Antwort What are benefits of Mastercard? Weitere Antworten – What is the difference between Visa and Mastercard

Visa charges the card issuer on a per-transaction basis or based on the card volume. Contrarily, MasterCard charges card-issuing institutions based on the percentage of global dollar volume. Global dollar volume refers to the total volume of all transactions made using MasterCard-enabled cards within a specific period.Using a debit Mastercard is a convenient way to manage your finances because funds are deducted directly from your checking account. Having an electronic record of every transaction can be a real time-saver and makes keeping track of what you spend a snap.Up to P5 Million Travel Insurance Coverage

Just charge your travel fare (airline tickets and other means of public transport) to your BDO Gold Mastercard every time you travel and get FREE coverage for you and your immediate family members! Click here for the coverage and provisions.

Is Mastercard a debit card or credit card : 11 Mastercard's core products include consumer credit, consumer debit, prepaid cards, and a commercial product business. Mastercard has one reportable business segment, known as Payment Solutions, which is broken out by geographies across the United States and other countries.

Is it better to pay with Visa or Mastercard

Because Visa and Mastercard have nearly identical global acceptance records, it rarely makes sense to pick one type of card over the other based on where you can use it. The only real differences between Visa and Mastercard are the features and rewards individual cards offer.

Is A Mastercard Safer Than A Visa : Which is more secure Both Visa and Mastercard offer zero fraud liability for all cards, which means that any user who is victim to fraud, theft, or breach of data will not be liable for the lost money. Both networks are generally considered to be secure, but use different methods for securing your data.

Mastercard combines comprehensive travel & lifestyle benefits with constant support every single day of the year. Peace of mind for cardholders whether at home, travelling abroad or making everyday purchases.

Benefits comparison: Visa vs. Mastercard. On entry level cards, there is very little difference between Visa and Mastercard, as both provide a similar suite of basic features. However, Mastercard includes impressive special luxury offers on its World and World Elite level cards, which can be attractive for big spenders …

What does Mastercard do

Mastercard is a payment network processor. Mastercard partners with financial institutions that issue Mastercard payment cards processed exclusively on the Mastercard network. Mastercard's primary source of revenue comes from the fees that it charges issuers based on each card's gross dollar volume.The tier you receive varies by credit card, but you'll typically need to pay a higher annual fee to benefit from a higher tier. Beyond tiers, Mastercard holders can earn competitive rewards, benefit from no annual fees and even pay off debt with an intro 0% APR depending on which card you have.Which is more secure Both Visa and Mastercard offer zero fraud liability for all cards, which means that any user who is victim to fraud, theft, or breach of data will not be liable for the lost money. Both networks are generally considered to be secure, but use different methods for securing your data.

Benefits comparison: Visa vs. Mastercard. On entry level cards, there is very little difference between Visa and Mastercard, as both provide a similar suite of basic features. However, Mastercard includes impressive special luxury offers on its World and World Elite level cards, which can be attractive for big spenders …

What is the disadvantage of Mastercard : The disadvantage of Mastercard is that their credit cards tend to offer fewer benefits than Visa cards, and Mastercard debit cards don't always provide full protection from ATM fraud. Still, owning a Mastercard has far more advantages than disadvantages.

What is Mastercard famous for : MasterCard provides the technology and network that facilitate electronic forms of payments. It may use credit, debit, or prepaid cards as its core payment cards.

What are some benefits of Mastercard

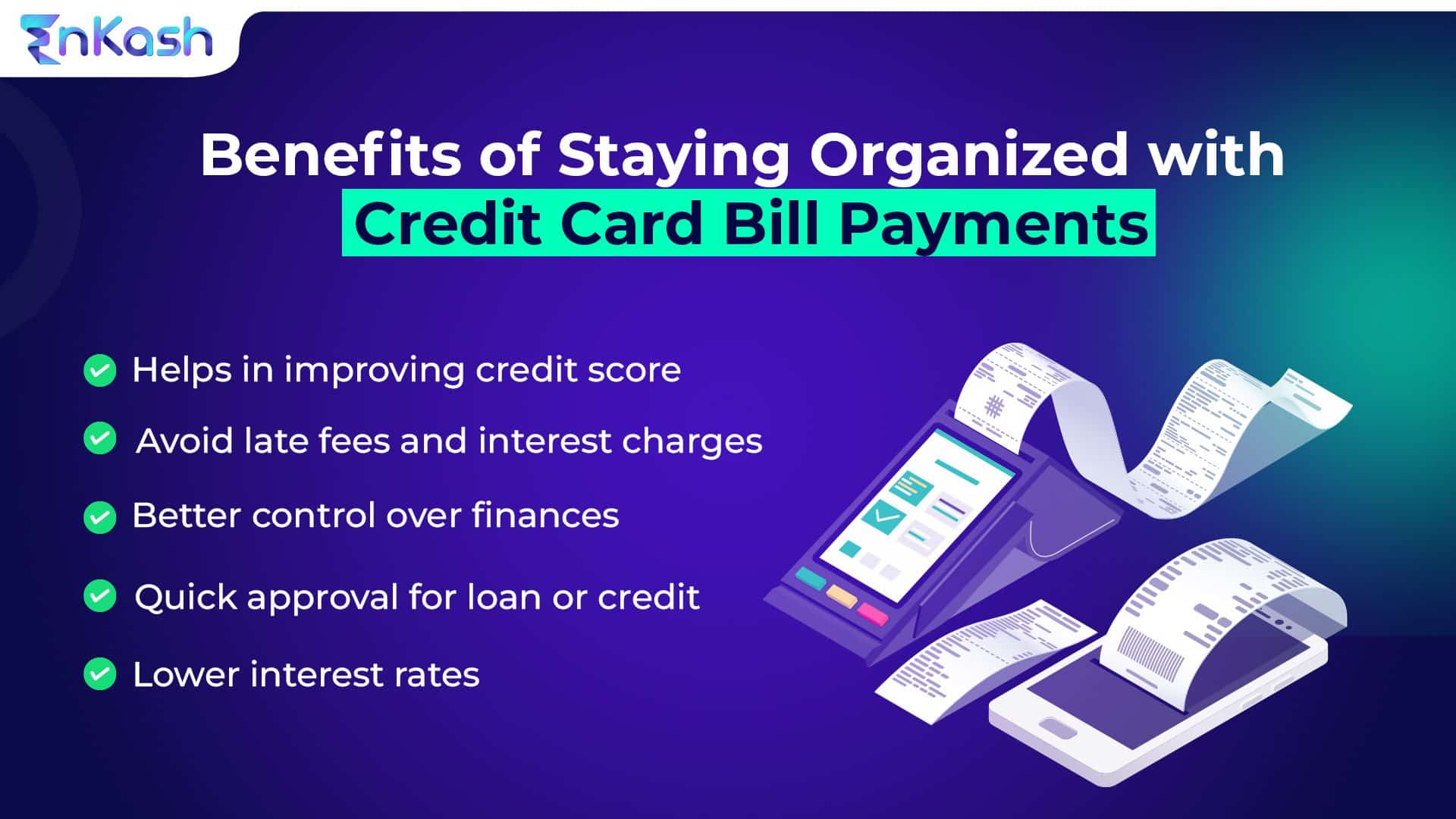

Standard benefits

- Zero fraud liability. You won't be held responsible for fraudulent use of your card.

- Mastercard Global Service. This is a hotline you can call worldwide.

- ID theft protection. You get free identity theft prevention and response services.

- Booking.com.

- HealthLock.

Mastercard® Titanium Card™

Find peace of mind with protection benefits that exceeds standard credit cards. Flat-rate redemption value of 1% for cash back or 2% value for airfare redemption with no airline or seat restrictions and no blackout dates. Earn one point for every dollar spent.Mastercard reward points award cardholders for purchases they make using their credit card in the form of points. Then, these points can usually be redeemed for travel, merchandise, cash back, or gift cards.