Antwort Is it smart to put money in a safe deposit box? Weitere Antworten – Is it smart to keep cash in a safe deposit box

You're better off stashing your cash in a bank deposit account, like a savings account or certificate of deposit, than in a home safe or a safe deposit box. Among the reasons: "Cash that's not in a deposit account isn't protected by FDIC insurance," noted Luke W.A safe deposit box can offer secure, reliable storage for valuables and important documents. This type of storage can be useful if you're uncomfortable storing documents digitally or have valuables you can't keep safe at home. It's also helpful if you move often or are prone to misplacing important items.Pros and Cons

- Unlike bank accounts, the contents are not insured.

- Safes can only be accessed during the bank's business hours.

- Contents can still be lost due to fire, flood, or other disasters.

Do banks know what is in a safety deposit box : The safe deposit box is a storage space you rent from the bank. Its contents are kept private, and the bank doesn't know what you put in there.

Why not keep cash in safe deposit box

It's best not to hide cash in a safe deposit box. It won't be insured, and you won't gain interest on your money if it's in a box. Some banks don't even allow cash to be stored inside a safe deposit box.

Is it better to keep cash in safe or bank : Banks are a reliable place to keep your money protected from theft, loss and natural disasters. Cash is usually safer in a bank than it is outside of a bank. For instance, there's no guarantee that funds kept in your home are safe from burglars or fires.

If your bank fails, you likely will be able to retrieve the contents of your safe deposit box. If another bank acquires your bank's branches, you can contact that bank to ask about accessing your safe deposit box. If the failed bank isn't bought by another bank, the FDIC will contact you about your safe deposit box.

When you break down the numbers, that's about 4,000 bank robberies per year and only about 8 or 9 involve safe deposit boxes. In contrast, there are nearly 1 million home burglaries each year. In other words, a home is about 250 times more likely to get robbed than a bank.

Why are safe deposit boxes not as popular as they used to be

If bank boxes are much more expensive than, say, a home safe or a home security system, customers will opt for the latter. Safe deposit also came with a handful of legal headaches. Banking industry executives fretted over hypothetical scenarios about when they would let a customer in to see their valuables.The economics of safe deposit boxes started to break, at least for the major banks, as the cost of commercial real estate ballooned. The number of bank branches peaked around the time of the 2008 recession, and have plummeted ever since.The FDIC does not insure the contents of safe deposit boxes at banks. If your bank fails, you likely will be able to retrieve the contents of your safe deposit box. If another bank acquires your bank's branches, you can contact that bank to ask about accessing your safe deposit box.

If you're looking for a ballpark figure, Taylor Kovar, certified financial planner and CEO of Kovar Wealth Management says, “By age 30, a good rule of thumb is to aim to have saved the equivalent of your annual salary.

Where is the safest place to keep your money : Here are some low-risk options.

- Checking accounts. If you put your savings in a checking account, you'll be able to get to it easily.

- Savings accounts.

- Money market accounts.

- Certificates of deposit.

- Fixed rate annuities.

- Series I and EE savings bonds.

- Treasury securities.

- Municipal bonds.

Why are safe deposit boxes going away : Due to this lack of consumer demand, they considered safe deposit boxes as unnecessary, unimportant customer service and not a beneficial profit center. They also decided they would not devote any additional time, money or resources to train their employees or secure these boxes properly.

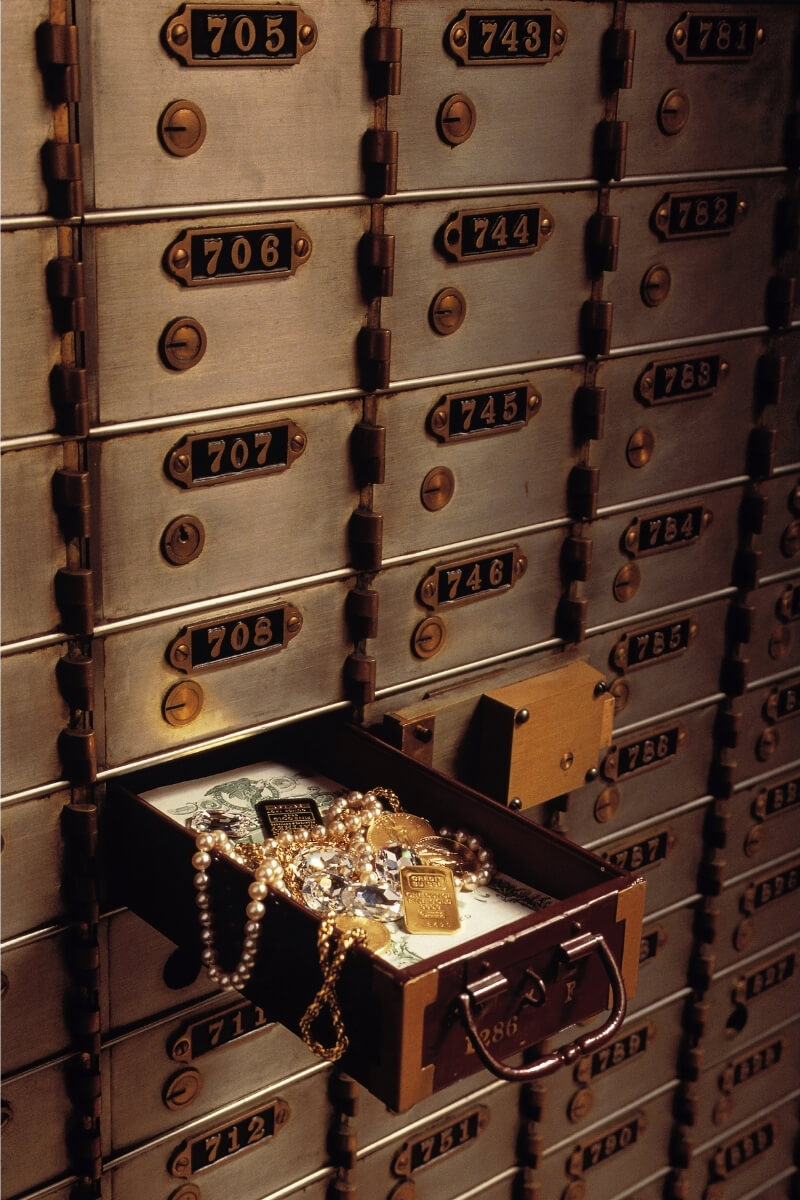

Is it safe to keep gold in a bank locker

The locker area in a bank is highly secure, and no one can enter it without prior permission. Therefore, keeping gold in bank lockers is a highly safe choice. But you won't earn any interest on gold kept in bank lockers. Instead, customers have to bear charges for keeping gold in bank lockers.

Safe deposit boxes are not the only option available when it comes to securing your valuables. Home safes, virtual vaults, private vaults, and insurance are all viable alternatives that provide unique benefits. Consider your needs and preferences carefully when choosing the option that's right for you.If your bank fails, you likely will be able to retrieve the contents of your safe deposit box. If another bank acquires your bank's branches, you can contact that bank to ask about accessing your safe deposit box. If the failed bank isn't bought by another bank, the FDIC will contact you about your safe deposit box.

Are safe deposit boxes becoming obsolete : Some banks today consider them an outdated service and have stopped offering them. But there's still a demand for them, says David P. McGuinn, a former banker, and president and founder of Safe Deposit Specialists, a Houston-based safe deposit training and consulting firm.

:max_bytes(150000):strip_icc()/safe-deposit-box-what-to-store-and-not-store-in-yours-4589854-final-61fbded2c9b54d1ba6550c4aeff384a6.png)