Antwort What is an example of a foreign exchange risk? Weitere Antworten – What is foreign exchange risk with examples

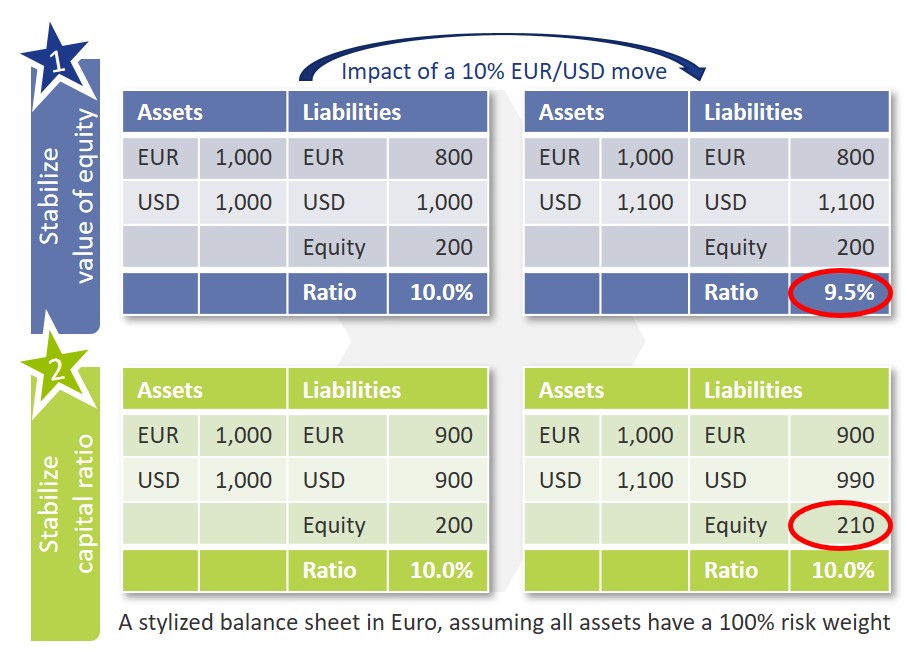

Foreign exchange risk is the chance that a company will lose money on international trade because of currency fluctuations. Also known as currency risk, FX risk and exchange rate risk, it describes the possibility that an investment's value may decrease due to changes in the relative value of the involved currencies.Impact of Translation Risk

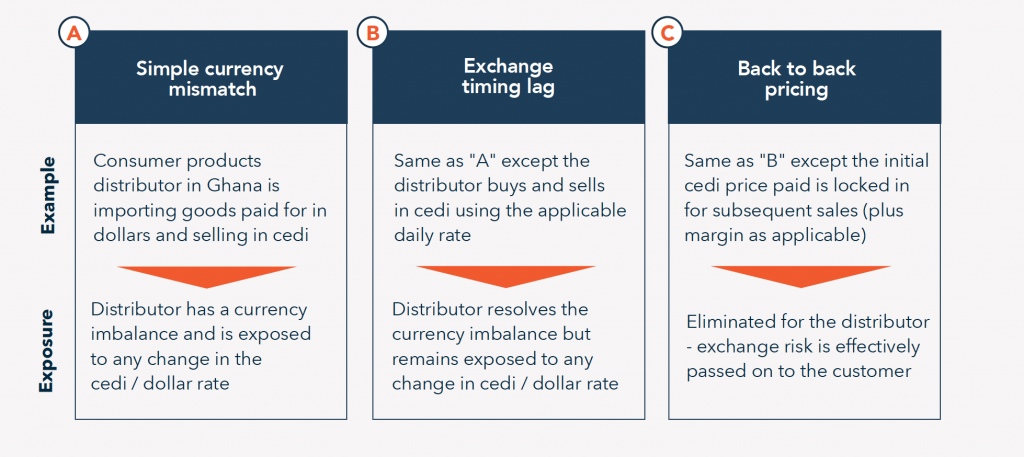

For example, let's say a U.S. company has assets in Europe valued at 1 million euros, and the euro versus the U.S. dollar exchange rate has depreciated by 10% on a quarter-to-quarter basis. The value of the assets, when converted from euros into dollar terms, would also decline by 10%.The three types of foreign exchange exposure that you may face when making transactions in FX include transaction, translation, and economic exposure. The latter is also known as operating exposure.

What is the FX risk management : FX risk management is a strategy used by companies to avoid or minimize potential losses that could result from fluctuations in exchange rates. It involves assessing the type and level of risk, measuring it, and deciding on appropriate methods to manage the risk.

What is a foreign exchange example

a market in which one currency is exchanged for another currency; for example, in the market for Euros, the Euro is being bought and sold, and is being paid for using another currency, such as the yen.

What is an example of an international risk : Definition of International Risk

For instance, suppose your firm plans to invest in a new factory in Country A. The local government announces a sudden change in its trade policy, posing an unpredicted hurdle. Therefore, this kind of change is an example of international risk you may face.

Transaction risk example

A transaction with a value of US$1,000 would net you around A$1,370. However, if the US dollar were to surge in value before the transaction is completed, the value of the transaction would be reduced by the exchange rate.

Translation exposure (also known as translation risk) is the risk that a company's equities, assets, liabilities, or income will change in value as a result of exchange rate changes. When a firm denominates a portion of its equities, assets, liabilities, or income in a foreign currency, translation risk occurs.

What are the three types of foreign exchange

There are three main types of foreign exchange markets:

- Spot Forex Market.

- Forward Forex Market.

- Futures Forex Market.

A common way to measure currency exchange risk is through a value-at-risk calculation (VaR). This calculation relies on three parameters: The functional currency being used. The length of time the position is held.Foreign exchange rate risk refers to potential losses from currency fluctuations in international transactions. Investing in fast-paced foreign countries may seem lucrative, but exchange risk can unexpectedly impact returns. With high market volatility, CFOs are monitoring FX exposures and policies.

Basis risk arises when the price of a futures contract does not have a predictable relationship with the spot price of the instrument being hedged. When basis risk is introduced to a scenario, it may mean an alternative hedging method would provide a better result.

What is foreign exchange rate in real life examples : For example, an AUD/USD exchange rate of 0.75 means that you will get US75 cents for every AUD1 that is converted to US dollars. Bilateral exchange rates are visible in our daily lives and widely reported in the media.

What is an example of a foreign exchange option : For example, you would buy a GBP/USD call option if you thought GBP would rise in value against USD. Your potential profit would be unlimited in this case, and your losses would be limited to your options premium. You can also sell FX call options – if you believe the quote will rise against the base currency.

What are the examples of country risk

Specific risks include fluctuations in currency exchange rates, economic or political instability, the potential for trade sanctions or embargo and anything else occurring in the country that could negatively impact the business environment or trade and cash flows in and out of that country.

In particular, country risk denotes the risk that a foreign government will default on its bonds or other financial commitments increasing transfer risk. In a broader sense, country risk is the degree to which political and economic unrest affect the securities of issuers doing business in a particular country.Transaction risk is the chance that currency exchange rate fluctuations will change the value of a foreign transaction after it has been completed but not yet settled. It is a form of currency exchange risk.

What are 5 example of financial risk : Credit risk, liquidity risk, asset-backed risk, foreign investment risk, equity risk, and currency risk are all common forms of financial risk. Investors can use a number of financial risk ratios to assess a company's prospects.