Antwort What is an example of a foreign exchange exposure? Weitere Antworten – What is the meaning of foreign exposure

By definition, a foreign exchange exposure refers to the risk of foreign exchange rates that change quickly and frequently. When this happens, it can greatly affect financial transactions with foreign currency rather than the domestic currency of a company.The value of one country's currency compared to that of another. An example of Economic Exposure could be a U.S.-based company doing business in the UK. If the value of the pound falls dramatically against the dollar, the company's profits, when converted back into dollars, might be significantly less than anticipated.Foreign exchange risk examples

At an exchange rate of 1 USD = 0.83 GBP, the company has to pay £83,000 for the purchase of goods. If the exchange rate is more favourable, for example 1 USD = 0.78 GBP, the company only has to pay £78,000.

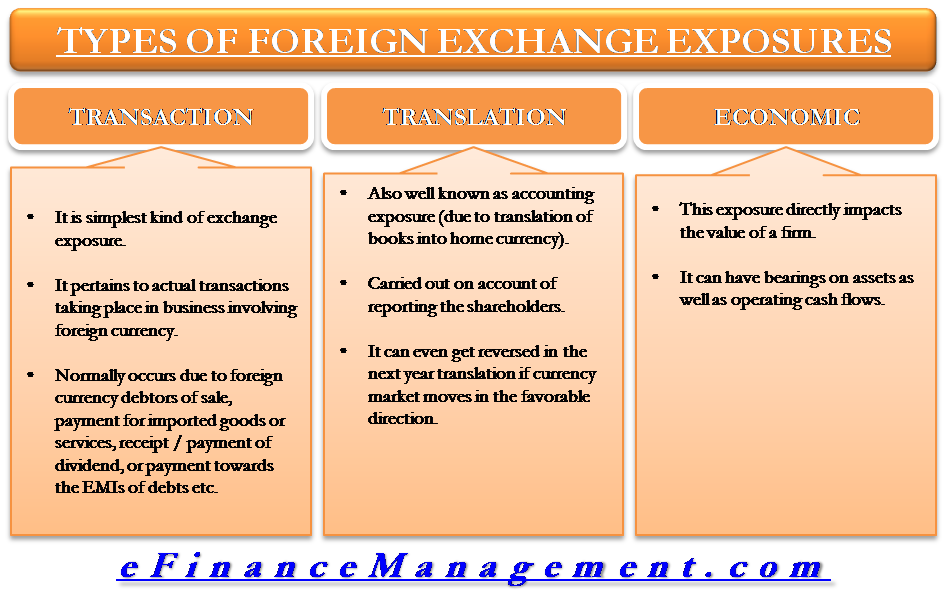

What are the types of foreign exchange exposure : The three types of foreign exchange risk include:

- Transaction risk. Transaction risk is the risk faced by a company when making financial transactions between jurisdictions.

- Economic risk.

- Translation risk.

What is the meaning of foreign exchange exposure limit

The overall foreign exchange risk exposure is the sum of the equivalent amount in domestic currency of all net short or long positions (whichever is greater) in currencies in which the Authorized Dealer has positions.

What is the largest foreign exchange market in the world : London

Foreign exchange is traded in an over-the-counter market where brokers/dealers negotiate directly with one another, so there is no central exchange or clearing house. The biggest geographic trading center is the United Kingdom, primarily London.

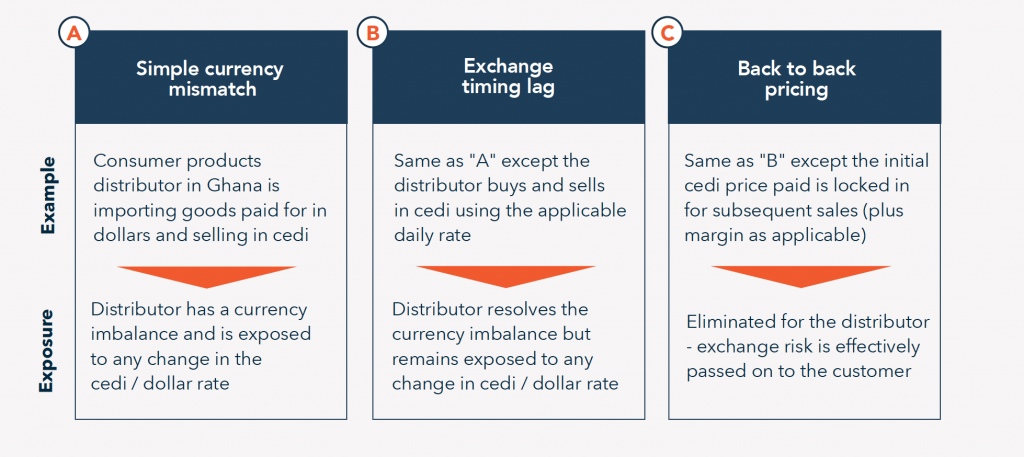

Example of Transaction Exposure

This rate of exchange equates to one euro being equivalent to 1.50 U.S. dollars (USD). Once the agreement is complete, the sale might not take place immediately. Meanwhile, the exchange rate may change before the sale is final. This risk of change is transaction exposure.

Exposure Categories are: occupational, public, and medical. Exposure Situations are: planned, existing, and emergency.

What is a foreign exchange example

a market in which one currency is exchanged for another currency; for example, in the market for Euros, the Euro is being bought and sold, and is being paid for using another currency, such as the yen.The foreign exchange market assists international trade and investments by enabling currency conversion. For example, it permits a business in the United States to import goods from European Union member states, especially Eurozone members, and pay Euros, even though its income is in United States dollars.a market in which one currency is exchanged for another currency; for example, in the market for Euros, the Euro is being bought and sold, and is being paid for using another currency, such as the yen.

- The U.S. Dollar. The U.S. dollar, which is sometimes called the greenback, is first and foremost in the world of forex trading, as it is easily the most traded currency on the planet.

- The Euro.

- The Japanese Yen.

- The Great British Pound.

- The Australian Dollar.

- The Canadian Dollar.

What is an example of exposure in finance : What Is Financial Exposure Financial exposure is the amount an investor stands to lose in an investment should the investment fail. For example, the financial exposure involved in purchasing a car would be the initial investment amount minus the insured portion.

What is an exposure transaction : What Is Transaction Exposure Transaction exposure is the level of uncertainty businesses involved in international trade face. Specifically, it is the risk that currency exchange rates will fluctuate after a firm has already undertaken a financial obligation.

What are the 3 main types of exposures

An exposure pathway refers to the way a person can come into contact with a hazardous substance. There are three basic exposure pathways: inhalation, ingestion, or direct contact. The degree or extent of exposure is determined by measuring the amount of the hazardous substance at the point of contact.

The foreign exchange market assists international trade and investments by enabling currency conversion. For example, it permits a business in the United States to import goods from European Union member states, especially Eurozone members, and pay Euros, even though its income is in United States dollars.For example, you would buy a GBP/USD call option if you thought GBP would rise in value against USD. Your potential profit would be unlimited in this case, and your losses would be limited to your options premium. You can also sell FX call options – if you believe the quote will rise against the base currency.

What are the 5 types of foreign exchange : What Are the Types of Foreign Exchange Markets There are different foreign exchange markets related to the type of product that is being used to trade FX. These include the spot market, the futures market, the forward market, the swap market, and the options market.