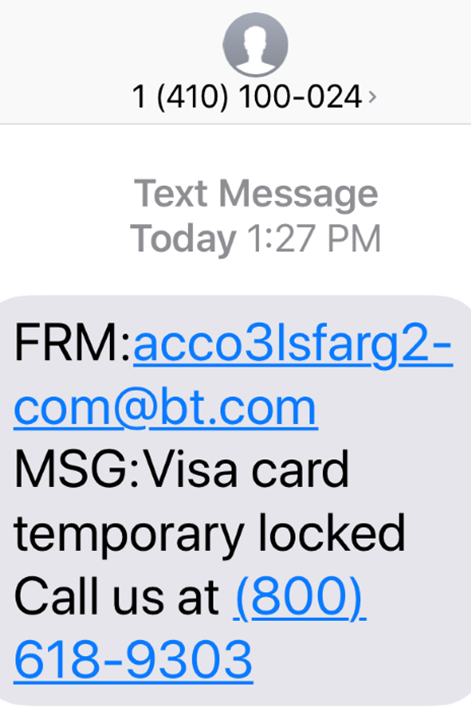

Antwort What can I do if my card is blocked? Weitere Antworten – How do I unblock my card

You can directly approach your bank or its branch and submit a written application, requesting an automatic unblock of the ATM card. To verify your identity as the card's user, you must submit ID and address proof. Once these details are verified, the bank will unblock your card.Some banks or credit unions use blocking — putting a hold on a portion of your available credit on your credit card. That means you have less to use until the block clears. If they block your debit card, your account balance may get low, you may bounce a check, or a recurring payment you authorized may be declined.How to unlock your debit card using online banking

- Choose your checking account from the dashboard.

- Select Card controls, then select Lock or unlock card.

- Choose your card if you have more than one.

- Select Lock card or Unlock card to change the status of the card.

Can I still use online banking if my card is blocked : When your card is blocked, you cannot make online payments as it will get declined. Also, the card will not be read by the card reader at the ATM or it will not accept the PIN or decline the transaction again. You can confirm if the card is blocked by calling customer care service or at the bank branch.

How long does it take to unblock a card

The time taken to unblock a credit card varies from bank to bank. In some cases, it may be unblocked immediately, while in others, it may take a few days.

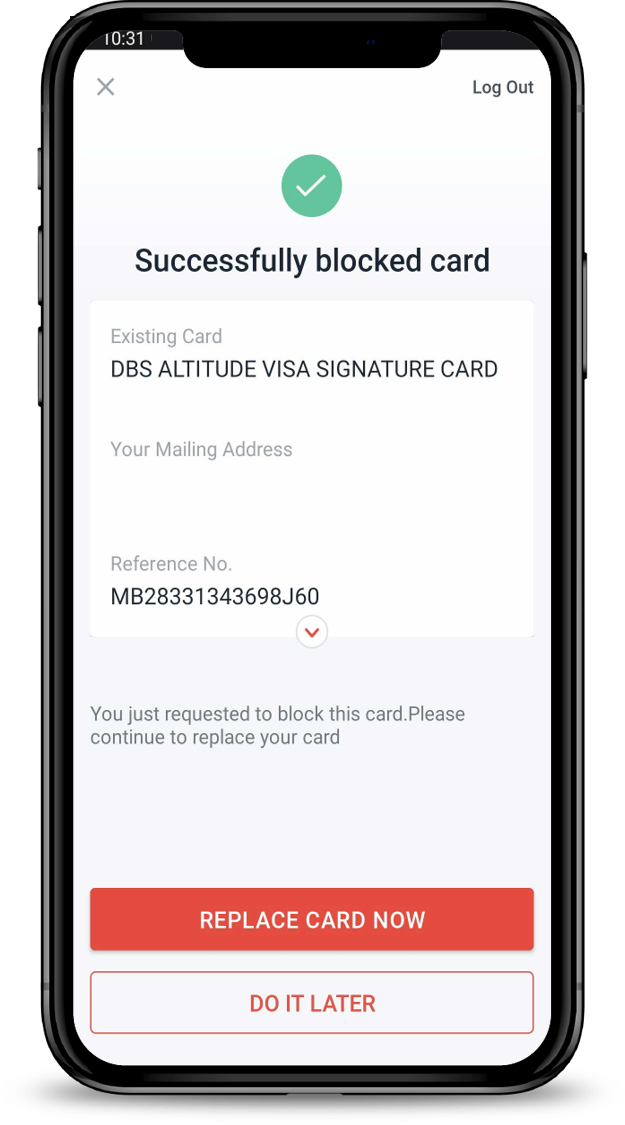

Can I unblock my Visa card online : To unblock your credit card, you will have to contact your bank by following various online and offline methods. To unblock your credit card online, you can visit your bank's mobile application or official website and apply for 'reissue' or 'reactivation' of your credit card.

These situations sometimes resolve themselves; for example, cards that are blocked due to daily limits, or due to excessive PIN entry attempts, will typically be unblocked within 24 hours. In cases of expired cards, activating and using the replacement card will solve the problem.

The Speedy Release: Used a card at a hotel or rental car place They might block a chunk of your credit limit to cover potential extras. But fear not, once the final bill is settled, that block usually vanishes within 1-2 days.

Will my card unblock after 24 hours

If you enter your PIN incorrectly three times, either at ATMs or various merchants, your card will be temporarily blocked for 24 hours. ⚠️ You must wait at least 24 hours after your last failed attempt to unblock your card.Blocked cards can be unblocked only by the issuer /bank. In fact if you go to the ATM, it could be captured by the machine.If your card was blocked due to suspicious or fraudulent activity, you will not be able to withdraw money until the issue is resolved. And second If your card was blocked because you entered the wrong PIN too many times, you will need to contact your bank to have the block lifted before you can withdraw money again.

Once you block the ATM Card, you could not withdraw money with your card as they already deactivate the ATM Card. You can request for a new card. However you can withdraw/Transfer the money in your account via Cheque/internet banking.

How long does it take to unblock a Visa card : The time taken to unblock a credit card varies from bank to bank. In some cases, it may be unblocked immediately, while in others, it may take a few days.

How do I unblock my CVV : If you enter the wrong CVV code three times in a row, the card will be automatically blocked. To unblock the CVV code: In your online account go to Card settings (click on the gear icon above the image of your card or just directly on the image) Click on Unblock CVV.

Can blocked card be unblocked

You can unblock your card online by logging in to your net banking account as well for the banks who offer the option of doing so. You can click on the section of 'cards' and select your credit card and choose to unblock it.

Message and data rates may apply. When you place a lock on your debit or ATM card via Online or Mobile Banking, it will prevent most types of card transactions from being processed until you take action to unlock your card. Any virtual cards linked to the locked card will also be locked.When you lock a card, new charges and cash advances will be denied. However, recurring autopayments, such as subscriptions and monthly bills charged to the card, will continue to go through. Typically, so will bank fees, returns, credits, interest and rewards.

Can you still transfer money if your card is frozen : Unless there is a reason for the card remaining frozen (e.g. it is lost) you will need to unfreeze your card to use this for card transactions but you can still do bank transfers, or internal transfers for investments.