Antwort What are the three types of foreign risk? Weitere Antworten – What are the different types of foreign risk

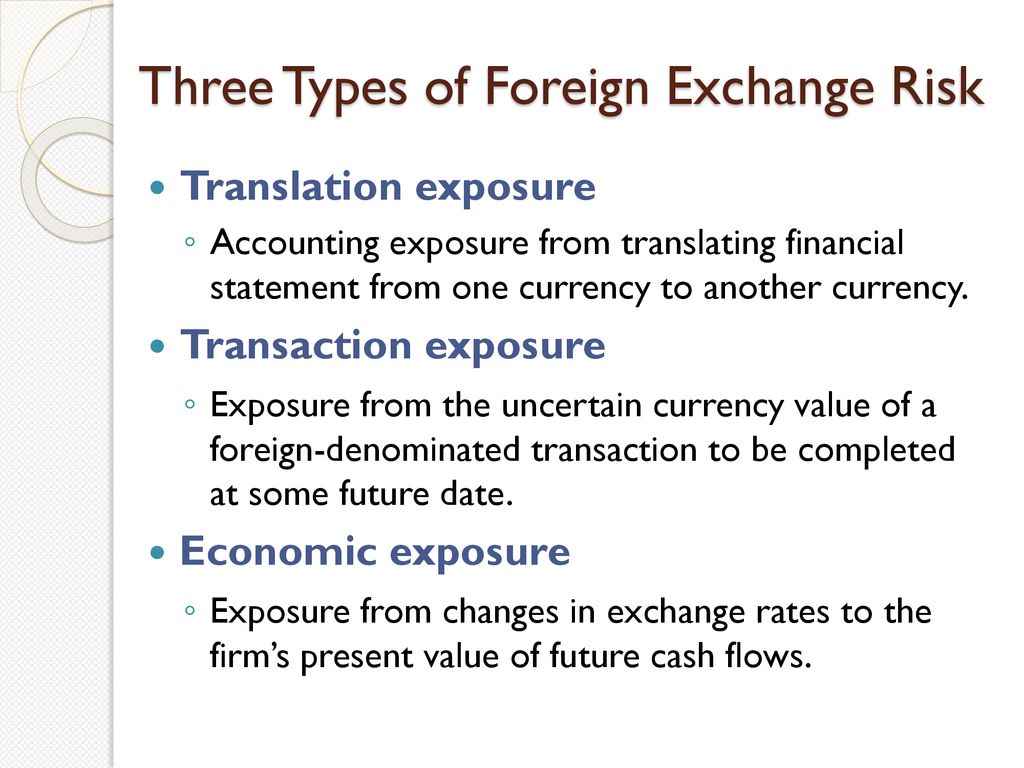

There are three main types of foreign exchange risk, also known as foreign exchange exposure: transaction risk, translation risk, and economic risk.Exposure Categories are: occupational, public, and medical. Exposure Situations are: planned, existing, and emergency.The three types of foreign exchange risk include transaction risk, economic risk, and translation risk. Foreign exchange risk is a major risk to consider for exporters/importers and businesses that trade in international markets.

What are the risks of international finance : The main risks that are associated with businesses engaging in international finance include foreign exchange risk and political risk. These challenges may sometimes make it difficult for companies to maintain constant and reliable revenue.

How are risks classified

Risk classification is the grouping together of risks in a way that makes it easier for the business to manage them. Risks could be classified by: likelihood of occurrence. cost and/or impact should they occur.

What is an example of an international risk : Definition of International Risk

For instance, suppose your firm plans to invest in a new factory in Country A. The local government announces a sudden change in its trade policy, posing an unpredicted hurdle. Therefore, this kind of change is an example of international risk you may face.

There are two primary categories of risk exposure: pure risk and speculative risk. Pure risk exposure is a risk that cannot be wholly foreseen or controlled, such as a natural disaster or global pandemic that impacts an organization's workforce.

By definition, a foreign exchange exposure refers to the risk of foreign exchange rates that change quickly and frequently. When this happens, it can greatly affect financial transactions with foreign currency rather than the domestic currency of a company.

What are the 3 components of exchange rate risk

Exchange rate risk refers to the risk that a company's operations and profitability may be affected by changes in the exchange rates between currencies. Companies are exposed to three types of risk caused by currency volatility: transaction exposure, translation exposure, and economic or operating exposure.There are three major types of exchange rate risk: Transaction risk is when rates change before your transaction is finished. Translation risk is when the value decreases on financial statements due to rate changes. Economic risk is when a company's value is impacted by fluctuations.Businesses involved in international trade face a range of trade risks, including changes in exchange rates, political instability, regulatory changes, and natural disasters. Failure to manage these risks effectively can lead to reduced revenue, increased costs, damage to reputation, and uncertainty.

The main four types of risk are:

- strategic risk – eg a competitor coming on to the market.

- compliance and regulatory risk – eg introduction of new rules or legislation.

- financial risk – eg interest rate rise on your business loan or a non-paying customer.

- operational risk – eg the breakdown or theft of key equipment.

How many types of risks are there : Different types of financial risk include credit risk, operation risk, liquidity risk, foreign investment, and legal and equity risk.

What are the top 3 global risks : Global Risk Profile in 2024

| 2024 Ranking | Risk | Share of Respondents |

|---|---|---|

| 1 | Extreme weather | 66% |

| 2 | Misinformation and disinformation | 53% |

| 3 | Societal polarization | 46% |

| 4 | Cost-of-living crisis | 42% |

Which are the four 4 identified risks in international business

Four types of risk: cross-cultural risk, country risk, currency risk, and commercial risk Use no more than a total of 250 words. Explain the four types of risks in international business using specific examples Airbnb can face when it does international business.

Different types of financial risk include credit risk, operation risk, liquidity risk, foreign investment, and legal and equity risk.By definition, foreign exchange risk is the possibility for a company to be affected by a variation in the exchange rate between its local currency and the currency used in a transaction with a foreign country.

What is an example of a foreign exposure : For a foreign exchange exposure example, imagine a multinational company that buys products from a foreign supplier. They import raw materials, but here's the catch: if their currency loses value compared to the supplier's, the cost of those raw materials goes up. This negatively impacts the company's profits.