Antwort What are the types of foreign exchange market? Weitere Antworten – What is the type of foreign exchange market

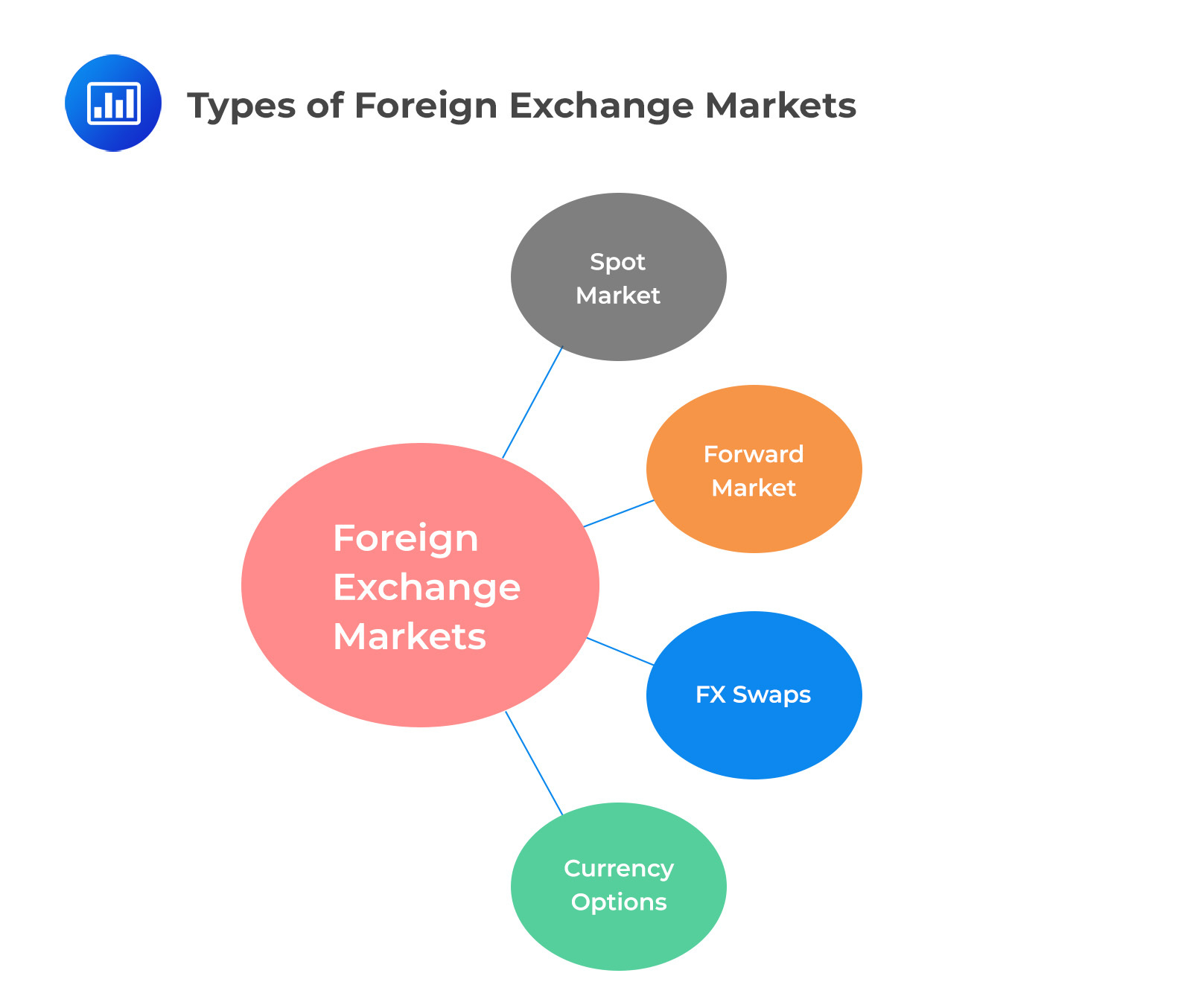

There are three main forex markets: the spot forex market, the forward forex market, and the futures forex market. Spot Forex Market: The spot market is the immediate exchange of currencies at the current exchange. On the spot.Types of Foreign Exchange Rate

- Fixed Exchange Rate System.

- A Flexible Exchange Rate System.

- Managed Floating Exchange Rate System.

Types of trade

- Spot contract. Spot trading is the most common way of trading with us.

- Forward contract. Forward contracts can help protect you against market volatility.

- Window Forward.

- Limit order.

- Stop loss order.

- FX Swaps.

What are the four key groups in the foreign exchange market : To get a sense of this, it is useful to consider four groups of people or firms who participate in the market: (1) firms that import or export goods and services; (2) tourists visiting other countries; (3) international investors buying ownership (or part-ownership) in a foreign firm; (4) international investors making …

What is the most common foreign exchange market

1. US dollar (USD) The US dollar is by far the most traded currency in the forex market, with a global daily average trading volume of about $6.6 trillion. In fact, USD takes such a large precedent in forex markets that all 'major' currency pairs in foreign exchange trading include the dollar.

How many types of foreign trade are there : three types

The three types of foreign trade are as follows: Import. Export. Entrepot.

Besides, fixed, flexible, and managed floating exchange rate systems, the other types of exchange rate systems are: Adjustable Peg System: An exchange rate system in which the member countries fix the exchange rate of their currencies against one specific currency is known as Adjustable Peg System.

Exports, direct purchases, and remittances from abroad are sources of supply of foreign currency. Q.

What are the four categories of exchange

There are four main types of like-kind exchanges that real estate investors can choose to execute. The types of 1031 exchanges are simultaneous exchange, delayed exchange, reverse exchange, and construction or improvement exchange.The main types of exchange rate regimes are: free-floating, pegged (fixed), or a hybrid. In free-floating regimes, exchange rates are allowed to vary against each other according to the market forces of supply and demand.The four traditional majors are:

- EUR/USD.

- USD/JPY.

- GBP/USD.

- USD/CHF.

The major currency pairs on the forex market are the EUR/USD, USD/JPY, GBP/USD, and USD/CHF. The four major currency pairs are some of the most actively traded pairs in the world, along with the so-called commodity currency pairs: USD/CAD, AUD/USD, and NZD/USD.

What are the largest foreign exchange markets : There are FX markets in all countries. The major FX markets are London, New York, Paris, Zurich, Frankfurt, Singapore, Hong Kong, and Tokyo. London is the largest.

What is the most famous foreign exchange :

- The U.S. Dollar. The U.S. dollar, which is sometimes called the greenback, is first and foremost in the world of forex trading, as it is easily the most traded currency on the planet.

- The Euro.

- The Japanese Yen.

- The Great British Pound.

- The Australian Dollar.

- The Canadian Dollar.

What are 5 examples of foreign trade

Almost every kind of product can be found in the international market, for example: food, clothes, spare parts, oil, jewellery, wine, stocks, currencies, and water. Services are also traded, such as in tourism, banking, consulting, and transportation.

Different Types of Trading in the Stock Market and Their Benefits

- Day Trading. Day trading, a.k.a. Intraday trading, is one of the most common types of trading in the stock market.

- Positional Trading.

- Swing Trading.

- Long-Term Trading.

- Scalping.

- Momentum Trading.

Speculators in foreign exchange market would like to know the direction of exchange rate movement aforehand to make profit. In the following, we explain three models of exchange rate determination, namely, the purchasing power parity(PPP), the monetary model and the portfolio balance theory.

What are the 3 major types of foreign trade : There are three different types of foreign trade, which are as follows:

- Import trade: It is the purchase of goods and services by one country from another country.

- Export trade: It is the selling of goods and services to another country.

- Entrepot trade: This process is also called re-export.