Antwort What are the disadvantages of the digital euro? Weitere Antworten – What are the disadvantages of CBDC currency

Risk of bank runs and system instability: If there is a sudden surge in demand for CBDCs, it could cause a bank run and potentially destabilize the financial system.Central Banks have limited control over the economy. They can influence it through monetary policy tools like interest rates, but they cannot directly control factors like consumer spending, business investment, technological changes, etc. The effects of monetary policy changes take time to work through the economy.One specific country that has publicly rejected the use of Central Bank Digital Currency (CBDC) is El Salvador. In 2021, El Salvador became the first country in the world to adopt Bitcoin as legal tender and has rejected the use of CBDC as a means of financial transactions.

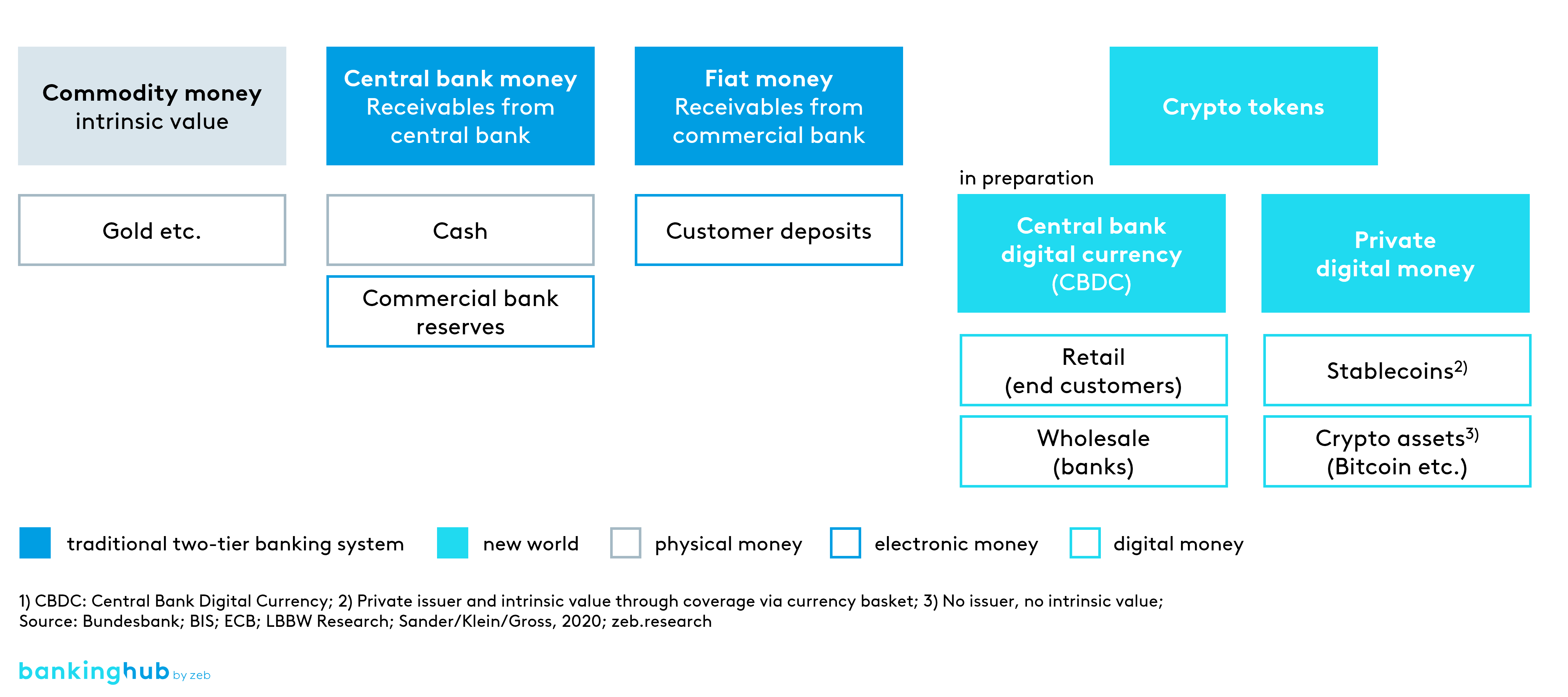

What are the advantages of a central bank digital currency : CBDCs aim to reduce costs in the financial sector while striving to increase transaction speed. They aim to provide access to financial services for those without bank accounts. CBDCs aim to enhance payment security while striving to reduce chances of fraud.

What are the negatives of digital currency

Cons of Digital Currencies

- Volatility: Digital currencies such as Bitcoin are known for their volatility.

- Lack of Regulation: Digital currencies are not regulated by governments or financial institutions, which can make them more susceptible to fraud and illegal activities.

What are the risks of a CBDC : A UK House of Lords economic affairs committee report concluded that a CBDC poses two main security risks: first, that individual accounts could be compromised through cybersecurity weaknesses; and, second, that a centralised CBDC ledger could be a target for attack from “hostile state and non-state actors”.

Key Takeaways. The digitization of money through a Central Bank Digital Currency (CBDC) creates substantial threats to financial privacy, increases government power, and could be weaponized against the American people.

Con: No Personal Relationships

Additionally, if you need to make changes to the terms of your account, a bank manager usually has some discretion if your personal circumstances do change. Additionally, digital banking platforms may not be as accessible for some people and can be difficult to navigate and understand.

Is CBDC risky

A UK House of Lords economic affairs committee report concluded that a CBDC poses two main security risks: first, that individual accounts could be compromised through cybersecurity weaknesses; and, second, that a centralised CBDC ledger could be a target for attack from “hostile state and non-state actors”.2. Will a U.S. CBDC replace cash or paper currency The Federal Reserve is committed to ensuring the continued safety and availability of cash and is considering a CBDC as a means to expand safe payment options, not to reduce or replace them.A UK House of Lords economic affairs committee report concluded that a CBDC poses two main security risks: first, that individual accounts could be compromised through cybersecurity weaknesses; and, second, that a centralised CBDC ledger could be a target for attack from “hostile state and non-state actors”.

Cryptocurrencies can be vulnerable to hacking and theft. Cybercriminals employ various techniques, including phishing attacks, malware, and exploiting vulnerabilities in exchange platforms or wallets, to steal funds.

What are the dangers of a digital dollar : The concern is that financial privacy will be lost with a digital dollar. The government would be able to watch how people spend their money, close their bank accounts, or even just take the money. In other words, the worry is that a digital dollar would be one more way for the government to control us and our money.

Will digital currency replace cash : Will a U.S. CBDC replace cash or paper currency The Federal Reserve is committed to ensuring the continued safety and availability of cash and is considering a CBDC as a means to expand safe payment options, not to reduce or replace them.

Is digital currency high risk

Crypto is volatile and a substantial risk. Invest only what you can afford to lose. Crypto scammers are experts at getting you to buy their digital assets.

Cryptocurrency Risks

- Cryptocurrency payments do not come with legal protections. Credit cards and debit cards have legal protections if something goes wrong.

- Cryptocurrency payments typically are not reversible.

- Some information about your transactions will likely be public.

Disadvantages Of Digital Payment Systems

- Security Concerns: One of the primary disadvantages of digital payments revolves around security issues.

- Technological Infrastructure Gaps:

- Digital Divide:

- Transaction Costs:

- Dependence on Technology:

- Privacy Concerns:

- Resistance to Change:

What are the disadvantages of digital payment : 10 Disadvantages and Concerns of Online Payments

- Risk of Fraud. This is the first concern that comes to mind when we think of risks related to digital payments.

- Technical Issues.

- Transaction Limits.

- Dependency on Internet.

- Identity Theft.

- Loss Of Cards.

- Unfamiliarity With Technology.

- Password Threats.