gpi : Swift GPI isn't a proof of concept. It's tried and tested by a community of over 4,450+ financial institutions.

As of now, 100 banks in the APAC region, delivering 90 percent of traffic are gpi-enabled or in the process of enabling while globally 3500 banks have committed to adoption of gpi, SWIFT said. In 2018, the payments platform handled over $40 trillion worth of transactions globally.

All member banks are listed in the gpi Directory. This includes details such as: which banks can send and receive gpi payments by business identifier code (BIC); in which currencies; reachable through which channels; cut-off times; and if a bank acts as an intermediary for gpi payments.

How many banks use SWIFT GPI

Swift GPI isn't a proof of concept. It's tried and tested by a community of over 4,450+ financial institutions.The genuine progress indicator (GPI) is a national-level measure of economic growth and prosperity. GPI is an alternative metric to GDP but which accounts for externalities such as pollution. As such, GPI is considered to be a better measure of growth from the perspective of green or social economics.All member banks are listed in the gpi Directory. This includes details such as: which banks can send and receive gpi payments by business identifier code (BIC); in which currencies; reachable through which channels; cut-off times; and if a bank acts as an intermediary for gpi payments.

SWIFT global payments innovation

With SWIFT global payments innovation (gpi), you can account for your money every step of the way. Plus, your payments arrive in minutes, not days. FNB is among the select banks and financial institutions offering SWIFT gpi capabilities.

What is GPI in banking : Gpi guarantees that all remittance data that is sent with payments will be unaltered throughout the whole payments journey. This allows recipients to easily reconcile payments against invoices or orders.

How do I find my SWIFT GPI code : You may get the unique payment code by visiting the Transfers menu, selecting Payments Management and checking the Outgoing Transaction Details in the "GPI Reference" field.

How does SWIFT GPI work

SWIFT gpi works by assigning a unique identifier (UETR) to each payment instruction, which allows the sender, the receiver, and the intermediary banks to track the status and details of the payment in real time.

Genuine Progress Indicator (GPI) is an economic tool used to measure the health of a nation's economy. It incorporates environmental and social factors, such as family structure, benefits from higher education, crime, and pollution, not considered in the GDP.Swift GPI enables you to

Your customers expect the best. Whether it's a pizza, a parcel or a cross-border payment, they expect their payment to be trackable right to the beneficiary. That's what you can deliver with Swift GPI.