Antwort What happens if I don’t use my ATM card? Weitere Antworten – What happens if you don’t use your bank card

Key takeaways. Not using a credit card regularly can cause the card to become inactive. If a credit card issuer deems your account to be inactive, it may close the account. However, closing unused credit card accounts can help protect your accounts from fraudulent charges.Any digital card numbers linked to the card will also be turned off. For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account.When you report your debit card lost or stolen, your bank will immediately cancel it. It may also ask you to confirm if recent transactions are valid or unauthorized. Once your old card is canceled, it can't be used anymore. Even if you find it later, your bank won't be able to reactivate it.

How long will a bank account stay active : If you don't use your account for a long period of time the bank or building society may declare it dormant, but the length of time before this happens will vary between institutions. It could be as little as 12 months for a current account, three years for a savings account, or in some cases up to 15 years.

Do debit cards expire if not used

When Does A Debit Card Expire Debit cards typically expire within 2 to 5 years of their issue date and are good through last day of the expiration month printed on the front of the card. For instance, if your debit card's expiration date reads 08/23, then it will expire at the end of the day on August 31, 2023.

Is it bad to never use a credit card : It's important to keep your credit utilization ratio under 30% — this is a healthy balance of using your credit to a reasonable degree. However, never using your credit card could result in a lack of financial data for lenders/bureaus to collect to determine your credit score.

You will still have your money in the account as canceling the debit card does not impact the balance in your account. The money is not on “The Card” The money is in a account the card is tied to. If the card is lost/stolen/canceled.

It allows you to freeze your card or account temporarily and block further charges. Locking will typically prevent new transactions but leave automatic payments, such as bills, bank fees, and subscriptions, enabled.

Do debit cards get deactivated if not used

It is tied to a bank deposit account. If the underlying account closes, the debit card will cease to function. Many banks will place an account in a suspended status if there are no transactions made within a certain period of time — often a couple of years.Debit cards may remain inactive for as long as the bank will allow them to sit, and then they will get an administrative block on them which can be cleared by the customer proving their ID and saying they want that card active.Accounts, where there is no 'customer induced' transaction for a period of 6 months will be converted to dormant account status in the interest of the depositor as well as the Bank. The depositor will be informed of charges, if any, which the Bank will levy on dormant accounts.

Your bank could slowly drain the money away

This either leads to the account holder noticing that the bank is taking their money, or eventually the bank fees will bring the account balance down to $0 — at which point, the bank will just close the account due to inactivity.

How long can a card be inactive : If you stop using the card altogether, there's a chance that your account will be closed (typically after at least 12 months of inactivity). This will appear on your credit report and could drop your score, so it's vital to keep your account active and make the payments needed to keep your account in good standing.

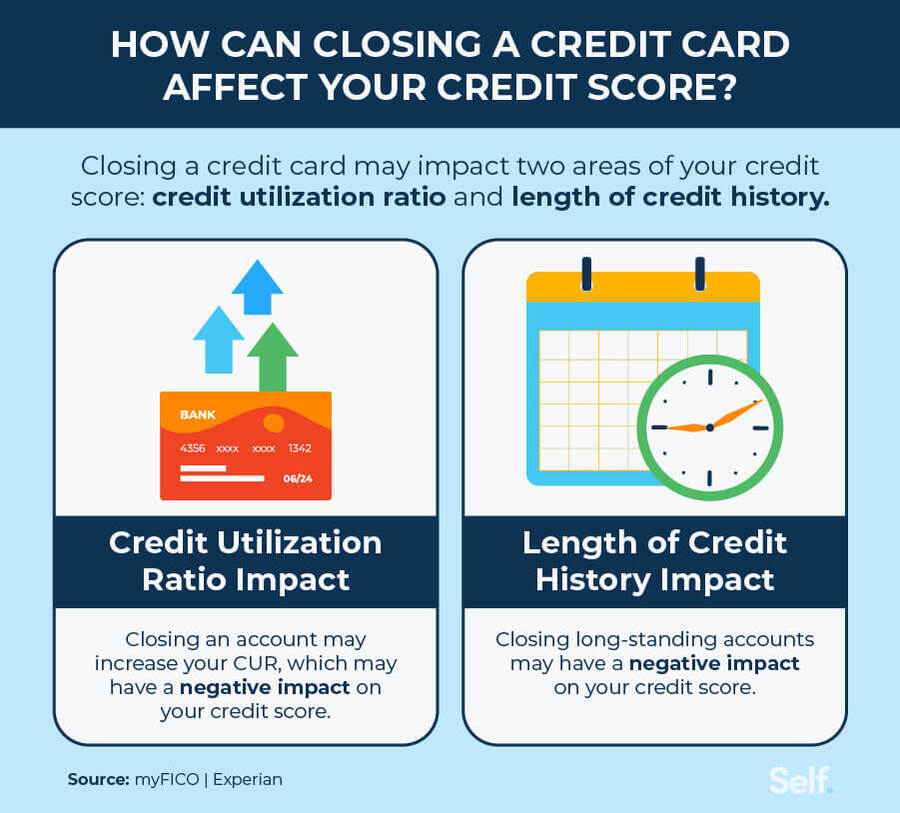

Does cancelling a card hurt credit : Before you close a credit card account, consider the following: Closing a credit card could lower the amount of overall credit you have versus the amount of credit you're using (your debt to credit utilization ratio), which could impact your credit scores.

Does closing a card hurt credit

Key takeaways: Closing a credit card can hurt your scores because it lowers your available credit and can lead to a higher credit utilization, meaning the gap between your spending and the amount of credit you can borrow narrows. Canceling a card can also decrease the average age of your accounts.

Canceling a credit card will cause a direct hit to your credit score, so more often than not, you'll want to keep the account open. Correctly managing an open, rarely-used account may require some extra attention, but the added effort will help your credit in the long run.But closing an unused credit card account isn't always the best move. In fact, unless the credit card comes with an annual fee, most experts will tell you to just leave the account open.

Does cancelling a debit card hurt : I already decided: If my bank implements a fee, I'm canceling my card. But will this hurt my credit score A: No. Having a debit card doesn't help or hurt your credit score.