Antwort What is a high risk Country money laundering? Weitere Antworten – What countries are high risk for money laundering

Risk and Compliance Questions and Answers

- Bulgaria.

- Burkina Faso.

- Cameroon.

- Croatia.

- Democratic People's Republic of Korea (DPRK)*

- Democratic Republic of the Congo.

- Haiti.

- Iran*

The client's sector or area of work is also a significant risk factor, in particular if they are associated with a higher risk of corruption or being used for money laundering, for example those from the arms trade, casinos, or trade in high value items (eg art or precious metals).High Risk Countries & Counter Measures

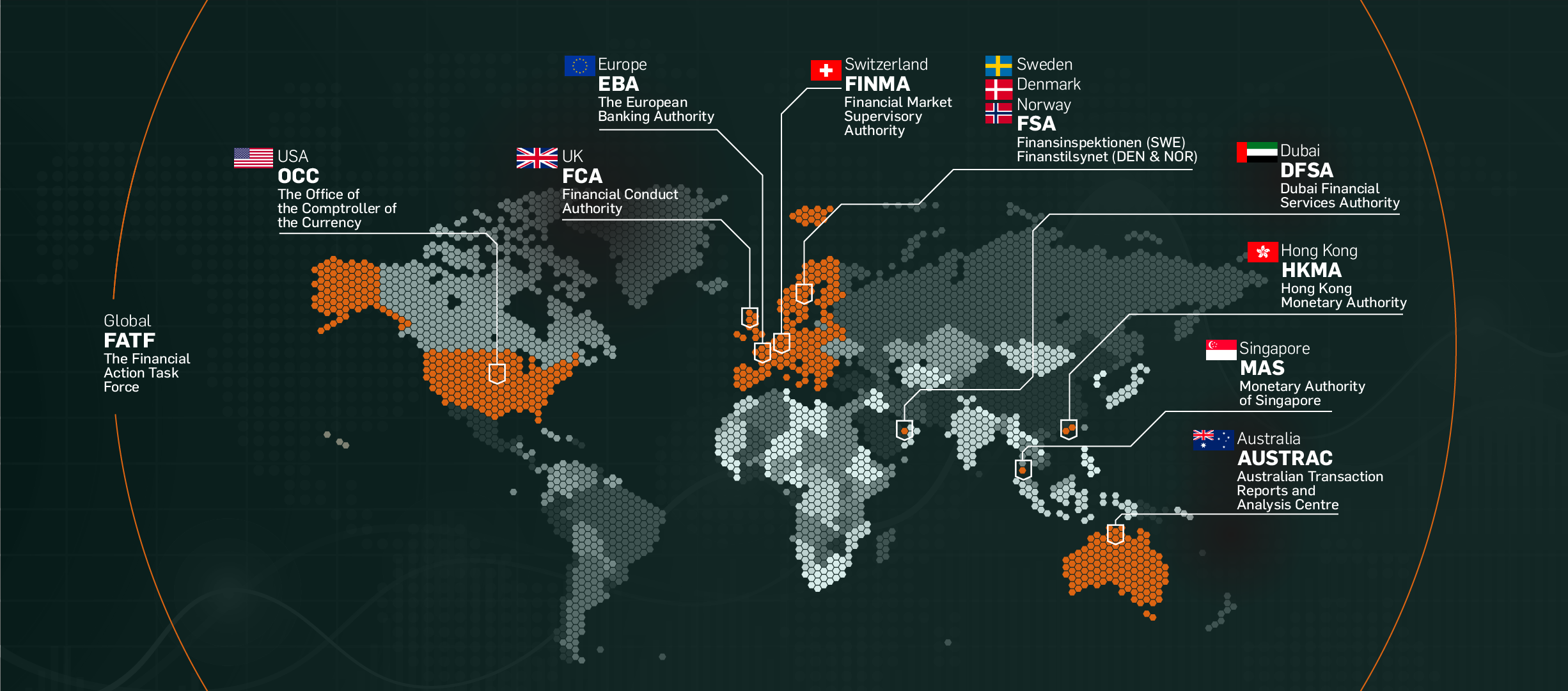

The Financial Action Task Force (FATF) classifies high-risk jurisdictions as having significant strategic deficiencies in their regimes to counter money laundering (ML), terrorism financing (TF) and proliferation financing (PF).

What is a high risk third Country : A HRTC is defined as: a country named on either of the following lists published by the Financial Action Task Force as they have effect from time to time— (i) High-Risk Jurisdictions subject to a Call for Action; (ii) Jurisdictions under Increased Monitoring.

What are the high risk 3 countries

Latest version of the list of high-risk third countries

| High-risk third country | Date of entry into force |

|---|---|

| Haiti | 13 March 2022 |

| Iran | 23 September 2016 |

| Jamaica | 1 October 2020 |

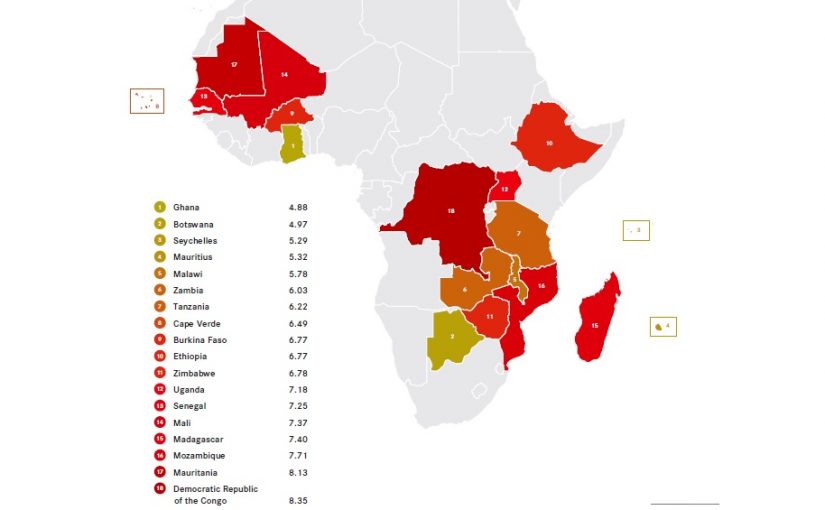

| Mali | 13 March 2022 |

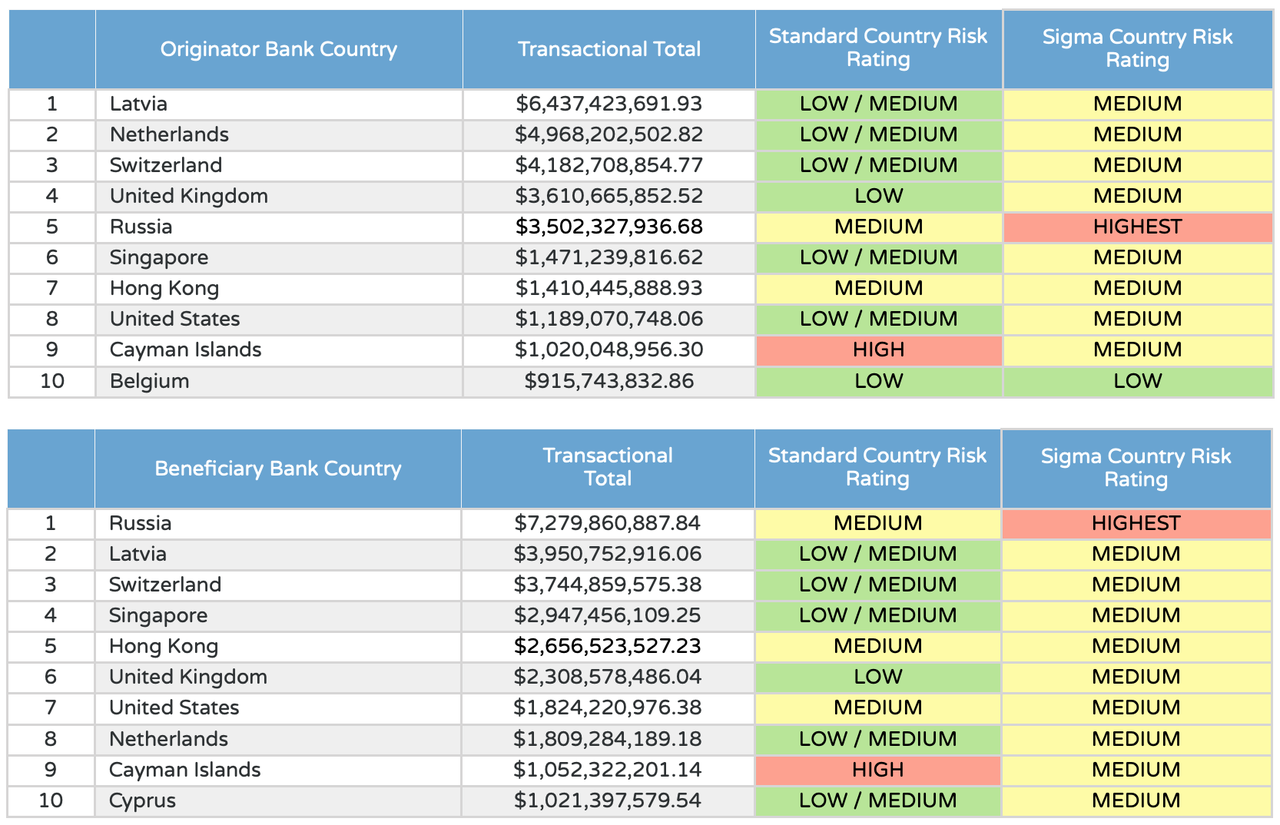

Which Country is top in money laundering : The Top 10 Countries With The Highest Money Laundering Risk

| JURISDICTION | OVERALL SCORE |

|---|---|

| Haiti | 8.25 |

| Chad | 8.14 |

| Myanmar | 8.13 |

| The Democratic Republic Of The Congo | 8.10 |

Cash-Intensive Businesses: Businesses that primarily deal in cash transactions, such as casinos, money service businesses, or pawnshops, are at higher risk for money laundering due to the ease with which cash can be used for illicit purposes.

The traditional high-risk areas of money laundering remain, including financial services, money service businesses, and cash.

What is high country risk

Country risk refers to the economic, social, and political conditions and events in a foreign country that may adversely affect a financial institution's operations. Banks must institute adequate systems and controls to manage the inherent risks in their international activities.Causes of Being a High-Risk Country

Weak legal frameworks or inconsistent enforcement create an environment conducive to money laundering and illicit financial activities. Political Instability and Corruption: Nations characterized by political instability and corruption significantly heighten their risk profile.Causes of Being a High-Risk Country

Weak legal frameworks or inconsistent enforcement create an environment conducive to money laundering and illicit financial activities. Political Instability and Corruption: Nations characterized by political instability and corruption significantly heighten their risk profile.

Highest-Risk

- Afghanistan. #1. Country Rank. Our statistical model estimates that there is a 6.5%, or approximately 1 in 15, chance of a new mass killing beginning in Afghanistan in 2023 or 2024.

- Pakistan. #2. Country Rank.

- Yemen. #3. Country Rank.

Which money laundering is most vulnerable : Placement

This is arguably the most vulnerable phase for those laundering money, as criminals have to move large bulk amounts of money into a legitimate financial system.

Is Switzerland a high risk Country for money laundering : Money laundering risk alerts sent to Moody's subscribers, from January 1, 2018, to August 18, 2023, show 1,451 alerts sent in relation to Switzerland, higher than neighboring countries such as Germany with 1,261 alerts, France with 1,059 alerts, and Austria with 180.

How do you define a high risk transaction

What Does High-Risk Transaction Mean Technically speaking, all credit card transactions are risky, but some are riskier than others. High-risk transactions refer to credit card payments associated with significant risks of chargebacks, fraud, and other potential issues, like money laundering.

The following may suggest a high risk of money laundering or terrorist financing: undue client secrecy (e.g., reluctance to provide requested information); and. unnecessarily complex ownership structures (including nominee shareholders or bearer shares);While money laundering and terrorist financing is a risk anytime money is exchanged, there are industries where the risk is significantly higher. These industries include any financial institution like banks, currency exchange houses, check cashing facilities, and payment processing companies.

What are the high-risk 3 countries : Latest version of the list of high-risk third countries

| High-risk third country | Date of entry into force |

|---|---|

| Haiti | 13 March 2022 |

| Iran | 23 September 2016 |

| Jamaica | 1 October 2020 |

| Mali | 13 March 2022 |