Antwort What countries is HSBC Global Transfer available in? Weitere Antworten – Which countries are covered by HSBC Global Transfer

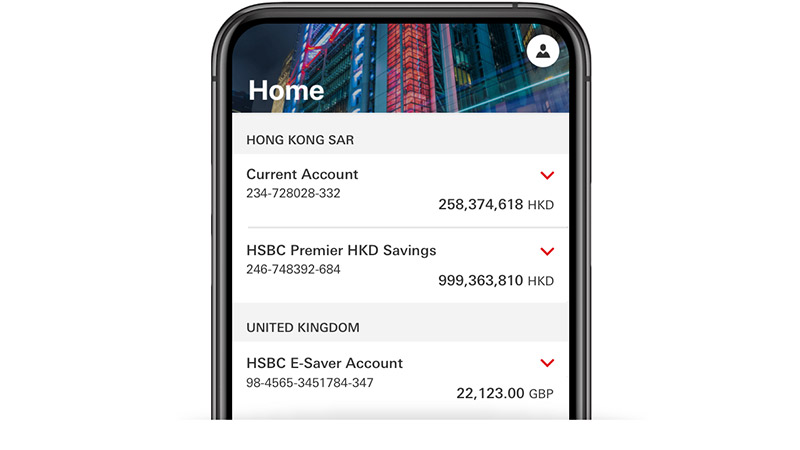

Global View and Global Transfers are available in Australia, Bahrain, Bermuda, Channel Islands, Mainland China, Egypt, Hong Kong SAR, India, Indonesia, Isle of Man, Philippines, Jersey (HSBC Expat), Malaysia, Malta, Mexico, Qatar, Singapore, Sri Lanka, Taiwan, UAE, UK, US and Vietnam.Available countries and regions

- Australia.

- HSBC Expat (Offshore banking services)

- China.

- Hong Kong.

- India.

- Singapore.

- UAE.

- USA.

As an HSBC Premier or Advance customer with accounts around the world, you can view and manage all your accounts in one place with our Global View service, wherever you are, and make free transfers between them with Global Transfers.

How does HSBC Global Transfer work : To do this, just follow these steps:

- Log into your HSBC Mobile app.

- Select Pay & Transfer.

- Select Send Money Internationally.

- Select Country or Territory.

- Select the account you want to send from.

- Enter the amount you want to send.

Can I use HSBC Global money account abroad

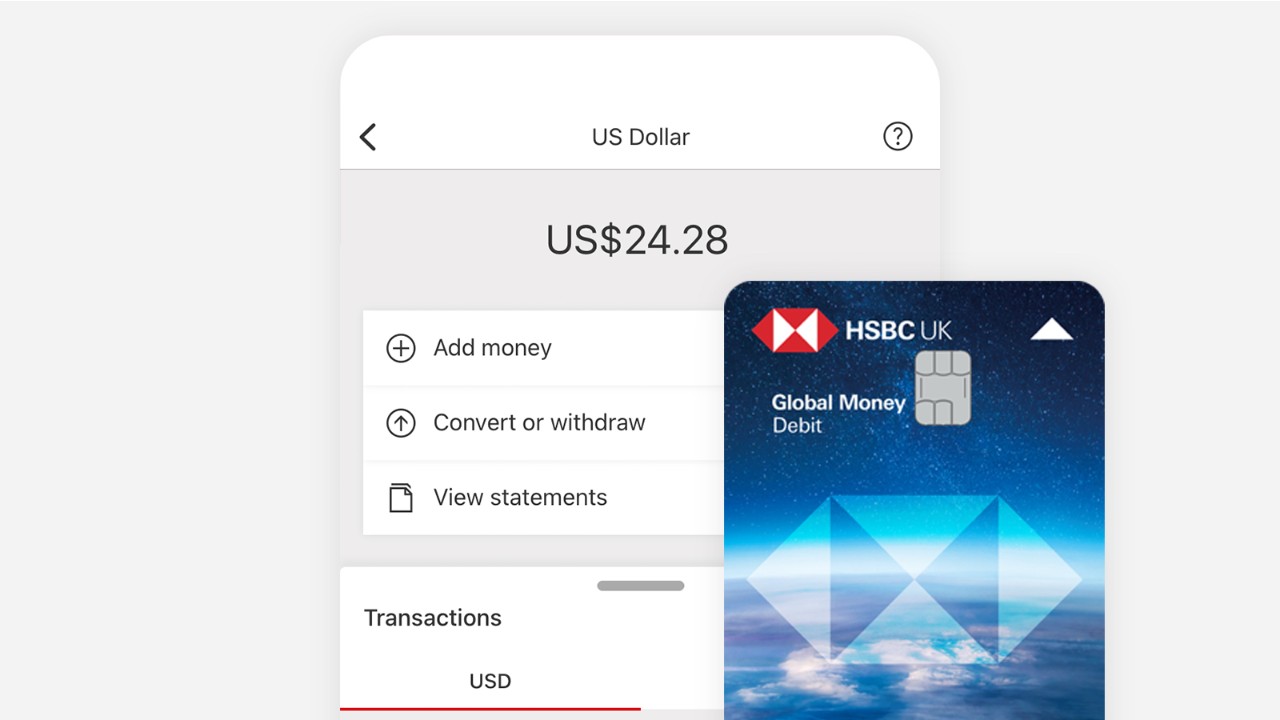

Access the world with one account

Spend money at home or abroad using your Global Money debit card, or simply add it to your digital wallet for spending free from HSBC fees. Non-HSBC fees may apply.

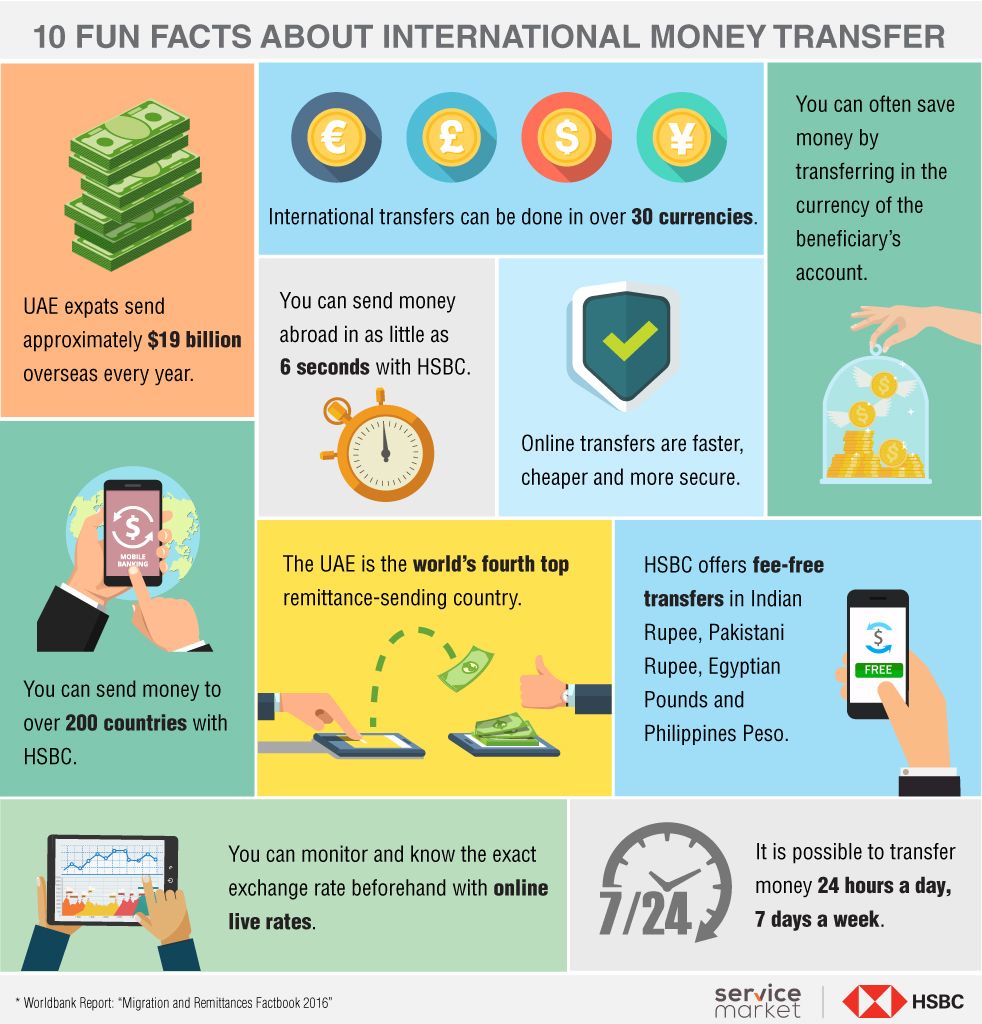

Can I use my HSBC account internationally : You can rely on HSBC wherever you travel. While traveling internationally, you will have the peace of mind of knowing that the HSBC Group's ATMs and branch locations offer personal financial services in many countries. Emergency financial support is also available worldwide.

HSBC has offices, branches and subsidiaries in 62 countries and territories across Africa, Asia, Oceania, Europe, North America, and South America, serving around 39 million customers.

More on HSBC International

Our premium banking services are designed to give you and your family a range of privileges you can enjoy worldwide.

How to use HSBC Global money Account abroad

Simply add GBP or any supported currency to your HSBC Global Money Account. Use your debit card as you would at home. We'll debit payment from your currency balance if funds are available. If not, or if the transaction is in a currency you can't hold a balance in, we'll debit your GBP balance.The inbound limit is USD200,000 for all customers. Most countries and regions have an outbound limit of USD100,000-200,000.An easy, quick way to send and receive money worldwide

With HSBC you can do it securely via the app or online, at any time and in local currency. Plus, we only use up-to-date exchange rates during market hours.

HSBC Trinkaus & Burkhardt AG, operating as HSBC Deutschland, is a German financial services company. It traces its history back to 1785 and is one of the longest-established members of the HSBC Group.

Can you use HSBC abroad : When making a payment or withdrawing cash in a foreign currency (non-sterling) you may be asked if you want to pay in Sterling or the local currency. By selecting to pay in the local currency, HSBC will make the conversion using the relevant payment scheme exchange rate applied on the day the conversion is made.

Can I transfer more than $25,000 HSBC : You can send money up to your personal payment limit to friends and family or up to £25,000 for payments to a company via online and mobile banking. Payments above these limits will be sent as a CHAPS payment. If you're an HSBC customer, you can send a CHAPS payment in branch or by post.

Can I use my HSBC Global money account abroad

Access the world with one account

Spend money at home or abroad using your Global Money debit card, or simply add it to your digital wallet for spending free from HSBC fees. Non-HSBC fees may apply.

HSBC Germany is part of HSBC Continental Europe, the leading international wholesale bank in Europe. With our standardised platform, we offer customers and employees the opportunity to work together across borders and throughout Europe..If you need to pay someone straight away or transfer a large amount of money, CHAPS transfers allow you to make same-day, high-value electronic payments. You might use CHAPS if you were paying the money for a home deposit or moving your savings between accounts.

How do I send 5000 dollars to someone : Venmo, Cash App, Google Pay, Zelle, PayPal, and wire transfer are some of the safest way to send money digitally. Money transfer apps are inexpensive and convenient options for paying family and friends. Wire transfers at a bank are ideal for securely sending large amounts domestically or internationally.