Antwort Should I use IBAN or SWIFT? Weitere Antworten – Can I use a SWIFT code instead of an IBAN

In this case, they simply give you their IBAN number. However, in many instances, a bank requires both an IBAN number and a SWIFT code to pinpoint a recipient's bank and specific bank account number. If the country of the recipient does not support IBAN, SWIFT codes are the only other option.Do I need a SWIFT or BIC code to make an international payment Wherever you are in the world, if you need to send or receive funds overseas through your bank, the SWIFT code of the recipient is usually required. Without this code, the transaction will likely not go through.AIRACZPP XXX

AIRACZPP XXX BIC / SWIFT Code – AIR BANK A.S. Czech Republic – Wise.

Can you get the SWIFT from the IBAN : How do I find my SWIFT code You will typically be able to find your SWIFT code on bank statements and on your online or app banking. Most often it will be in the same place as your IBAN number.

Is an IBAN enough to transfer money

IBAN numbers can only be used to send or receive money between accounts, not for withdrawing money or transferring account ownership.

Which countries don’t use IBAN : An IBAN code is used in bank account identification. Depending on your country, you may not have heard of IBANs. For instance, banks in the United States, Canada, Australia, New Zealand and China don't use IBANs.

A SWIFT transfer, also called an international money transfer, is a secure and standardised method of sending or receiving money from banks anywhere in the world.

SWIFT owns and administers the BIC (Business Identifier Code) system. This means it can identify a bank in seconds and send a secure payment quickly.

How to find my SWIFT code

The SWIFT code can be found on a bank's website, on your bank statement, or through an online search. Make sure you copy down the correct characters when recording a SWIFT code, and check that it has 8 or 11 characters. The first 4 characters stand for the bank to which money is being transferred.How can I find out my bank's SWIFT code Most banks include their SWIFT code in customer account details and on their mobile apps, websites and statements. Otherwise, you can request it at your branch. You can find the bank's SWIFT/BIC code or an IBAN on some websites.The SWIFT payment network allows individuals and businesses to accept/send international money via electronic or credit card payments.

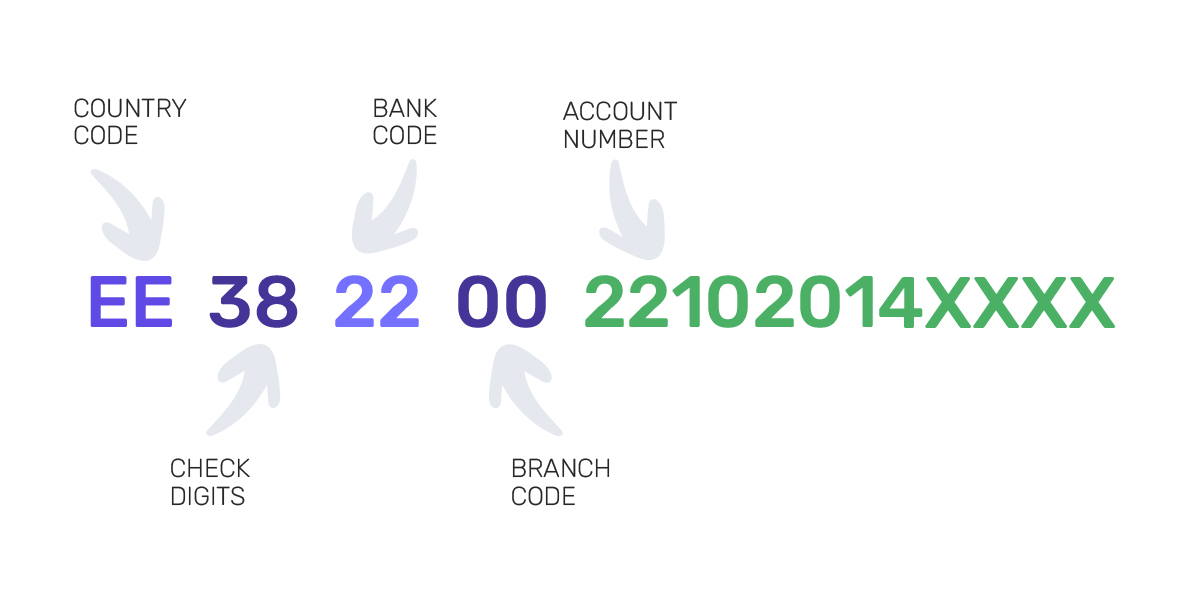

IBAN stands for International Bank Account Number, which you can use when making or receiving international payments. Your IBAN doesn't replace your sort code & account number ─ it's an additional number with extra information to help overseas banks identify your account for payments.

Is it better to use IBAN or account number : IBAN stands for International Bank Account Number, which you can use when making or receiving international payments. Your IBAN doesn't replace your sort code & account number ─ it's an additional number with extra information to help overseas banks identify your account for payments.

Do you need both SWIFT and IBAN for international transfer : Do I need IBAN if I have SWIFT You might be asked to provide both an IBAN and SWIFT to help a bank identify exactly where the money needs to be sent to. Not all countries support the IBAN system, so if you're sending money to a country that doesn't you'll just need the SWIFT code for the overseas transfer.

Which countries don’t use SWIFT

| Afghanistan | Barbados | Chad |

|---|---|---|

| Coral Sea Islands, territory of | Dhekelia | Heard Island and McDonald Islands |

| Democratic Republic of Congo | Falkland Islands | Jamaica |

| East Timor | Haiti | Johnston Atoll |

| Gibraltar | Iran | Kingman Reef |

A SWIFT (Society for Worldwide Interbank Financial Telecommunication) a.k.a. BIC code is used to identify a specific bank during an international transfer. The SWIFT network standardized the formats for the IBAN system and owns the BIC system. Oftentimes, both codes are required for an international transaction.Fees for Swift payments

Your bank will likely charge a fee to make a Swift transfer to Wise. When the money is in transit, correspondent banks in between may also deduct their handling fees.

What are the disadvantages of SWIFT payment : Disadvantages:

- Expensive fees: Swift money transfers can be costly due to the fees involved.

- Unfavourable exchange rates: Exchange rates may not be as favourable as local transfers.

- Longer processing time: Swift transfers can take longer than local transfers, especially if any intermediary banks are involved.

:max_bytes(150000):strip_icc()/whats-difference-between-iban-and-swift-code.asp-FINAL-1df82a2312304df69037b86d6df59e6f.png)