Antwort What is an example of a swap in forex? Weitere Antworten – What is swap in forex with an example

In a currency swap, or FX swap, the counterparties exchange given amounts in the two currencies. For example, one party might receive 100 million British pounds (GBP), while the other receives $125 million. This implies a GBP/USD exchange rate of 1.25.Assuming that the exchange rate between Brazil (BRL) and the U.S (USD) is 1.60BRL/1.00 USD and that both companies require the same equivalent amount of funding, the Brazilian company receives $100 million from its American counterpart in exchange for 160 million Brazilian real, meaning that these notional amounts are …What is the value of an FX swap As far as I understand, a typical example of an FX swap would be the following: company A agrees to lend 1000,000.00 euros to B and in exchange B agrees to lend 1000,000.00 x s to A where s is the EUR/USD spot rate which is, say 1.2 and therefore B agrees to lend 1200,000.00 USD to A.

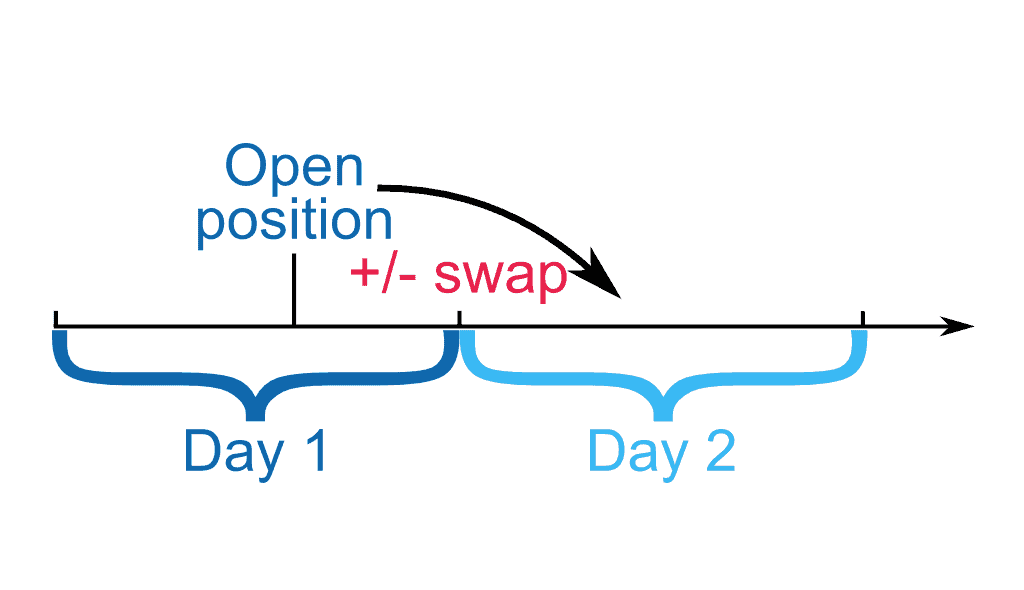

How does a FX swap work : A FX Swap is a combination of a spot and a forward transaction. In a FX Swap an amount of one currency is purchased (or sold) in a spot transaction and subsequently sold (or purchased) in the forward. This is a fixed agreement with both parties entering into an obligation.

Is an FX forward a swap

An FX swap is not two forward contracts but includes one FX spot transaction and usually includes one FX forward contract for the second swap at a future date. Is an FX forward a swap An FX forward is not a swap, as it represents a single transaction at a future date at today's FX spot price.

What causes swap in forex : Forex Swap Strategy

This involves making a trade where you borrow in a currency with a low interest rate and invest in a currency with a higher interest rate, with the aim of earning interest on your position via the Forex swap.

Swaps are customized contracts traded in the over-the-counter market privately, versus options and futures traded on a public exchange. The plain vanilla interest rate and currency swaps are the two most common and basic types of swaps.

Calculating Swap rates

- For Forex pairs & Indices. Swap Rate x Lots (Volume) x Number of Nights = Swap (in base currency)

- The instrument's Swap rate. So, let's suppose you are trading the AUD/USD Forex pair.

- Lots (Volume) Next, we have Volume.

- Triple swap.

- Exchange rate.

- How to Calculate Swap Rates for Commodities.

Is an FX swap a CFD

The Forex swap, sometimes called the Forex rollover rate, is a type of interest charged on positions held overnight in the Forex market and on Contracts for Difference (CFDs).In finance, a foreign exchange swap (forex swap, or FX swap in short) is a simultaneous purchase and sale of identical amounts of one currency for another with two different value dates and may use foreign exchange derivatives.A swap is a derivative contract. This financial agreement takes place between two parties to exchange assets that have cash flows for a set period of time.

The purpose of spot trades is to facilitate immediate transactions and meet immediate foreign exchange needs. On the other hand, foreign exchange swaps involve the simultaneous buying and selling of a specific amount of one currency for another, with an agreement to reverse the transaction at a future date.

Why are swaps risky : What are the risks. Like most non-government fixed income investments, interest-rate swaps involve two primary risks: interest rate risk and credit risk, which is known in the swaps market as counterparty risk. Because actual interest rate movements do not always match expectations, swaps entail interest-rate risk.

How to avoid swaps in forex : How to Avoid Swap Fees. Retail traders can avoid swap charges if they open and close their trades during the same trading session. This is done in high frequency trading and intraday trading. Opening and closing trades during the same trading session also reduces trading risks for the trader.

What are the most traded swaps

The most commonly traded and most liquid interest rate swaps are known as “vanilla” swaps, which exchange fixed-rate payments for floating-rate payments based on LIBOR (London Inter-Bank Offered Rate), which is the interest rate high-credit quality banks charge one another for short-term financing.

CFDs are also often confused with swaps, another type of financial derivative. However, CFDs and swaps work differently – a CFD is a contract that essentially mimics a financial market, in a swap two parties agree to exchange the cash flows from an asset (typically an equity) for a set period of time.3-day swap

Swap is 3 times bigger than usual if you keep your position overnight from Wednesday to Thursday. It happens because of the impact of the futures market. A swap involves pushing back the value date on the underlying futures contract. If a position was opened on Wednesday, the value date will be Friday.

What is swap in xauusd : For example: XAU/USD has a Long swap of – 11.27. If you bought 2 lots, the swap charged would be 2 x – 11.27 equaling -22.54 USD, this total will be converted to your accounts base currency from USD.

:max_bytes(150000):strip_icc()/foreign-currency-swaps.asp-final-02bae8a217974bafb0705ac48de59d8d.png)

:max_bytes(150000):strip_icc()/Term-Definitions_swap-27b93a31e83c423a854db04030a67673.jpg)