Antwort What is average labour cost? Weitere Antworten – What is the typical labor cost

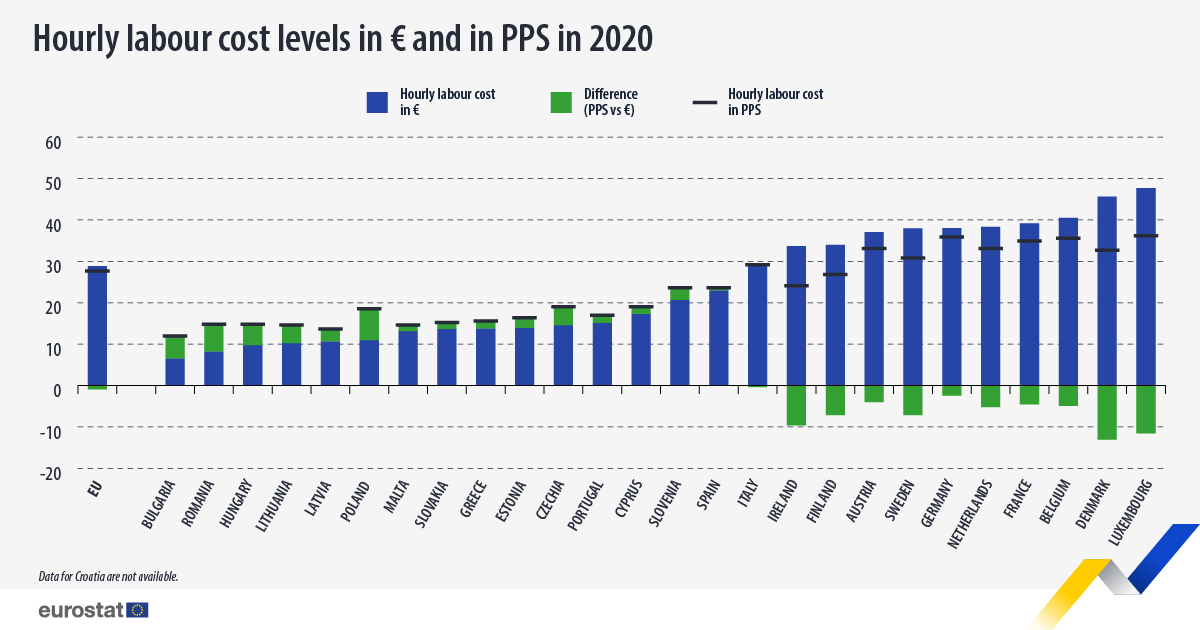

The average labor cost percentage should typically be in the range of 20% to 35% of a company's gross sales. However, there are variations, depending on your field. It's not uncommon for restaurants and other service businesses to have a labor cost percentage of up to 50%.Labour cost or total labour cost is the total expenditure borne by employers for employing staff. Total labour cost consists of: employee compensation (including wages, salaries in cash and in kind, employers' social security contributions); Total annual labor cost = gross wage + other annual costs

The total labor cost can be calculated after you've gathered all the expenditures your company has made on behalf of an employee, such as healthcare, taxes, etc.

What is cost of labour : The cost of labour is the amount of all salaries paid to the workers, as well as the employee benefits and payroll taxes charged by an employer. The labour costs are broken down into direct and indirect (overhead) costs.

What is an example of labor

Labor refers to the effort expended by an individual to bring a product or service to the market. Again, it can take on various forms. For example, the construction worker at a hotel site is part of the labor, as is the waiter who serves guests or the receptionist who enrolls them into the hotel.

Is labor a fixed cost : Labor costs, including minimum wage expenses, are considered semi-variable. Semi-variable costs have components of both fixed and variable costs. The cost of labor is always something that companies can expect to have but the amount they pay may vary. This makes it both fixed and variable.

Throughout the different stages of labor, it is also classified into four different types that women can experience. Those are prodromal labor, back labor, prolonged labor, and precipitous labor.

1. : physical or mental effort especially when hard or required : toil, work. 2. a. : the services performed by workers for wages.

Is labor cost part of operating cost

Examples of operating expenses include materials, labor, and machinery used to make a product or deliver a service. For example, operating expenses for a soda bottler may include the cost of aluminum for cans, machinery costs, and labor costs. Reducing operating expenses can give companies a competitive advantage.These stages can vary in duration for every woman, making labor a different experience for everyone. Throughout the different stages of labor, it is also classified into four different types that women can experience. Those are prodromal labor, back labor, prolonged labor, and precipitous labor.labour noun (WORK)

practical work, especially when it involves hard physical effort: The car parts themselves are not expensive, it's the labour that costs the money.

Overhead expenses are all costs on the income statement except for direct labor, direct materials, and direct expenses. Overhead expenses include accounting fees, advertising, insurance, interest, legal fees, labor burden, rent, repairs, supplies, taxes, telephone bills, travel expenditures, and utilities.

Is labor cost a fixed cost : Labor costs, including minimum wage expenses, are considered semi-variable. Semi-variable costs have components of both fixed and variable costs. The cost of labor is always something that companies can expect to have but the amount they pay may vary. This makes it both fixed and variable.

What defines labor : Labor is a series of continuous, progressive contractions of the uterus that help the cervix dilate and efface (thin out). This lets the fetus move through the birth canal. Labor usually starts two weeks before or after the estimated date of delivery. However, the exact trigger for the onset of labor is unknown.

What is Labour cost and overhead cost

The cost of labor is broken into direct and indirect (overhead) costs. Direct costs include wages for the employees who produce a product, including workers on an assembly line, while indirect costs are associated with support labor, such as employees who maintain factory equipment.

A good overhead percentage for small businesses is typically between 10-30%. This will depend on the industry and type of business. For example, a service-based business will have a lower overhead percentage than a manufacturing company. Lower overhead costs mean that there is more profit for the business.How to calculate manufacturing labor costs

- Wages + taxes + other benefits divided by number of hours worked during the pay period.

- Units produced divided by labor hours needed.

- Direct labor hourly rate x direct labor hours.

- Total direct labor variance = (actual hours × actual rate) – (standard hours × standard rate).

What does labour include : In economic terms, labour is the efforts exerted to produce any goods or services. It includes all types of human efforts – physical exertion, mental exercise, use of intellect, etc. done in exchange for an economic reward.

:max_bytes(150000):strip_icc()/Term-c-cost-of-labor_Final-b767db53fa404a26a0227c9caf506d35.png)