Antwort What is a labor rate? Weitere Antworten – What is the difference between labor cost and labor rate

Direct labor cost, also known as direct labor rate, direct labor hours, or hourly labor cost, encompasses the wages, benefits, and taxes paid to employees directly involved in the production process or service delivery.Commonly, labor cost percentages average 25% to 30% of the revenue. Percentages vary significantly by industry – companies providing services might have a labor cost percentage of 50 percent or even more. However, production companies will try to keep this percentage under 30.All-in labor rate is the labor cost of the facility divided by the number of direct work-hours; it includes the salaries of the various types of workers and the cost of equipment, supervision, training, and other costs directly involved in the work on this particular part of the facility.

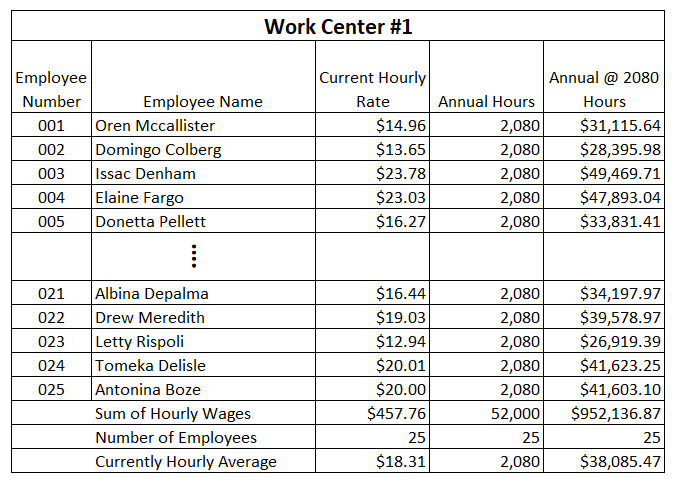

How to calculate a labor rate : How to calculate labor cost per hour. Calculate an employee's labor cost per hour by adding their gross wages to the total cost of related expenses (including annual payroll taxes and annual overhead), then dividing by the number of hours the employee works each year.

What is the standard labor rate

A Standard Labor Rate is a predetermined cost or rate that represents the expected wage rate to be paid per hour of labor.

What is labor rate : Labor rate is the cost of labor for a given period of time. It is usually expressed as an hourly rate, but can also be calculated on a daily, weekly, or monthly basis.

All-in labor rate is the labor cost of the facility divided by the number of direct work-hours; it includes the salaries of the various types of workers and the cost of equipment, supervision, training, and other costs directly involved in the work on this particular part of the facility.

The labor rate is calculated by dividing the total cost of labor for a given period of time by the number of hours worked during that period. For example, if an employee works 40 hours in one week and earns $800 in wages and benefits, then their labor rate would be $20 per hour ($800 divided by 40).

:max_bytes(150000):strip_icc()/Term-c-cost-of-labor_Final-b767db53fa404a26a0227c9caf506d35.png)