Antwort Is SWIFT only for international transfers? Weitere Antworten – Is SWIFT only used for international transfers

:max_bytes(150000):strip_icc()/how-swift-system-works.asp-Final-b308a4e3bf8b439f9ab467bd298262ef.png)

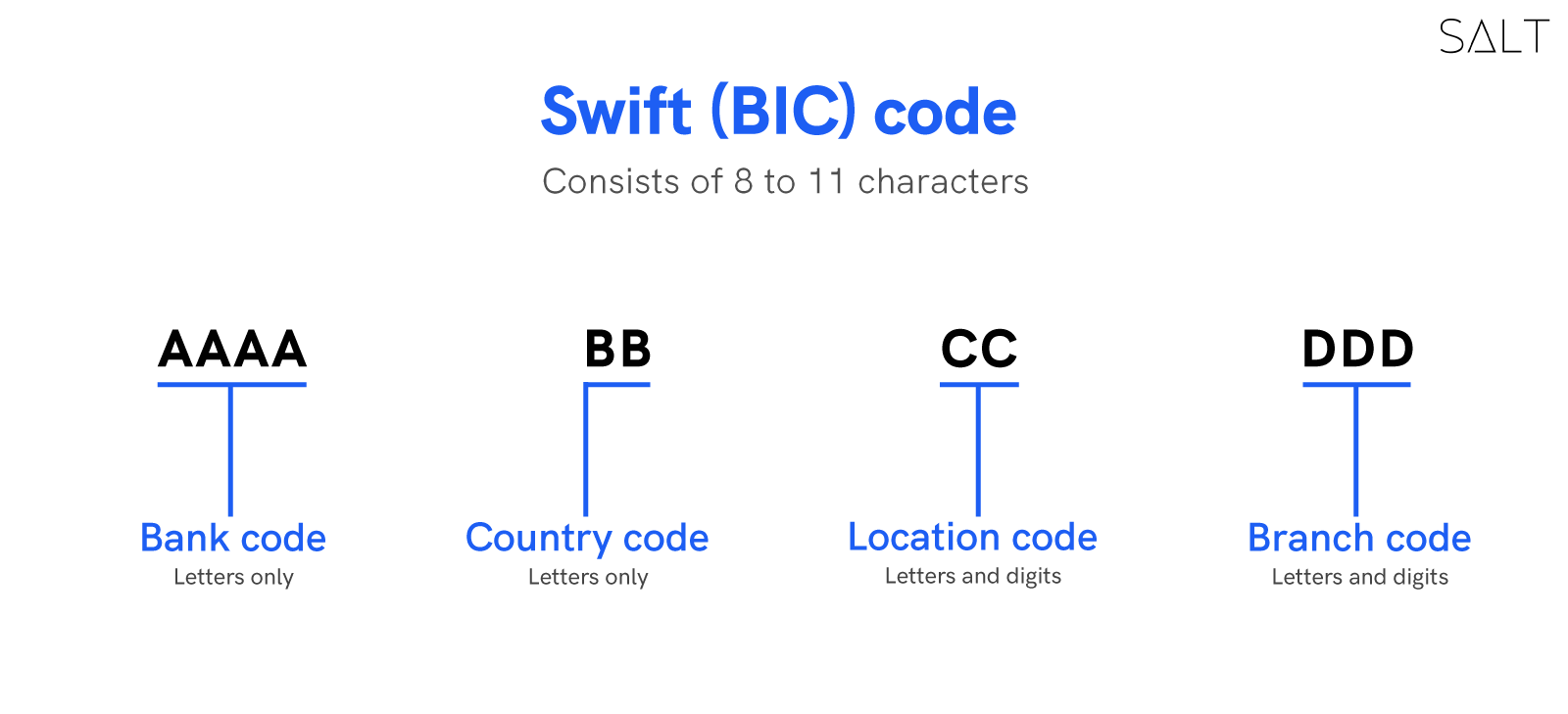

SWIFT is the largest and most streamlined method for international payments and settlements. SWIFT works by assigning each member institution a unique ID code (a BIC number) that identifies the bank name and the country, city, and branch. SWIFT has been used to impose economic sanctions on Iran, Russia, and Belarus.Also called a SWIFT number, this code facilitates the transfer of money between banks and is needed for both international wires and SEPA payments.It's worth noting that SWIFT payments are primarily used for high-value, cross-border transfers. For smaller, domestic payments, there may be faster and cheaper alternatives available. To use SWIFT for international money transfers, a bank or financial institution would need to meet certain software requirements.

Can you transfer without SWIFT : Your SWIFT code is usually required if someone is sending you an international money transfer as it's used to identify an individual bank to verify international payments. For example, a company might ask for your SWIFT code if they're paying your invoice via overseas transfer.

Can I use SWIFT instead of IBAN

Bank Requirements

In this case, they simply give you their IBAN number. However, in many instances, a bank requires both an IBAN number and a SWIFT code to pinpoint a recipient's bank and specific bank account number. If the country of the recipient does not support IBAN, SWIFT codes are the only other option.

Is SWIFT only in Europe : Swift was founded to replace the telex. It is a member-owned cooperative connecting more than 11,000 banks, financial institutions and corporations in more than 200 countries and territories. Swift operates internationally with 26 offices located across the world, and is headquartered in Belgium.

In this case, they simply give you their IBAN number. However, in many instances, a bank requires both an IBAN number and a SWIFT code to pinpoint a recipient's bank and specific bank account number. If the country of the recipient does not support IBAN, SWIFT codes are the only other option.

IBAN numbers, or International Bank Account Numbers, are used for fast and secure payments both domestically and internationally. Unique to you and your account, this number offers a safeguarding system that checks account data before sending funds between international banks.

Can SWIFT be used domestically

Is the SWIFT code needed for a domestic transfer The swift code is only used for international money transfers for any reason. Even when you use your credit card in a foreign country. It allows inter bank money transfers.SWIFT transfers use a global network of secure banks for electronic payments, while local transfers use a national network to send money to a recipient's local account. SWIFT transfers are more secure and suitable for larger transactions but have higher fees and longer processing times.When you transfer money between banks, to a bank account across international lines, or for SEPA payments, you'll almost always need a SWIFT/BIC code.

IBANs are more secure than SWIFT codes because they are unique identifiers for bank accounts in specific countries. SWIFT codes only identify the bank that will receive a payment, but they do not identify the specific bank account. This means that there is a greater risk of errors and fraud when using SWIFT codes.

Which countries don’t use IBAN : An IBAN code is used in bank account identification. Depending on your country, you may not have heard of IBANs. For instance, banks in the United States, Canada, Australia, New Zealand and China don't use IBANs.

Which countries do not use SWIFT :

| Afghanistan | Barbados | Chad |

|---|---|---|

| Navassa Island | Palmyra Atoll | Senegal |

| Pakistan | Philippines | Spratly Islands |

| Paracel Islands | Saint Martin | Syria |

| Russia | South Sudan | Vanuatu |

Is SWIFT used worldwide

Having disrupted the manual processes that were the norm of the past, Swift is now a global financial infrastructure that spans every continent, 200+ countries and territories, and services more than 11,000 institutions around the world.

In this case, they simply give you their IBAN number. However, in many instances, a bank requires both an IBAN number and a SWIFT code to pinpoint a recipient's bank and specific bank account number. If the country of the recipient does not support IBAN, SWIFT codes are the only other option.No. The key difference lies in what they identify. A SWIFT code is used to identify a specific bank in a cross-border transaction, while IBAN numbers are used to identify an individual account in cross-border transactions. Both help make international payments more seamless.

Is SWIFT only for banks : Swift was founded to replace the telex. It is a member-owned cooperative connecting more than 11,000 banks, financial institutions and corporations in more than 200 countries and territories.