Antwort What are characteristics of money? Weitere Antworten – What are the 5 characteristics of money

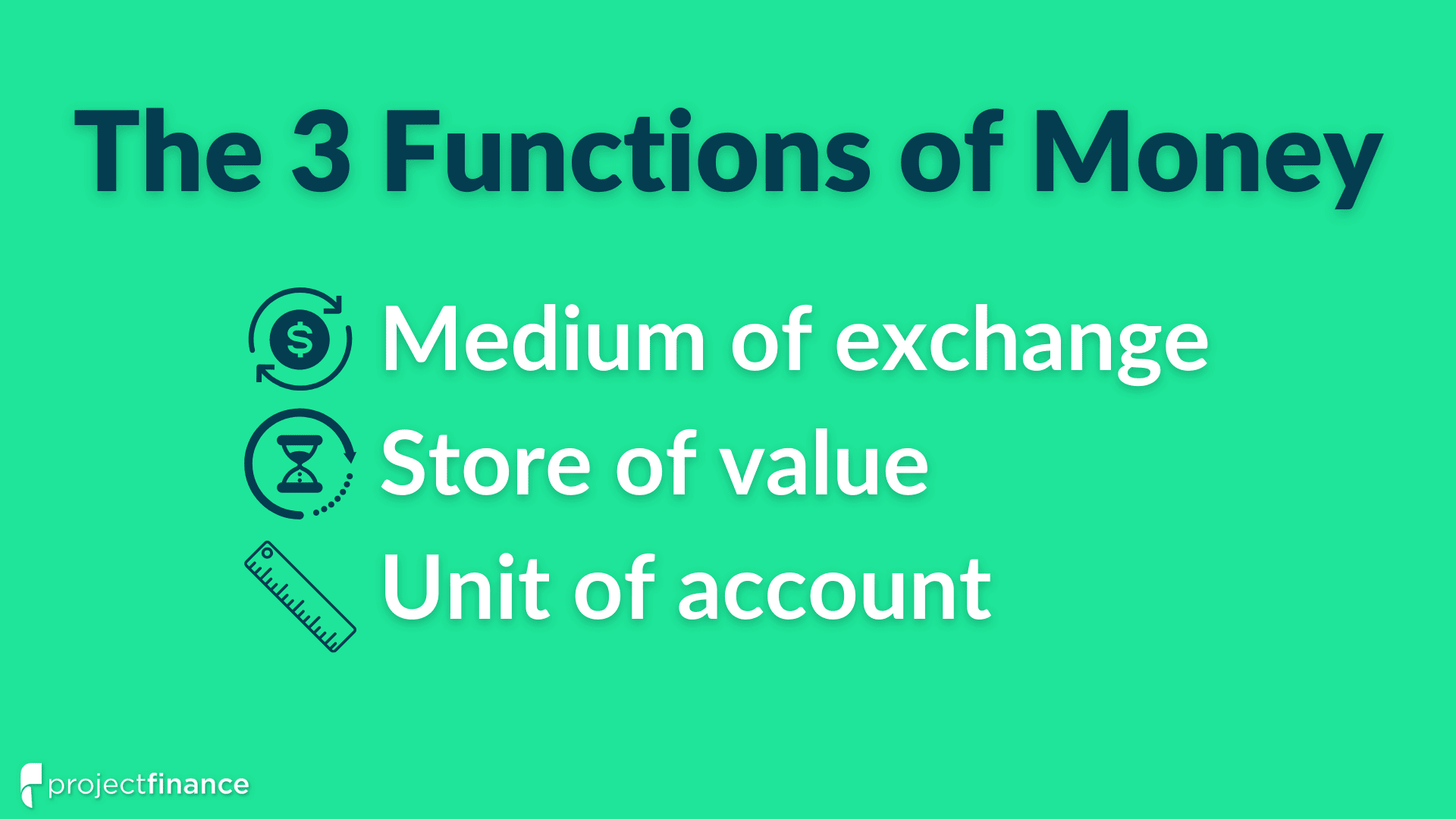

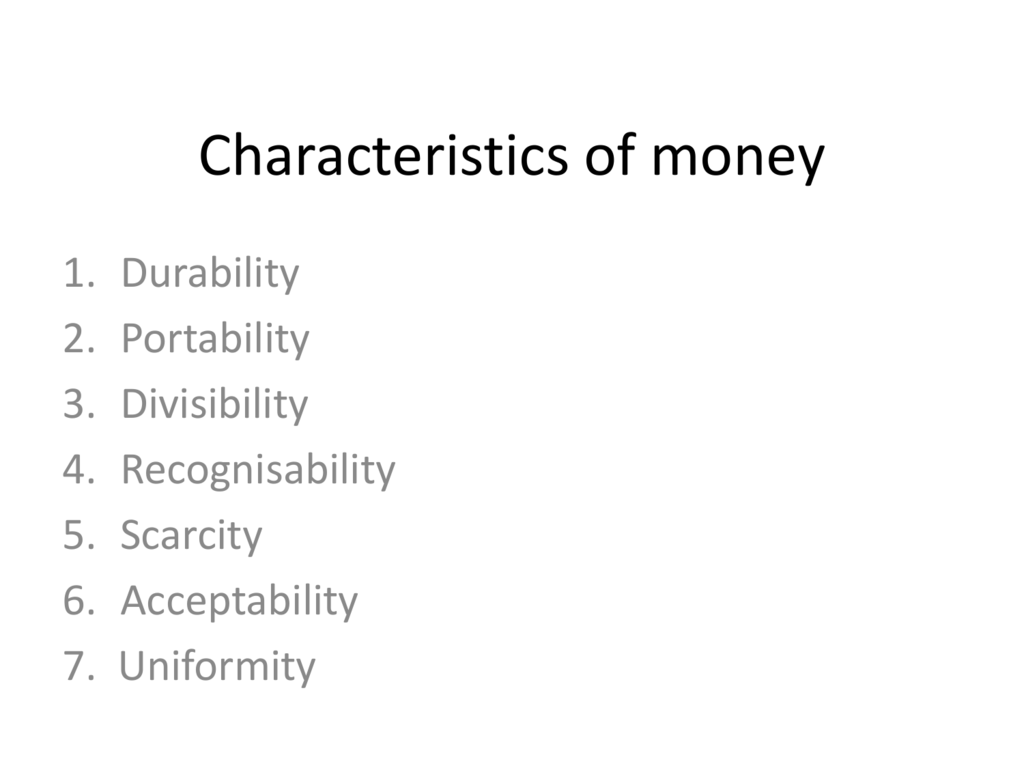

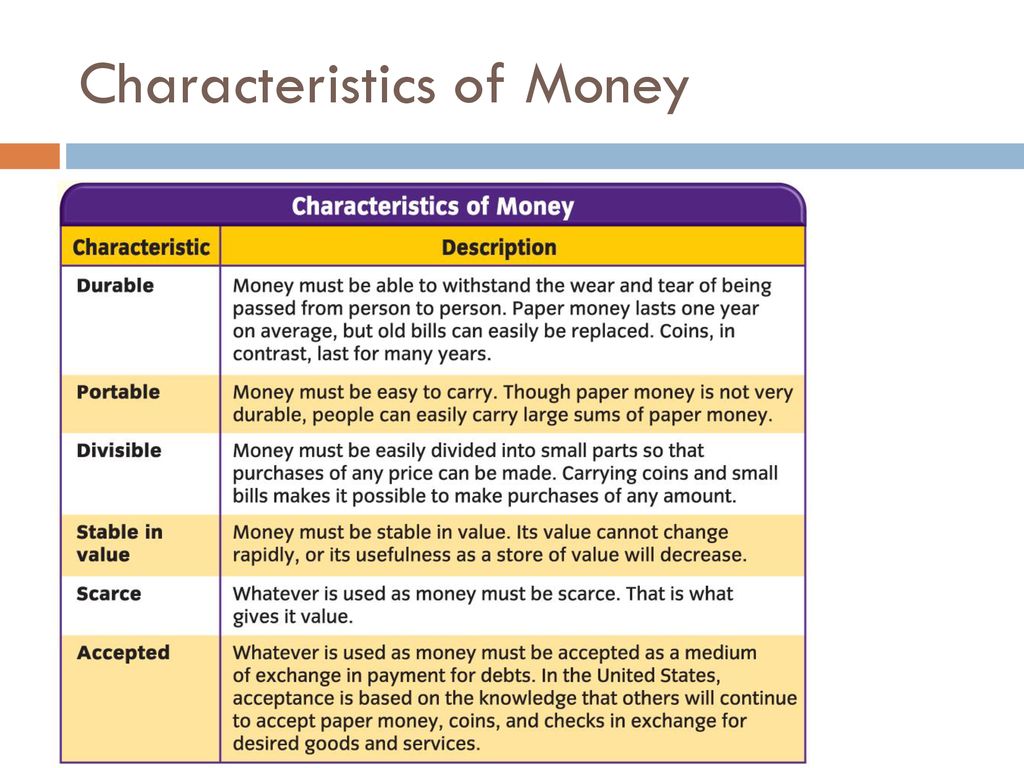

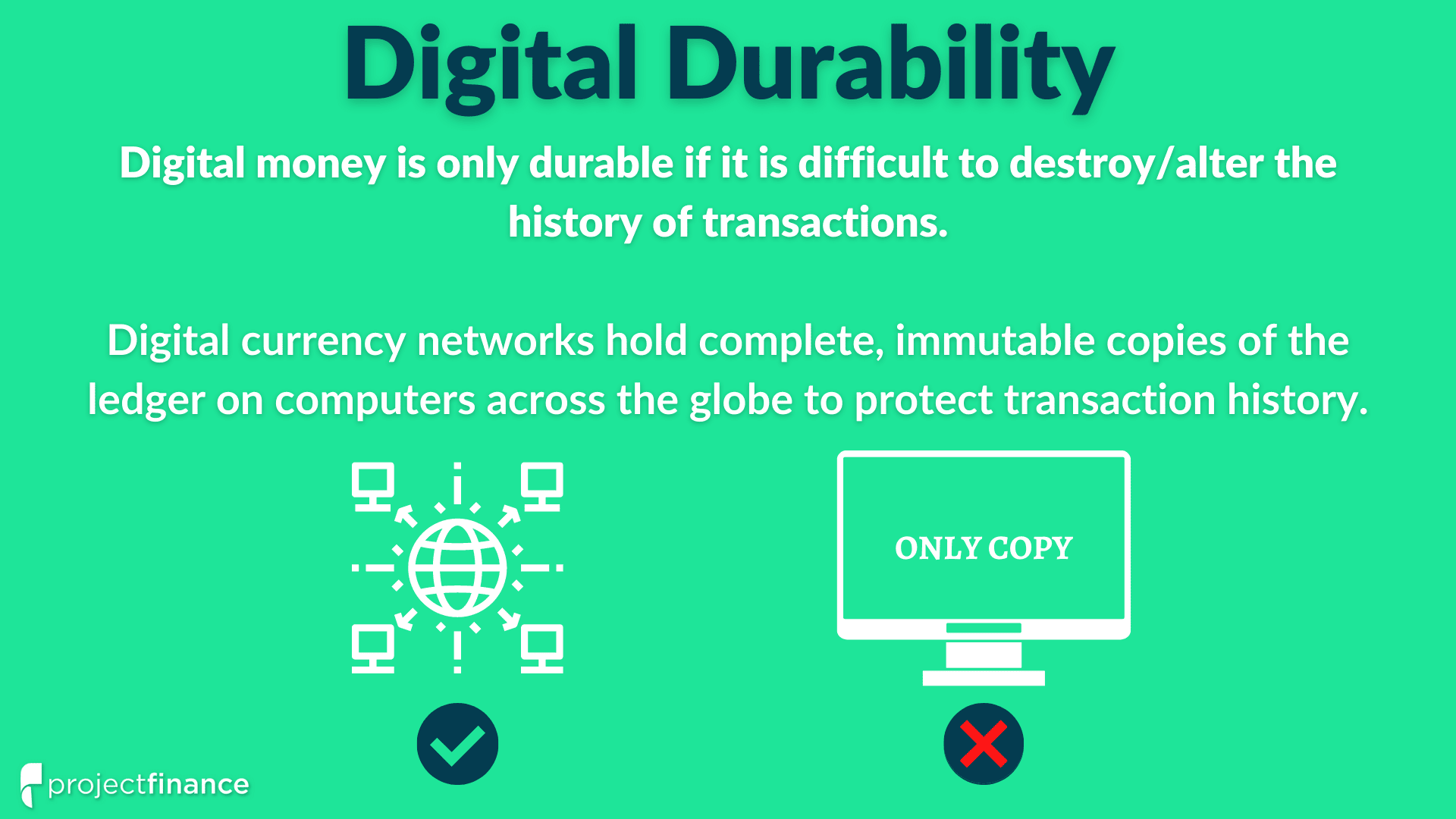

Money is defined as a unit of measure that is generally accepted and recognized as a medium of exchange in the economy. For a commodity or currency to be recognized as money, it must be fungible, stable, recognizable, portable, and durable.To summarize, money has taken many forms through the ages, but money consistently has three functions: store of value, unit of account, and medium of exchange. Modern economies use fiat money-money that is neither a commodity nor represented or "backed" by a commodity.Durability: If money stays the same in terms of shape and substance over time, it is said to be durable. This means that it does not easily change form and can be used for a long period of time.

What are the three types of money : Economists differentiate among three different types of money: commodity money, fiat money, and bank money. Commodity money is a good whose value serves as the value of money. Gold coins are an example of commodity money. In most countries, commodity money has been replaced with fiat money.

What are the four types of money characteristics

Different 4 types of money

- Fiat money – the notes and coins backed by a government.

- Commodity money – a good that has an agreed value.

- Fiduciary money – money that takes its value from a trust or promise of payment.

- Commercial bank money – credit and loans used in the banking system.

What are the four main functions of money : The four main functions of money include: acting as a standard of deferred payment, being used as a store of value, acting as a medium of exchange, and being used as a unit of account.

The four main functions of money include: acting as a standard of deferred payment, being used as a store of value, acting as a medium of exchange, and being used as a unit of account.

Money serves several functions: a medium of exchange, a unit of account, a store of value, and a standard of deferred payment.

What are the 4 functions of money

The four main functions of money include: acting as a standard of deferred payment, being used as a store of value, acting as a medium of exchange, and being used as a unit of account.Expert-Verified Answer

The correct answer is B) Lack of divisibility.Different 4 types of money

Fiat money – the notes and coins backed by a government. Commodity money – a good that has an agreed value. Fiduciary money – money that takes its value from a trust or promise of payment. Commercial bank money – credit and loans used in the banking system.

In order for money to function well as a medium of ex- change, store of value, or unit of account, it must possess six characteristics: divisible, portable, acceptable, scarce, durable, and stable in value.

What are the 6 characteristics of money definition economics : What are the six characteristics of money durability, portability, divisibility, uniformity, limited supply, and acceptability. Currency.

What is the most important characteristic of money : Stability. Of all the qualities of good money, stability is probably the most essential one. The value of money cannot change for a long period of time and hence remain stable. If the value of money keeps changing, then it will fail to function as a measure of value and as a standard of deferred payment.

What is money and its main functions

Money is a liquid asset used to facilitate transactions of value. It is used as a medium of exchange between individuals and entities. It's also a store of value and a unit of account that can measure the value of other goods.

Money is the link which connects the values of today with those of the future. c) Money as a Transfer of Value: Since money is a generally acceptable means of payment and acts as a store of value, it keeps on transferring values from person to person and place to place.Different stages of money are Commodity Money, Metallic Money, Paper Money, Credit Money, and Plastic Money. According to D.H. Robertson, “Anything which is widely accepted in payment for goods or in discharge of other kinds of business obligation, is called money.”

What are the 4 steps of money : 4 Steps to Financial Success

- Step 1: Know Your Numbers. Comparing your income to monthly payments will help you budget for savings.

- Step 2: Protect What's Yours. Insurance is the best defense against the unexpected.

- Step 3: Fund Your Future. How do you see your retirement

- Step 4: Build Your Wealth.